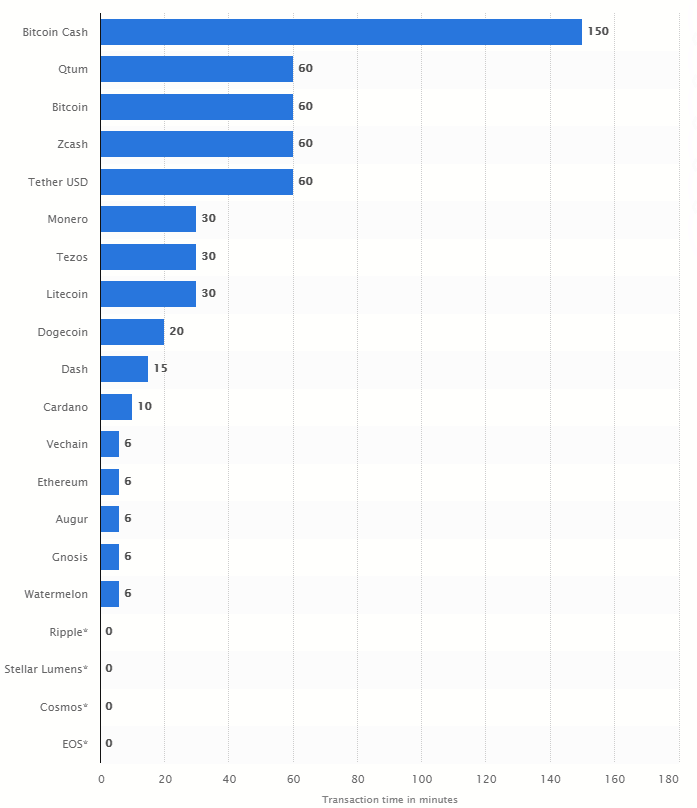

Binance Chain is home to the ever-famous Binance Token ($BNB) is a platform created to encourage fast-trading via decentralized applications. Before the introduction of Binance Smart Chain extension, the estimated time of bitcoin transactions was roughly 60 minutes, while Ripple, Cosmos, Stellar Lumens, and EOS protocols were considered to be the fastest ones out there.

Of course, they had their own set of pros and cons.

To achieve this speed, Binance has to make certain trade-offs as well. Think of it as Road Runner from Looney Tunes. It’s very quick, and Willie E. Coyote keeps trying to catch up, but our friendly bird doesn’t have any cool toys to play with. Similarly, the Binance chain isn’t as flexible in terms of its programming compared to other blockchains.

Because of the speed and efficiency this system boasts, it can handle large transactions, and consumer demand for the currency increases. A prime example of this is how the CryptoKitties craze slowed down transactions on Ethereum back in 2017.

Binance Smart Chain has a blockchain infrastructure based on Ethereum that facilitates the development of high-performing decentralized applications that offer cross-chain compatibility unlike any other to facilitate users by offering them the best decentralized finance (DeFi) protocols and speed.

The chain activated its parallel blockchain to Binance Chain (known as the Binance Smart Chain) on the 1st of September, 2020.

The Beginning of Binance Smart Chain Network

As mentioned above, the Binance Smart Chain (BSC) was introduced in September 2020, but its parent was available already. The two can be slightly confusing at first because of their very similar names.

- Binance Chain. This is the parent network created in 2019. The goal here was to support the DEX (binance decentralized exchange) to support industry token standards available at the time (BEP-2). Unfortunately, this meant that there was no support for smart contracts, thus limiting their use.

- Binance Smart Chain. The next year, Binance introduced the Binance Smart Chain with the main idea of letting people build, develop, and use decentralized apps. It supports smart contracts and has a DeFi ecosystem backing it up. The goal was to support a more modern industry token, the BEP-20.

Binance is available in the US across 43 states at the time of writing, with other states in the process of considering whether to adopt it or not. Only Connecticut, Hawaii, New York, Texas, Vermont, Idaho, and Louisiana don’t have Binance yet.

$BNB & It’s Rise to The Top

At the time of writing, Binance Smart Chain and Binance Chain (collectively known as BNB) is the third-largest cryptocurrency, with the Binance Coin costing $290.05, a 24-hour trading volume of over 1.78 billion, and a live market capital of over $44.5 billion. It is just behind Ethereum (2nd) and Bitcoin (1st).

During its impressive journey, BSC (or BNB), the crypto currency, has seen steady growth in the number of transactions and investors since September 2020, as shown in the graph below.

