When the Avalanche network launched last year, it caught the attention of many in the DeFi community.

Designed by Ava Labs to solve the current limitations in the blockchain industry (scalability, centralization, and slow transaction speeds), this network serves as an open-source platform for financial markets. It allows people to easily use decentralized web services, including dApps, smart contracts, P2P payments, and smart assets.

It has become the go-to platform for creating launching smart assets on the blockchain network. These assets can be bonds, equities, real estate, debt, etc.

Let’s dive right into the details of the Avalanche network.

What is Avalanche?

Avalanche enables users to create new assets, launch private and public customized, multi-functional blockchains, and build smart contracts. On this platform, developers can customize virtual machines and blockchain operations to suit their needs and preferences. These blockchains are a complete package comprising validator sets, scripting language, legal regulations, and more.

For more details, watch this video: https://www.youtube.com/watch?v=mWBzFmzzBAg.

How Does It Work?

Avalanche network revolves around three highly compatible blockchains:

- Exchange or X Chain – it allows users to create new digital assets.

- Platform or P Chain – it helps coordinate validator sets and builds subnets.

- Contract or C Chain – it implements Avalanche’s Ethereum Virtual Machine (EVM).

The C and P Chains are secured by the “Snowman” consensus, involving chain optimization. They help create highly secure smart contracts. On the other hand, the X Chain is bonded by DAG-optimized “Avalanche” consensus. This scalable protocol finalizes transactions in seconds.

Built around three blockchain systems, the Avalanche platform ensures optimal speed, flexibility, and security. Also, there are no trade-offs whatsoever. Hence, it serves as a robust network for private and public cases. Developers on this platform enjoy outstanding levels of flexibility when building applications.

That being said, Avalanche is centered on AVAX, the native token. It helps pay network fees and provides a basic account unit between the subnets. It is also used for staking.

Key Features

Below are the highlights of the Avalanche network.

- It takes mere seconds to settle thousands of transactions, allowing for seamless asset transfers and P2P payments.

- It allows developers to build interoperable blockchains.

- It offers impressive scalability, making it possible to accommodate millions of network participants.

- It enables the launch of private, fully customizable, and compliant blockchains, allowing developers to choose validator sets of their choice.

Uses of AVAX Tokens on Avalanche

As stated earlier, AVAX is the native token used on the Avalanche network. Let’s find out what this token is used for.

- Fee payments: Avalanche users can pay for operational costs using AVAX.

- Network security: AVAX allows validators to secure the network through staking. The circulating supply of AVAX is 360 million, whereas the maximum supply is up to 720 million.

- Value Transfer: With AVAX, you can transfer value between users to and from the Avalanche wallet. Validators also get rewards using this token.

- Subnet creation: AVAX is used to create subnets on the Avalanche platform all the time.

How to Trade Avalanche Tokens

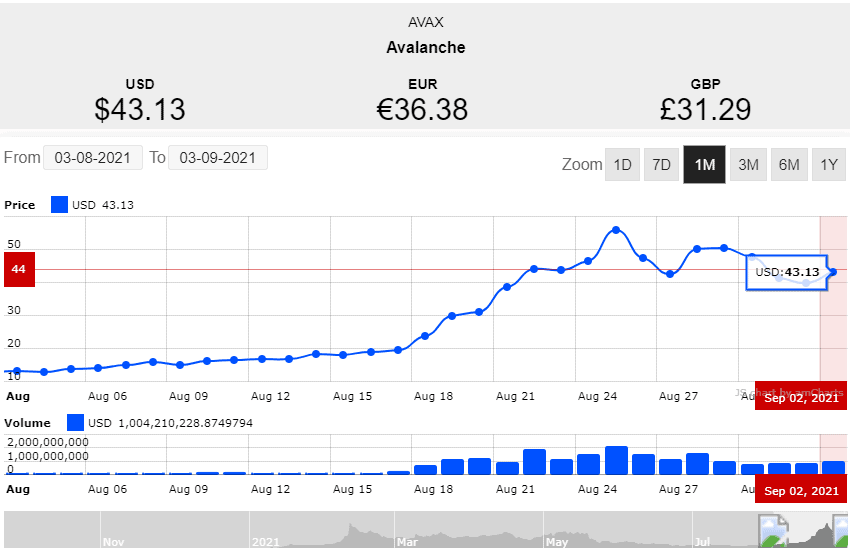

Since the launch of the Avalanche platform, more people have realized how profitable AVAX trading is. Here are a few convincing reasons for you to jump on the bandwagon.

- AVAX is growing steadily and is already among the top 30 cryptocurrencies.

- Its value has risen by 300% within a year.

- The price may go even higher in the future, so you can buy them today and sell for a good profit later.

- AVAX trading happens on reputable exchanges, and a variety of trading strategies apply to it.

Where to Trade AVAX?

You can trade Avalanche on various platforms. We highly recommend Binance since it allows you to buy cryptocurrency using Mastercard or Visa. 7b is also a good option for beginners. This platform supports all the crypto assets presented on Binance.

Trade AVAX on Binance in X Steps

Step 1

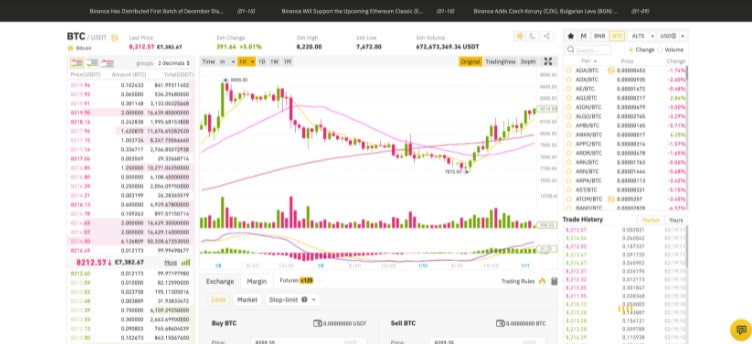

Go to Binance and click on “Exchange.” You’ll see several numbers constantly flicking on the screen.

