If you’ve got your crypto in a lending platform like Crypto.com, BlockFi, or Celsius Network, or you’re planning to, then you’ll really want to learn a little more about Cred. In this article, we’re going to learn about one of the biggest crypto lending companies that ultimately went bankrupt and lost millions of dollars in users’ funds.

We’ll also cover 3 main key points you might want to consider when using ANY lending platform in the crypto space. After all, the saying goes… “Not your keys, not your crypto.”

Let’s dive in!

History of Cred Inc.

Cred Inc. is – or was – a cryptocurrency-based lending company founded in 2018. Led by CEO and former PayPal executive Dan Schatt and Chief Capital Officer James Alexander, they specialized in delivering crypto lending and borrowing services to customers in approximately 140 countries.

Customer balances as of November 2020 amounted to about $115 million – before it all came crashing down.

“Cred Earn” – the core financial product offered to investors with the firm – earned account holders interest of 4-10% on their cryptocurrency balances. Similar to BlockFi or Crypto.com – other popular crypto lenders – Cred’s written business model implied borrowing at lower interest rates and lending at higher ones, transacting through an ecosystem of other borrowers and lenders fielding strong balance sheets.

However, Cred’s business model was not fully transparent and its lending relationships were not as secure as they were made out to be. Due to a combination of bad debts, fraudulent asset management, and the inherent volatility of the major cryptocurrency prices, such Bitcoin and Ethereum, Cred filed for Chapter 11 bankruptcy in November 2020.

Despite Cred’s guarantees of a comprehensive insurance on customer balances “enabled by custodial partners with some of the biggest BTC holdings in the world,” an estimated $140 million was lost, or at risk, at the end of the day – including all $115 million of those customer balances.

Cred ultimately shut down their platform and froze investor funds. In effect, Cred’s investors lost everything. The reorganization process and lawsuits between major executives from the firm are still ongoing.

Here is a summary of the Cred story, from start to finish, dream to nightmare.

Cred’s Product Presentation vs. Reality – Crypto CD vs. Fund of Crypto Funds

Cred’s platform operated much like a bank, or as any other lending institution might, with investors transferring assets – like Bitcoin or Ethereum – into account balances that would earn a percentage interest for them over time.

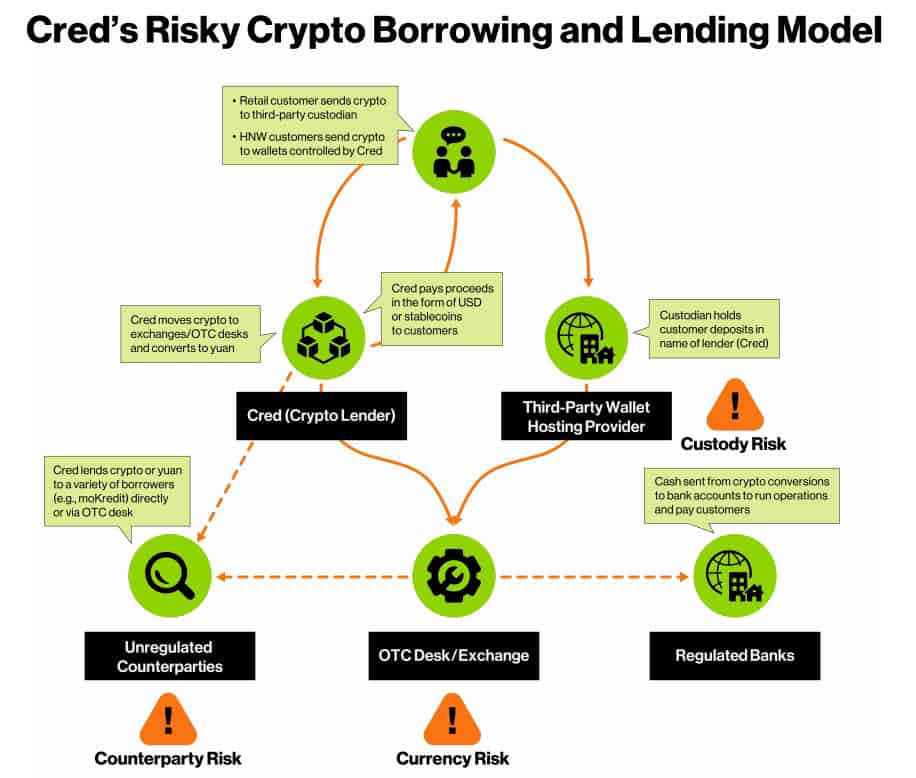

Retail customers transferred their funds into an online e-wallet managed by a third party, while high net worth individuals transferred their crypto directly to Cred.