It is only now that the industry as a whole has seen a dip because of the Chinese crypto crackdown that the upward trend has broken; yet, the number of transactions is still much higher than others. This is a marvelous feat; consider it only started as a utility token. The primary factor that led to this success was discounted Binance trading fees. The transaction speed was the icing on top of the cake, making it more attractive to users.

The smart contract was initially deployed on Ethereum (ERC-20 token) but now has its native token, which gives it the versatile range of uses it is known for. This further facilitated the users to help earn a passive income and reduce transaction fees. Another great functionality that helped the currency rise to the top is its availability for collateral for crypto loans.

Apart from users, BSC also became immensely popular with developers worldwide because of its ability to offer a decentralized platform for app development.

With so many features to offer and the overall diversity it boasted, BSC and DeFi community saw numerous new projects being developed, which further helped the currency to get popular. Apart from functionality, some significant players also joined the BSC community, major companies adopted payment merchants that supported BSC, travel agencies started accepting the currency, online gaming, and gambling rewards, and gift card acceptance for the currency also became popularized.

All of this boosted Binance Smart Chain’s journey to the top, and thanks to the constantly developing DeFi apps, there is very little to suggest that this growth won’t continue.

How To Use the Binance Smart Chain Extension

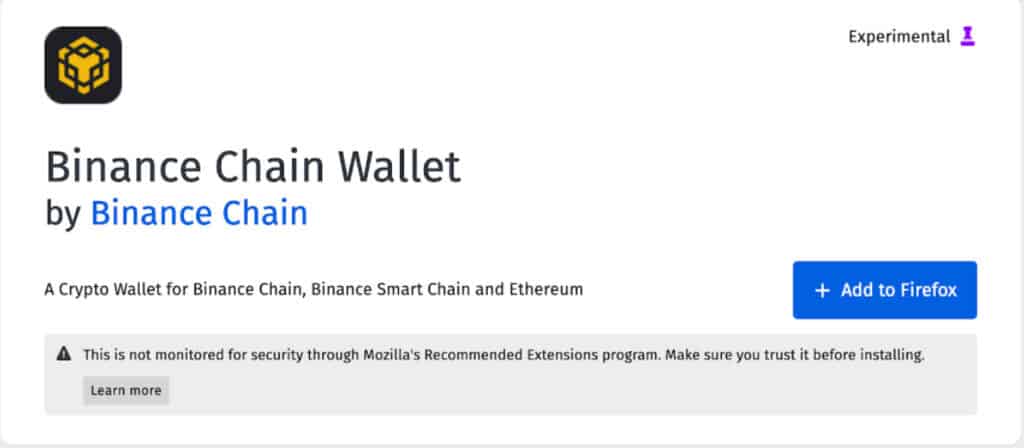

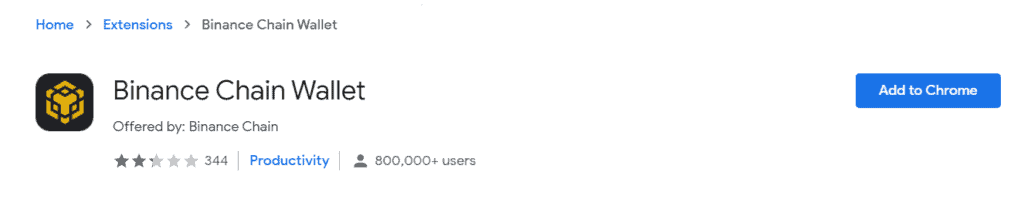

Much like MetaMask and Trust Wallet, Binance Chain Extension Wallet is a crypto wallet specially for BNB and BSC. It acts like any other wallet, helping you transfer funds, store crypto, and most importantly, cross-chain transfers between the two blockchains with just a tap. Currently, the extension is available for Chrome and Firefox users only.

According to the developers, the extension will also support the Ethereum blockchain soon, allowing distributed applications or “Dapps” to be accessed within your browser.

The extension works better on Firefox, but that does not mean it lacks any Chrome functionality, either. Think of it like Firefox being the elder brother and therefore receives updates before Chrome.

To set up your wallet;

Install The Extension

Start by installing the extension for your browser. Here are the links for your reference;

Simply click on the link and download the extension. You can also add the same extension to other browsers, but you might experience minor compatibility issues. There are a few copies of the extension as well, so make sure Binance Chain offers it.

