Cryptocurrency is something we’re all interested in, and in the heart of it all lies blockchains. But with a lot of different types of blockchains, it’s sometimes hard to understand them. And, it can be difficult for developers to build on all of them.

Luckily, this is where Ankr comes in. Ankr helps developers build blockchain applications and blockchain organizations run their blockchains better.

As a result, developers and users can enjoy a faster, more reliable, and overall better Web3 experience.

Curious about Ankr? Let’s dive right in.

What is Ankr?

In a nutshell, Ankr is an infrastructure provider. This means Ankr builds a global network of nodes that blockchains are built on top of, which everyone can use to access and interact with blockchain data.

Ankr runs the global node network which powers the world’s leading blockchains like BNB Chain, Ethereum, and Avalanche. They provide the solution called RPC Service for seventeen of the top blockchains out there, making them the RPC leader in the industry.

Now, these blockchains use Ankr because it helps them run faster. And, they allow developers to build on top of them easily, allowing decentralized applications open for software access and communicating with them.

This makes Ankr one of the most universally useful services in Web3. Ankr is also one of the few companies in the space that will grow exponentially with the market as the industry evolves as a whole—whether that’s on Fantom, Optimism, Ethereum, or beyond.

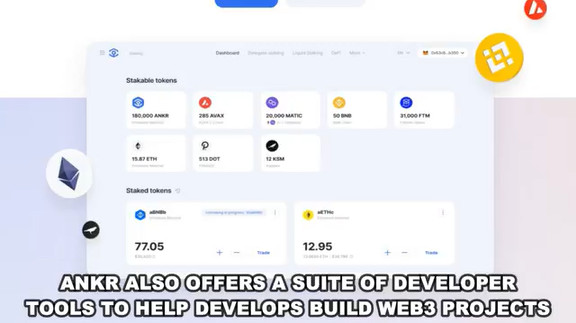

Now, on top of their core RPC business, Ankr also offers a suite of developer tools to help developers build Web3 projects, including tools for staking, gaming, and running blockchain infrastructure.

How Are Developers Currently Using Ankr?

First, Ankr helps DeFi platforms, NFT projects, blockchain games, and dApps have faster, more scalable, and more affordable access to blockchains. Using Ankr, they can reduce loading times by 50%.

Second, Ankr makes it easy and fast to build multi-chain and cross-chain applications, allowing a suite of tools and endpoints for dApp developers to build on multiple blockchains. Companies like SushiSwap utilize Ankr, for example, to launch across multiple chains and provide services.

Third, for Web2 businesses looking to get into the space, Ankr provides flexible, customized solutions for building in Web3. Ankr’s gaming SDK also allows for Web2 games to easily port games over to Web3 utilizing Ankr’s infrastructure wallets, and NFTs to create games with full crypto and NFT capabilities. Ankr app chains provide similar services but takes it one step further by helping companies launch completely customized new chains with their own validators.

Deep Dive Benefits of Ankr

Now, let’s get a little bit more technical. For starters, Ankr network provides organizations looking to combine blockchain systems with new infrastructure options. Integrating blockchain functionalities would take a significant amount of effort in resources. Unfortunately, technological and financial obstacles have slowed acceptance.

Ankr’s global network provides protocols, developers, and end users with services to make blockchain run faster and transactions go smoother. It offers RPC, advanced APIs, gaming SDKs, and other services to make developing on and accessing products much easier.

If Web3 were a country and blockchains were cities, Ankr would be building the road and power lines connecting industry.

The Ankr Token

The final key piece of Ankr’s business is the Ankr Token and the network rewards that token holders can access.

The Ankr Token is used to power the Ankr protocol, creating an economy around the future of Web3 infrastructure and allowing token holders to benefit from the growth of Ankr.

When people launch nodes on Ankr’s global node network, they must stake Ankr tokens to provide security for their node. Similarly, when Ankr places nodes on its global node networks, Ankr must be staked to secure it as well.

The Ankr Team

Ankr was founded in 2018 by Chandler Song and Ryan Fang of the University of Berkeley, California. As ambitious entrepreneurs and deal-makers, they spend most of Ankr’s early days building relationships in the industry and recruiting top talent.

Most notably, Stanley Wu, the leading engineer at AWS who later becomes Ankr’s CTO.

Conclusion

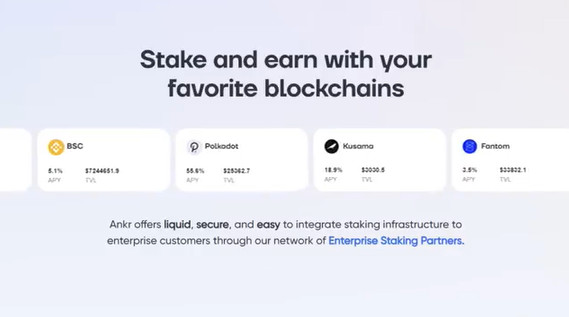

Ankr Staking will also become decentralized in 2022 as it expands its liquid staking services, allowing owners of Ankr liquid staking tokens to vote on which validators they point to and thus who they delegate the voting power to.

Ankr has established itself as the fastest growing decentralized infrastructure provider and it continues to expand its services for Web3 developers and users. The developers behind Ankr realize how important it is to decentralize the market and simplify dApp development.

The protocol achieves these goals uniquely and transparently. As such, Ankr is well positioned to remain a core component of the DeFi sector moving forward. Ankr offers everyone a chance to win Web3 together, whether it’s in Ethereum future, Avalanche future, or a future we don’t even know yet.

By continuing to offer the best in-class infrastructure services in the space and by continuing to evolve and innovate with the industry, Ankr has become one of the strongest companies in all of crypto.

Want to get involved? Check out Ankr today.