The Cred team then lended the crypto balances out to a variety of customer segments – including asset managers, crypto mining companies, and other third parties – who would further leverage the cryptocurrency to earn interest yields via arbitrage trading and other financial assets {according to Guidehouse}.

The movement of the funds between all parties was enabled through Cred’s relationships with commercial banks, crypto exchanges, and OTC, or “over-the-counter,” firms.

Every quarter, Cred’s investors would earn a portion of their balance’s 4-10% annual percentage yield (APY), paid in US dollars or stablecoins. Cred’s management would earn a spread, or profit, on the difference between the lower promised yields to their investors versus the higher interest rate terms on their loans to counterparties.

Here is a visual outline of the rather complex borrowing and lending model employed by Cred:

This setup is not unlike BlockFi, Celsius, or Crypto.com’s lending platforms – with cryptocurrency balances earning customers a yield ranging from 1-12% annually, depending on the specific coin and fluctuating over time based on international interest rates.

The difference for Cred dealt with the specific relationships – and the riskiness – of the counterparties they were actually lending to – namely one key principal named moKredit, a Shanghai-based crypto lender centered around micro-loans to retail customers.

After Cred lost value on an initial coin offering (ICO) in the latter half of 2018, the firm pivoted to feature Cred Earn as the primary product for investors to pour their money into. Overseen by then chief capital officer, James Alexander, Earn was a product meant to be conceptually similar in nature to a certificate of deposit (CD) from a bank.

A CD is one of the safest investments someone can make, as they provide a premium interest rate (typically around 1% APY) on a balance in exchange for the customer agreeing to leave a lump-sum deposit untouched for a predetermined period of time. Paired with FDIC insurance – which guarantees up to $250,000 of a depositor’s account balance with a financial institution – certificates of deposit traditionally make for a highly secure, and financially attractive, alternative to simply keeping your cash in a low-interest savings account.

However, the back-end, hidden investment sources for the Cred Earn model were much riskier than CD’s. That marketed similarity proved to be dishonest, and a dangerously artificial comparison to sell to prospective customers into Cred’s business model.

According to a CoinDesk interview with former employees, the new product’s users effectively signed unsecured notes to Cred, a relationship much closer to lending money to a company than depositing it in an FDIC-insured bank. Cred’s core business featured a relationship with a much higher risk than was being told to customers.

To that point – according to Cred insiders, in Q1 of 2020 a plan was proposed by the company’s capital markets team for a liquidation plan that would have prioritized repayment to Cred Earn noteholders over other creditors in the event of failure. That plan would’ve made their debt the most secure at the company during a potential future bankruptcy. CEO Dan Schatt, however, rejected that plan.

Source: Coindesk

And sure enough, in Q4 2020 – due to risky lending relationships with a few suspect firms, a hacking scandal, an executive fraud allegation, and recent volatilities from the price of major crypto coins – the company soon faced a liquidity crisis. Meaning liabilities, or debts, far outweighed the company’s assets on the balance sheet.

As soon as debts outweighed assets, this meant the majority of investors looking to potentially withdraw their Cred Earn balances would be left in the cold. Like in a “bank run” (think of the harrowing bank scene from It’s A Wonderful Life (1946)) – Cred Inc. would be unable to service investor requests for their money back and bankruptcy would legally have to be called in order to settle funds with all relevant stakeholders.