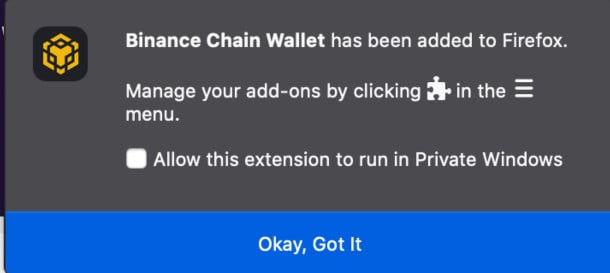

Once added, you will see the following dialogue.

Set up the Wallet

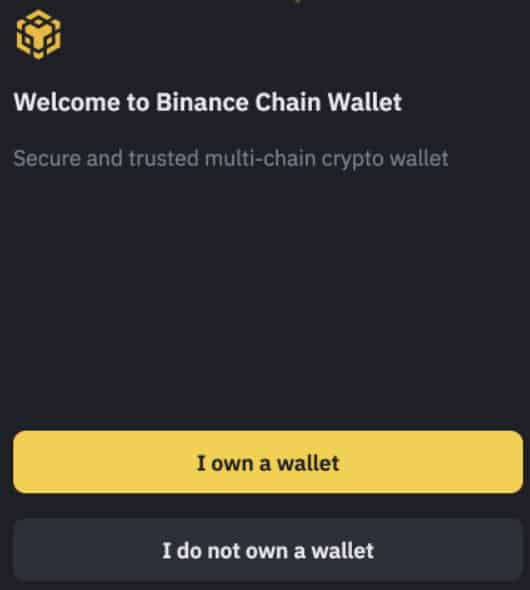

Once installed, a new tab will open, asking you for your account. If you already have a Binance Wallet, simply sign in using your username and password. If not, click on I do not own a wallet.

The extension will ask you to create a password with the following limitations;

- It should be at least eight characters long

- It must have at least one upper case character

- It must contain at least one digit

- It must contain at least one symbol. This may include a period (full stop) as well.

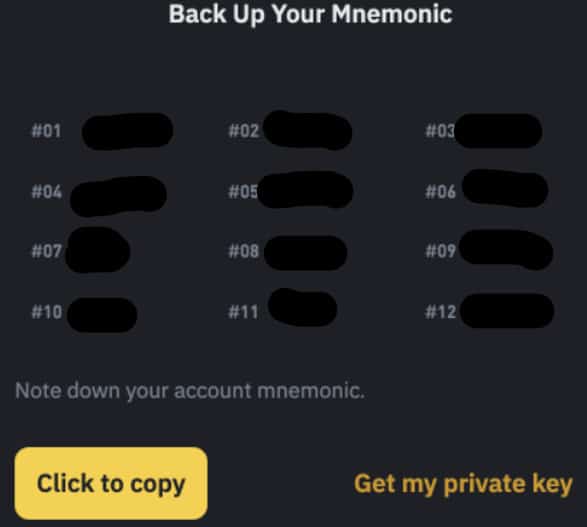

Click Continue once done. The next screen will ask you to back up your mnemonic.

Be very careful with the mnemonic you generate. If lost, you won’t be able to recover it. If stolen or phished, the chances are that your funds will be stolen.

Secure your key like it’s a million dollars. Who knows, it might be worth it one day! Back the mnemonic up somewhere safe, even if it involves writing it down on your bed’s base (not recommended).

Congratulations, you now have a Binance account!

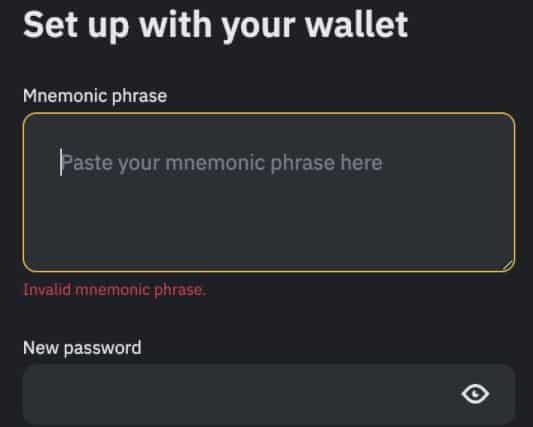

You can use the mnemonic you just generated to recover your account if you forget your password. Simply click on “I own a wallet” and paste your mnemonic phrase in the box below.

Once accepted, you can set a new password with the same guidelines as listed above. Click on Get Started, and you’re ready to go!

