It is no secret that Bitcoin, the world’s most famous cryptocurrency, has set the bar for all other altcoins. What started off as a means to empower uniform international transactions has now turned into a potentially lucrative investment platform. However, at the same time, the energy consumption associated with cryptocurrency and blockchain, in general, has been a concern for many.

Several studies have shown that bitcoin stands at the top of this concern, consuming more power than many countries every year! According to the University of Cambridge, its 2022 annual consumption is set to surpass 96.54 TWh of power. This is more than what all of Austria, Bangladesh, Switzerland, and many other countries use! If left unchecked, it could increase to consume as much energy as the entire world!

In this article, we will look closely at the energy consumption of Bitcoin and altcoins. We’ll see how they compare to each other as well as to traditional fiat currencies and the potential solution to this issue. We will also look at what the future holds for the environmental concerns surrounding cryptocurrency energy consumption.

The Bitcoin Energy Consumption Conundrum

As we mentioned before, Bitcoin is the most well-known and well-established cryptocurrency. It has been around since 2009, and its popularity has only grown in recent years. It now stands at the top of the cryptocurrency food chain as the highest-valued currency out there. However, with this increase in popularity has come an increase in energy consumption.

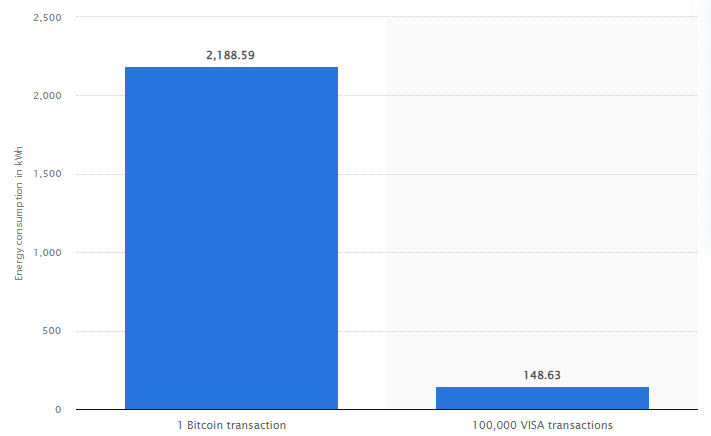

Studies have shown that while the number of Bitcoin transactions has been increasing, so too has the amount of energy needed to power these transactions. In fact, it is estimated that each Bitcoin transaction requires the same amount of energy as 476,000 Visa transactions!

Here is a graph showcasing the energy consumption of one BTC against 100,000 Visa transactions.

The reason for this high energy consumption is two-fold.

Why Does Bitcoin Use So Much Energy?

First, blockchain technology, which is the basis for all cryptocurrencies, is inherently energy-intensive. This is because each block on the blockchain must be verified by miners. In order to verify a block, miners must solve a complex computational problem. The more blocks that are added to the blockchain, the more difficult it becomes to solve these problems.

Second, the price of Bitcoin has been on a steady increase over the past few years. This has led to an increase in mining activity as people look to cash in on the currency. The more people that are mining Bitcoin, the more energy is needed to power the process.

The problem with Bitcoin’s high energy consumption is that the vast majority of the electricity used to power the currency comes from fossil fuels. While this has been changing recently, it is estimated that 74% of Bitcoins already mined were powered by coal.

This means that for every transaction made using Bitcoin, nearly 843.96 kg (1,861 lb.) of carbon dioxide is released into the atmosphere at 2,188 KWh.

This is a significant problem because it goes against one of the core principles of cryptocurrency: to be a more environmentally friendly alternative to traditional fiat currencies. If Bitcoin continues to consume energy at its current rate, it will do serious damage to the environment.

Ethereum, the second largest cryptocurrency by market capitalization, is much more efficient. However, even Ethereum’s annual power consumption is estimated to be around 112.8 TWh. For perspective, this is enough to power the entire Netherlands! While it is half of what BTC uses, it is still a significant blow to the environment and ecosystems around it.

A Problem For The Environment & The People

The high energy consumption of cryptocurrency is not just a problem for the environment. It is also a problem for the people that live in areas where mining takes place.

Many of the world’s largest Bitcoin mines are located in China, while its heart lies in inner Mongolia, where coal powers most semiconductor manufacturing. In fact, it is estimated that 65% of all Bitcoin mining takes place in China. This is largely due to the fact that electricity and labor are relatively cheaper in the country.