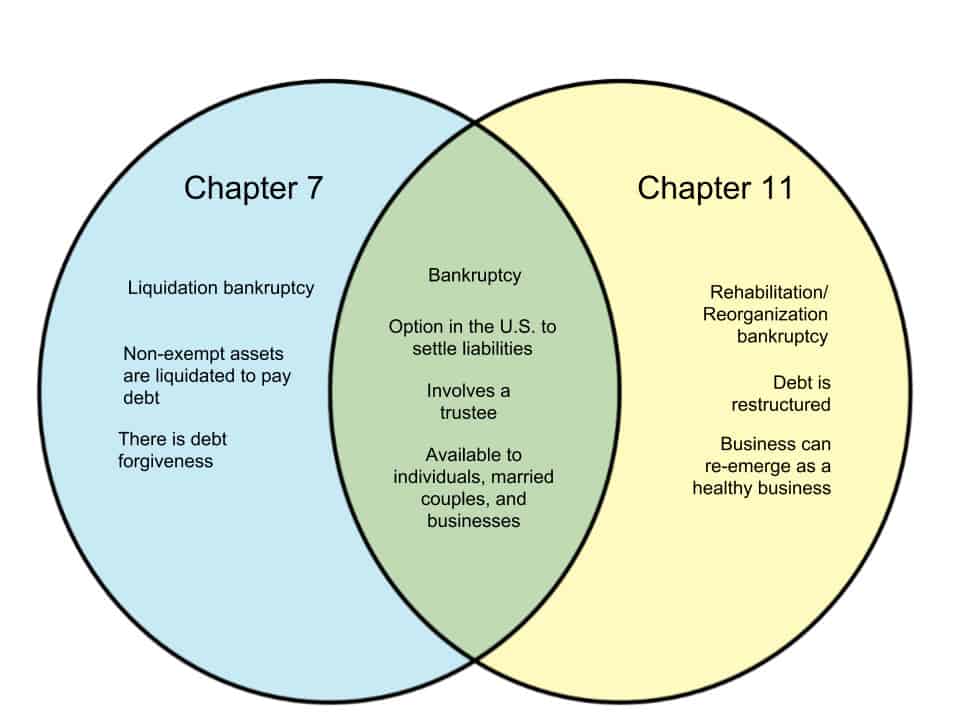

In November 2020, that is just what happened. Cred filed for Chapter 11 bankruptcy.

Cred’s Bankruptcy – What Went Wrong?

At the time of the Chapter 11 – or reorganization – bankruptcy filing, Cred held $136 million in liabilities, including customer deposits, compared to $68 million in assets.

According to the filing, the primary driver of Cred’s unfavorable financial situation was the rise in Bitcoin’s price, which skyrocketed 200% from around $5K in March 2020 to $15K in November 2020. This negatively impacted Cred’s balance sheet as all those customer deposits of BTC were a liability to them – i.e. they were a debt they’d have to repay in the future.

Additionally, Cred suffered a hack during 2020, leading to the freezing of customer cryptocurrency funds while law enforcement worked to recover the lost assets.

Most significantly, there was a “material loss [of funds] connected with the onboarding of a fraudulent asset manager…” – CCO James Alexander – and his misappropriation of a total of 800 BTC into an entity called Quantcoin between March and April 2020. (800 Bitcoin equaled an equivalent of about $16 million as of December 2020).

Source: Business Insider

According to former employees, the management team was aware of the apparent fraud and loss of funds in August 2020, but employees were nevertheless told to continue accepting deposits from new clients. After the fraud was announced, Cred froze its assets and fired three employees.

A series of lawsuits and counter lawsuits followed between CEO Schatt and CCO Alexander for the Quantcoin investment, including a claim the latter individual took over $2 million in BTC and USDC (a USD-based stablecoin) and transferred them to his own wallet, effectively stealing from the company.

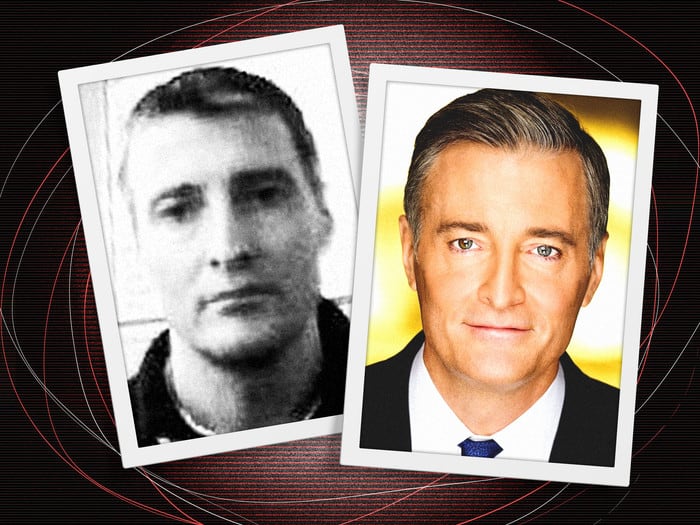

In fact, Alexander, the Cred CCO allegedly responsible for this misappropriation scheme, was a convicted criminal on the run from U.K. authorities over previous financial fraud activities in 2007. He was sentenced to 3 years in prison that was never served due to a prison break.

Yes, you heard that correctly! The Cred chief capital officer was a bona fide fugitive – and according to Yahoo Finance, up until Alexander’s firing due to the fraud he orchestrated with Quantcoin, the man was given “free reign to choose how capital was raised and deployed, with scant oversight from Cred’s board.” After all, that is what the chief capital officer does.

These three factors, only vaguely explained by the CEO in the filings, were presented as the major drivers of the bankruptcy. However, there is more to the story – as told by CoinDesk’s reporting, among others.

One of Cred’s primary financial relationships was with moKredit, a Shanghai-based lending service. As part of the core business model, Cred converted depositors’ cryptocurrency to the Chinese yuan and then lent those funds to moKredit in exchange for a staggering 15-24% in annual interest income.

Over the course of 2020, Cred lent $39 million to the Shanghai firm, which did micro-lending using special tokens, marketed to gamers under a “play-first, pay-later” model.

But of course, in finance – traditional or crypto – higher rewards always indicate higher risk! The investment in moKredit soon proved to be toxic.