Testing Out BNB

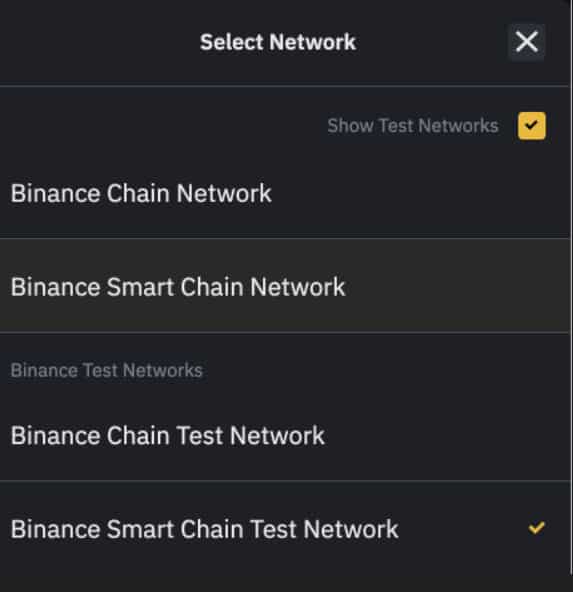

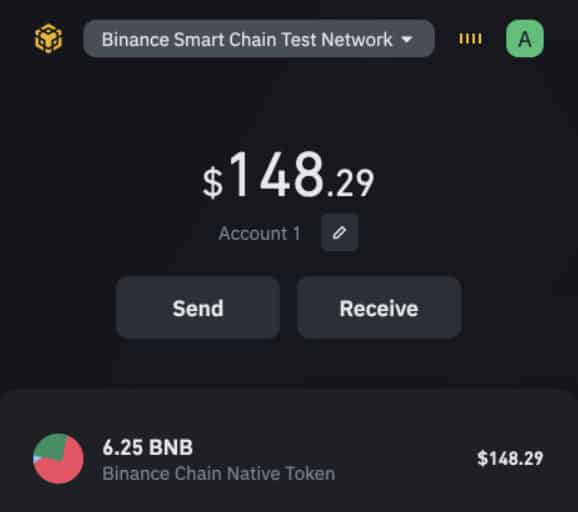

Now that you have your wallet set up let’s start with a test run to help you get familiar with the platform. Switch to Binance Smart Chain Testnet and copy the address you find there.

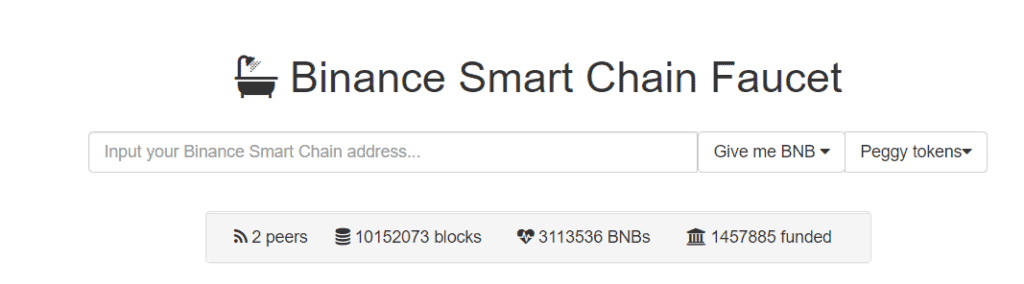

The address will be in the form of a QR code with a string on top of it. Copy it and then head to the test faucet.

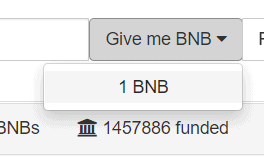

Paste the address you copied and click on Give me BNB.

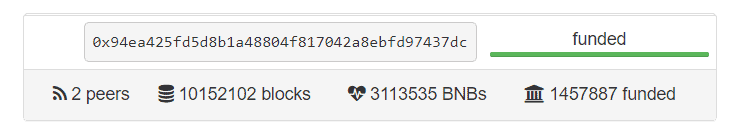

Once you have clicked on 1 BNB, you will see a progress bar below that will turn green in a second.

Switch back to your wallet. You should see that a native BNB token will have been added to your wallet at its current value.

Transferring BNB From BSC to BC

Click on the drop-down at the top and change your network from Binance Smart Chain Test Network to Binance Chain Testnet and copy the address as you did before.