As China continues to mine Bitcoin at its current rate, the country is using more electricity than the entire United States, standing at 8,310 TWh (compared to the US 3,930 TWh)

How Altcoins Compare Against Bitcoin’s Energy Usage

The table below shows the estimated annual electricity consumption of Bitcoin and Ethereum, as well as some of the most popular altcoins.

| Currency | KWh Per Transaction | Estimated Annual Transactions (Mil) | Estimated TWh (Annual) |

| BTC | 1,173 | 105.5 | 123.75 |

| ETH | 87.29 | 449 | 39.19 |

| BTC Cash | 18.52 | 46.4 | 0.88 |

| LTC | 0.88 | 33.5 | 0.62 |

| ETH 2.0 | 0.55 | 449 | 0.39 |

| Cardano | 0.55 | 17.8 | 0.01 |

| DOGE | 0.12 | 14.9 | 0.002 |

| XRP | 0.008 | 61..9 | 0.0005 |

As you can see, even the most efficient altcoins are still very energy-intensive. Ethereum 2.0 does use 90% less energy, which makes it even more efficient, in theory, than fiat. However, there is still a concern about the ETH that has already been minted and the energy it used up. This is because, at their core, all cryptocurrencies are powered by blockchain technology. And as we mentioned before, blockchain technology is inherently energy-intensive.

To put it simply, the more popular a cryptocurrency is, the more energy it will consume.

How Energy Is Converted into Currency

Now that we know how energy is used in cryptocurrency, let’s take a look at how this energy is converted into actual currency.

As we mentioned before, miners are responsible for verifying blocks on the blockchain. In order to do this, they must solve complex computational problems. The first miner to solve a problem gets to add a new block to the blockchain and is rewarded with a certain amount of currency.

This process is known as “mining.”

The amount of currency that miners are rewarded with varies depending on the cryptocurrency. For example, Bitcoin miners are currently rewarded with 12.5 BTC for each block they mine (may vary from time to time). Ethereum miners, on the other hand, are rewarded with 3 ETH per block (may vary).

The amount of energy that is consumed in order to mine one Bitcoin is enough to power nearly 30,000 homes for a day! However, there are two primary concepts that you should understand in terms of the type of currency when looking to solve this conundrum; the proof of work and the proof of stake.

What is Proof of Work?

The proof of work is the most common consensus algorithm in use today. The vast majority of cryptocurrencies, including Bitcoin and Ethereum, are based on this algorithm.

Under the proof of work consensus algorithm, miners compete against each other to solve complex computational problems, as mentioned above. The more “work” they put in to solve the problem, the more they are rewarded. This work, i.e., the energy consumed, is recorded on the blockchain, and this “spent energy” creates its value. This is one of the biggest problems with cryptocurrency and why it has not been deemed as a sustainable currency, environmentally or financially.

What is Proof of Stake?

The proof of stake is a newer consensus algorithm that is not as widely used as the proof of work. However, it is gaining popularity and could eventually replace the proof of work as the most common algorithm.

Under the proof of stake consensus algorithm, miners are not rewarded based on the amount of work they put in. Instead, they are rewarded based on the number of coins they have. This means that the more coins you have, the more you can earn.

The proof of stake algorithm is much more energy efficient. This is because there is no need to consume large amounts of energy in order to solve complex computational problems. However, the energy already spent for mining the currency/coins that the miner has is still “locked in,” so to speak, and cannot be reused. So, even though it may be more energy efficient, it is not necessarily more sustainable in the long term.

The proof of stake algorithm also has several other advantages. It is generally more scalable than the proof of work and can therefore handle more transactions per second, all while maintaining a sustainable energy footprint. Second, it is more secure. This is because it is very difficult to tamper with the blockchain without being caught.

Studies have shown that the PoS algorithm used by newer altcoins uses less energy to mint new coins than what would be needed to mint a single bitcoin.

How Much Energy Does Fiat Currency Consume?

While cryptocurrency may consume a lot of energy, it is important to note that fiat currency also consumes a significant amount of energy. In fact, the US dollar alone consumes more energy than all of the cryptocurrencies combined!

This is because fiat currencies are physical objects that need to be produced. The production of fiat currency (especially the US dollar) requires a lot of energy. The production of one US dollar requires about 0.22 kWh of energy. This might not seem like much, but when you consider that there are billions of dollars in circulation, the amount of energy consumed starts to add up.

In addition, fiat currencies also need to be transported and stored. This requires even more energy. For example, the transportation of one US dollar requires about 0.0006 kWh of energy. Fiat currencies also consume a lot of paper. And to avoid the risk of counterfeits, this isn’t any ordinary paper.