Due to the COVID 19-induced market crash in March 2020, Cred attempted to call back $10 million from moKredit but the highly leveraged Chinese lender was unable to repay. While the bankruptcy filing states Cred subsequently tried to renegotiate loan terms with moKredit, former employees now dispute that was the truth. Cred was ultimately not able to recoup the funds from moKredit – whose website is no longer active and whose services seemed to have also shuttered.

This relationship with moKredit and its effect upon the bankruptcy was omitted from the bankruptcy filing, in addition to the remaining losses based on the amount of total liabilities outstanding. According to Guidehouse, only $53 million of Cred’s $140 million in liabilities can be accounted for from the bankruptcy filing in combination with reporting on the specifics of the moKredit balance.

Altogether, we have the $39 million loan to moKredit, an estimated $12-14 million in BTC lost to the Quantcoin fraud, and about $2 million in stolen BTC from the former CCO.

Thus, about $80-90 million in unspecific liabilities remain, which must be due to either 1) the volatile positive price movement of Bitcoin (positive to depositors, negative to Cred!), or 2) other undisclosed financial relationships with lenders or borrowers.

3 Lessons from Cred’s Downfall – Know What You Are Investing In

Daniyal Inamullah, Cred’s former head of capital markets, said to CoinDesk’s reporters:

“There’s a fine line between being a Ponzi scheme and being a bank.”

Cred’s high risk investment in moKredit and the fraudulent transfers to Quantcoin doomed the company by making it unable to pay out total customer balances and interests. Bad loans and corporate malfeasance paired with a lack of federal deposit insurance and regulatory oversight effectively turned Cred Inc. into a Ponzi scheme. And Ponzi schemes always fall apart during extreme market events.

Source: MSNBC

The 2008 financial crash exposed Madoff; the March 2020 COVID crash exposed moKredit’s high risk lending operation, and by extension, Cred as well.

The 3 major lessons, or warning signs, from the story of Cred’s collapse could be as follows:

1. There are unique risks and limits for crypto lending platforms

While the ongoing crypto-based finance revolution means more access to potentially lucrative investment opportunities for the average person, there are limits.

Crypto lending platforms like Cred are classified as centralized finance (CeFi), while many other investment platforms and tools are part of the growing decentralized finance (DeFi) ecosystem. Each runs on cryptocurrencies, sometimes on their very own tokens created just for the platforms.

However, these platforms can fall victim to the same risky practices of the Wall St. asset managers of old – offering products that maximize returns by taking on too much leverage, or straight up lying about how the money is being invested.

While the 4-10% yield provided for investors from Cred seems reasonable – the 15-24% yield offered by smaller boutique firms like moKredit strain credulity, indicating something quite risky is bubbling under the hood of the operation. And since many of these lending institutions are exchanging loans with each other, one firm’s collapse could cause a domino effect – like in this case.

2. Ineffective due diligence into counterparties

Cred’s management failed their depositors by not performing proper due diligence in two primary areas: 1) not vetting the true risk of their very material relationship with moKredit, and 2) not vetting the background and past criminal activities of their chief capital officer, James Alexander.

Every counterparty a lending institution chooses to do business with should be rock solid, especially given the materiality of the investment – in this case, about $40 million, or nearly 35% of their customer’s total deposit balances!

And obviously, hiring a key executive that has not been previously convicted of financial fraud and is not currently a fugitive(!) is a smart thing for a would-be successful firm to do.

Cred Inc.’s management team and their negligence with regard to diligence into their primary business counterparties and the construction of their team itself signaled the end well before it came to pass.

3. Lack of transparency from executives = lack of security for investors

Altogether, Cred was not transparent with their investors regarding the nature of their business model and what kind of account a depositor with them would truly be opening up. It was less “certificate of deposit” and more casino.

Players in Cred’s “Earn” model were investing in a financial product with a significantly higher amount of risk than was advertised to them. This lack of transparency allowed Cred to build a customer base on false pretenses.

Prospective CeFi investors should be wary of similar schemes.

Regulatory oversight around crypto lending platforms like Cred are continuously evolving, including what is legally required for these companies to be transparent about. However, the case of Cred and their fraught history of hidden investments and management misbehavior provide a cautionary tale to investors past and present involving their hard-earned money with similar institutions.

Cryptocurrency and the ecosystem of CeFi & DeFi products surrounding them are still a novel technology. And yet, the same principles of debt, liquidity, and risk management apply to such investment opportunities, whether it is Bitcoin or fiat currency.

Needless to say, investors should perform their own due diligence, or as much as they can, into such companies before choosing to invest with them.

With crypto’s decentralized products, or in traditional finance, it pays to know exactly what you are investing in – lest you end up waiting in line for repayment as part of a chaotic bankruptcy filing, uncertain if you will be made whole on your investment.