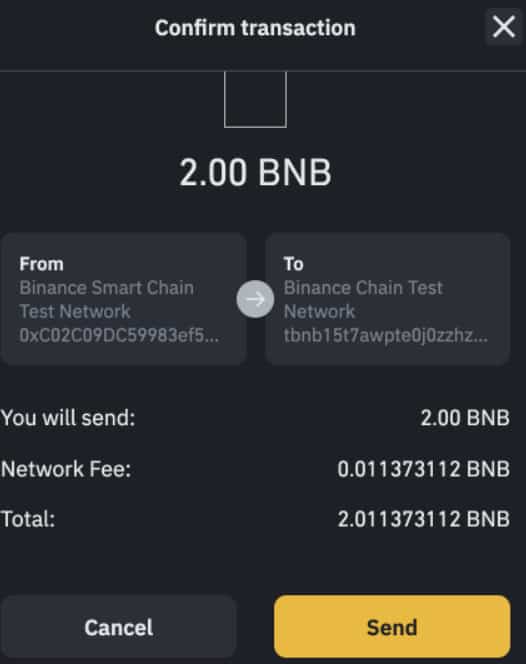

In your wallet, you’ll see a plus icon on the bottom right corner (varies between browsers and versions). Click on it, and a popup will appear. Input your address there, type an amount, switch the drop-down to Binance Smart Chain Testnet and click Send.

Confirm the transaction after reviewing your networks and amount. Switch back to the Binance Chain Testnet to confirm the transfer.

With this wallet, you will be able to:

- Transfer BNB from BSC to BC

- Transfer BNB from BC to BSC

- Swap Testnet BEP2 token to BEP20 equivalent

- Swap Testnet BEP20 token to BEP2 equivalent and more.

Withdrawing Funds From Binance Smart Chain

If at any time you fear a rug pull or otherwise anticipate a loss, you must withdraw your funds quickly before you are left with nothing but sand.

Pulling BSC out in an emergency involves:

- Finding the MasterChef contract

- Finding the Pool ID (PID) of the pool you invested in

- Connecting to your wallet

- Withdrawing.

Here is a more detailed guide on withdrawing BSC funds in an emergency.

Being Smart With Binance Smart Chain – Popular Projects

As DeFi grows, more and more decentralized exchanges (DEX) and automated markets are being formed. Binance Smart Chain extensions are faster and cheaper, which is why they are used for development ventures time and time again. Here is a Binance Smart Chain projects list that you can use to your advantage:

PancakeSwap

As a leading automated market maker, PancakeSwap is a Binance Smart Chain DEX that allows BEP-20 swapping, trading, farming, and more in a much cheaper and faster manner. The average transaction time on PancakeSwap is 5 seconds.

It allows new projects to create their own Binance Smart Chain tokens (BEP-20), dubbed as CAKE on PancakeSwap.

LenDefi Finance (LDF)

LenDefi Finance used the growing fees of Ethereum as an excuse to jump ship, migrating the platform to Binance Smart Chain. It allows people to access funding with BSC tokens as collateral, but the platform also offers uncollateralized loans

Autofarm

Autofarm is a yield aggregator that spans across a range of blockchains but is built on Binance Smart Chain. The main source of earning here is via farming, but you don’t need to micromanage it since it automatically switches user’s investments to more profitable liquidity pools.

DeFi Yield Protocol

One of the most well-known protocols of its time, the DeFi Yield Protocol (DYP), is similar to Autofarm in terms of how people earn, but instead of shifting investments for better profit, it focuses on reducing risks associated with yield farming.

Apart from farming, DYP also allows the staking of BEP-20 tokens for rewards.

BurgerSwap

BurgerSwap is trading, farming, and staking binance smart chain extension for BEP-20 tokens and creating liquidity.

Spartan Protocol

Right now, Spartan Protocol users can create liquidity against their BEP-20 tokens, just like any other AMM. However, the developers suggest that more features will be added in the future, such as creating synthetic assets, lending, on-chain derivatives, and more.

Conclusion

Binance Smart Chain is relatively new and has been widely popular in the crypto community because of the countless benefits it offers – not to mention the constant improvements being implemented on it. To use the smart chain, you need a bit of knowledge first, but it offers immense value at very little cost. According to the devs, these features and, thus, user activity is only bound to increase in the future.

Do you think BSC is suitable enough for you? Is there something that you would want to be changed if you could talk to the devs? We’d love to hear your side of things down in the comments!

Or get in touch with us on Telegram, and let’s be smart together!