The paper used is 25% linen and 75% cotton, and it has tiny red and blue synthetic fibers woven across the note itself. This, too, takes energy to produce. The production of one ton of this type of paper requires about 17 million BTUs of energy. This is enough to power about 1,400 homes for a day!

This shows that while cryptocurrency may consume a lot of energy, it is important to remember that fiat currency also consumes a significant amount of energy as well.

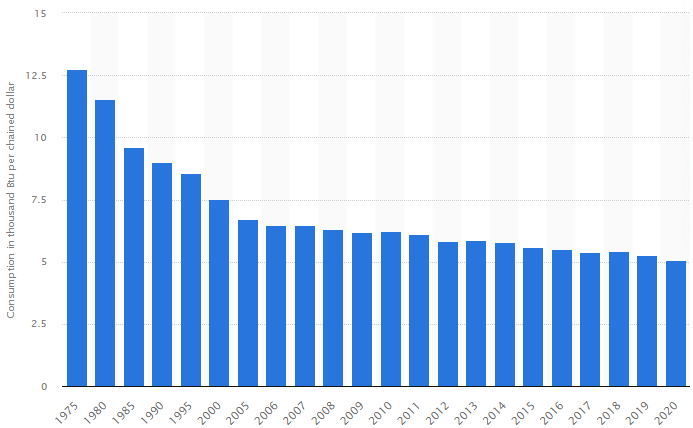

Here is a graph to show how energy consumption has reduced (but has stayed relatively the same in recent years) over time per dollar.

While the amount of energy every dollar uses has been reduced over the years via more efficient means of production, transport, and storage (mostly thanks to digital means), the energy consumption of every “real” dollar of the US GDP in 2020 amounted to 5.06 thousand BTUs.

How The Cryptocurrency Energy Problem Can Be Fixed

The cryptocurrency energy problem can be fixed in a number of ways, but it would require a bit of focus and a revolutionary step from the entire cryptocurrency industry. It doesn’t need to be immediate but needs to be done as quickly as possible.

Proof of Work Algorithm

One way is to move away from the proof of work algorithm and towards the proof of stake algorithm. As we saw earlier, the proof of stake algorithm is much more energy efficient.

Focus on Renewables

Another way to fix the problem is to use more renewable energy sources. Currently, most of the energy used to mine cryptocurrencies comes from non-renewable sources such as coal and natural gas. If more miners switched to using renewable energy, the overall energy consumption of the cryptocurrency industry would go down.

The latest development in mining technologies and energy generation has shown that now, Bitcoin gets roughly 74.1% of its energy needs from renewable sources, but the overall consumption still remains high.

Regulations, Credits, & Fees

Another way to reduce the energy consumption of cryptocurrencies is through better regulation. Currently, there are very few regulations governing the cryptocurrency industry. This means that miners can use as much energy as they want. If there were regulations in place that required miners to use less energy, the overall energy consumption of the cryptocurrency industry would go down.

Introducing carbon credits or carbon emission fees is one way to do this. For example, if a miner wants to mine a cryptocurrency that uses the proof of work algorithm, they would have to pay a carbon emission fee. This would incentivize miners to use less energy because they would have to pay more for each unit of energy they used.

However, this would require a lot of coordination among different countries and jurisdictions. And it is not clear if this is something that would be possible to implement in the near future.

Pre-Mining

Pre-mining is another way that can be used to reduce the energy consumption of cryptocurrencies. When a new cryptocurrency is created, all of the coins are typically mined before they are released to the public. This means that a lot of energy is consumed in the process. If the cryptocurrency was not pre-mined, the overall energy consumption would be reduced.

Pre-mining is the process of mining a cryptocurrency before it is released to the public. This can be done in a number of ways, but the most common way is for the developers of the cryptocurrency to mine all of the coins before they are released. This means that a lot of energy is consumed in the process. If the cryptocurrency was not pre-mined, the overall energy consumption would be reduced.

Cryptocurrencies can also be made more energy efficient through the use of sidechains. Sidechains are separate blockchains that are connected to the main blockchain. They are used to offload some of the work that the main blockchain needs to do. This means that less energy is needed to power the network.

The Future of Blockchain In Terms of The Environment

The cryptocurrency energy problem is a serious one. The industry has come under fire in recent years for the huge amount of energy that it consumes. This is because the process of mining cryptocurrencies requires a lot of energy.

However, it is important to remember that the problem is not unsolvable. The good news is that there are a number of ways to reduce the energy consumption of cryptocurrencies, as mentioned above. But at the time being, even in the maturing industry, it is likely that the energy problem will continue to be a bone of contention among different groups.