Step 2

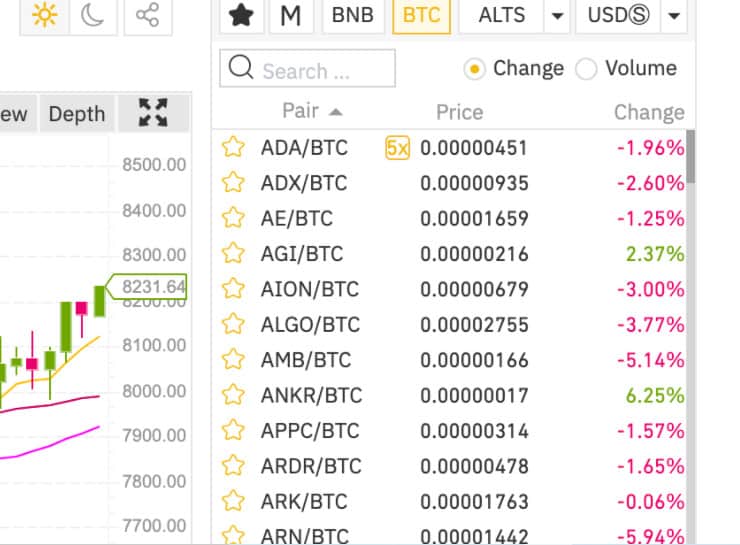

On the right side of the screen, spot BTC and make sure it is selected for trading BTC to altcoin pair. Then, type “AVAX” in the search bar.

Select “AVAX/BTC” to get a price chart of the pair.

Step 3

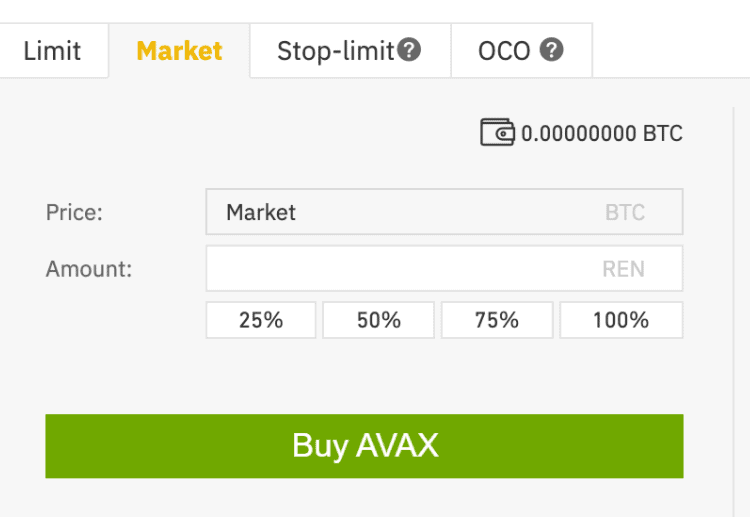

Tap on the “Market” tab to buy AVAX in a straightforward manner. You can type your desired amount or choose the particular portion of your deposit that you want to spend on buying AVAX.

Once done, click on “Buy AVAX.”

That’s it!

Congratulations. You just bought AVAX!

Avalanche vs. Other Blockchain Networks: What Makes It Better?

Although Avalanche has been in the business for just a year, it has proved valuable to cryptocurrency projects working towards a truly decentralized web.

This platform invites developers to create and launch new, customizable blockchains with advanced features. This ultimately puts them in the best position to make Web3 a reality. One of the best things about Avalanche is that it offers a grant program to support developers facing funding challenges.

If we talk about Avalanche vs. Ethereum, there lies a significant difference between the scalability of the two platforms. Avalanche stands out for its capability to accommodate millions of participants in one go without compromising the transaction throughput.

The Interoperability offered by the Avalanche network is also quite impressive. This platform allows developers to leverage the combined power of different blockchains for building one-of-a-kind products.

Lastly, Avalanche’s capped supply indicates great potential value. No matter how much the demand increases, the supply won’t grow.

The table below explains why Avalanche is better than other cryptocurrency networks, including Bitcoin, Ethereum, and Tendermint.

| Bitcoin | Ethereum | Tendermint | Avalanche | |

| Transactional throughput | ~7 tx/sec Protocol bound | ~14 tx/sec Protocol bound | ~1,000 tps Bandwidth bound | >4,500 tps CPU bound |

| Energy efficient | No | No | YesCPU optimal | YesCPU optimal |

| Transactional finality | 6 confirmations in 60 minutes | 25 confirmations in 6 minutes | 6-7 second block time | <3 seconds or less |

| Safety threshold | 51% | 51% | 33% | 80% |

| Validators | 3 pools>51% hash rate | 2 pools>51% hash rate | <200 nodes | Thousands of nodes, no hash rate |

| Sybil protection | Proof of work | Proof of work | Proof of stake | Proof of stake |

Final Words

Avalanche is a successful, decentralized network that promises excellent value for developers. It is transforming how they make payments, use dApps, and create smart contracts and customizable blockchains. Considering the advanced features, scalability, and flexibility this open-source platform offers, we can expect it to become a leader in the decentralized web space soon.