DeFi (decentralized finance) aims to build a new ecosystem of financial services for our globally interconnected online population. Through crypto-based applications, Ethereum smart contracts, and various digital investment tools, DeFi provides alternative savings and investment options for anyone.

DeFi tools are primarily centered around financial services – but offer such service through a customizable digital environment allowing for greater transparency (all user interactions are tracked and verified) and interoperability (different DeFi projects can efficiently utilize each other’s services).

Check out our list of the top DeFi tools to start using to get going in the realm of decentralized, 21st-century finance.

MetaMask

A crypto wallet and blockchain app gateway with over 21 million users, MetaMask equips you with a key vault, secure login, token wallet, and token exchange for maximum security. Everything you need to securely manage digital assets is smoothly included in this smartphone app.

One of the most popular among DeFi tools, MetaMask features a highly utile browser extension on major players Brave, Chrome, Microsoft Edge, and Firefox. Metamask helps users in interacting with the Ethereum ecosystem through decentralized applications, or dApps.

Thankfully, users don’t have to download the whole blockchain on their device for the chosen dApps to work their magic. Metamask links directly with decentralized exchanges, allowing for seamless interoperability. The wallet also has a unique system that easily backs up every account.

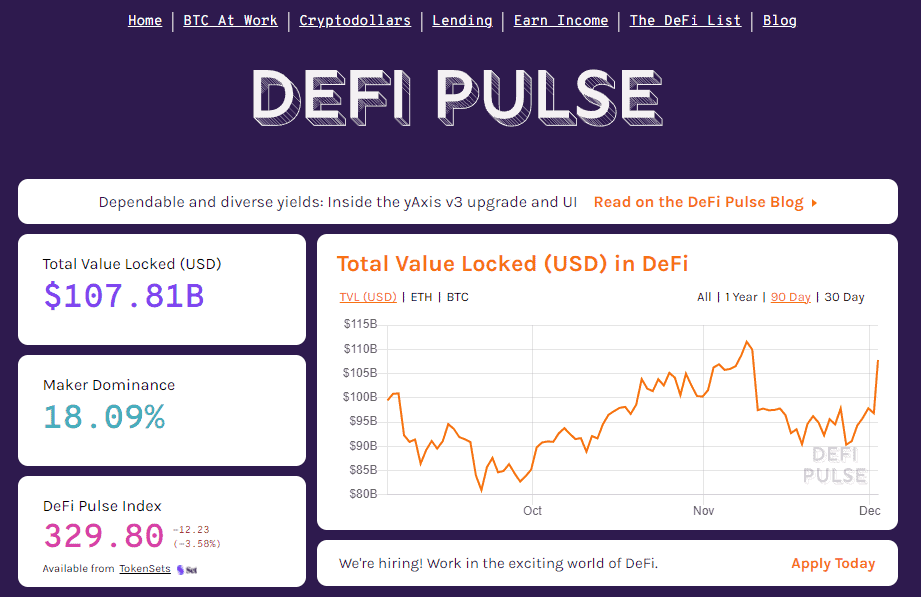

DeFi Pulse

DeFi Pulse is perhaps one of the top resource for keeping track of DeFi assets and projects of all kinds. Crypto enthusiasts call it THE leaderboard of decentralized finance. The home page features a handy overview of the whole DeFi market, with over $100 billion in total locked value (TVL) as of December 2021, including a “Market Dominance” % and DeFi Pulse index score for visitors to explore.

Along with the latest analytics and rankings for the various DeFi protocols, DeFi Pulse provides The DeFi List (collection of the best DeFi resources) and DeFi Pulse Farmer (a newsletter on the latest opportunities in the space) for anyone to access and learn from.

DeFi Pulse’s creators, to put it in terms anyone can understand, describe the realm of decentralized finance as “financial software built on the blockchain that can be pieced together like Money Legos.” Now doesn’t that sound exciting?

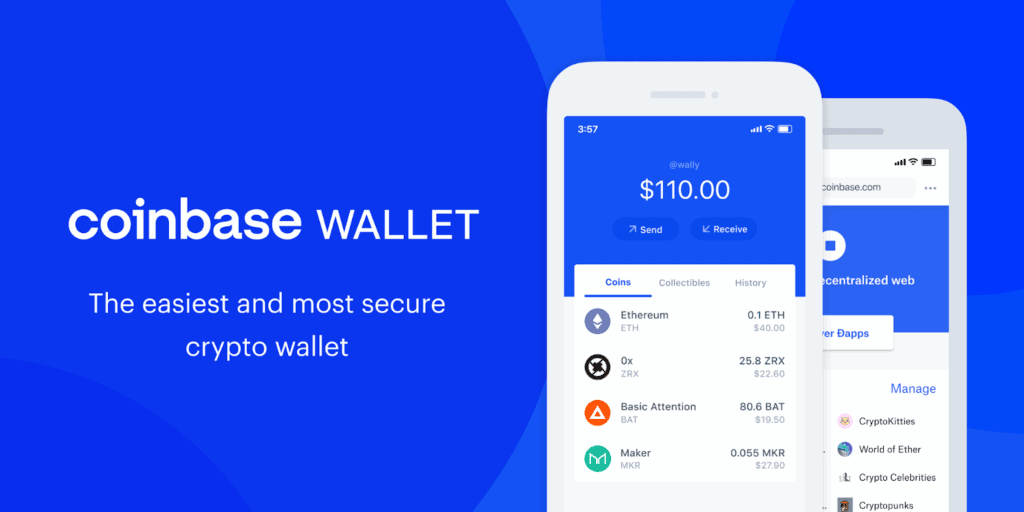

Coinbase Wallet

Coinbase is one of the simplest, and earliest adopted, platforms for buying, selling and managing cryptocurrency. Coinbase Wallet is a new system, separate from the original Coinbase app, yet just as easy to use. It is a multi-coin wallet based on Ethereum, and is a dApp browser.

Coinbase Wallet is widely considered one of the best overall tools for beginners in decentralized finance.

Coinbase Wallet lets you store all your crypto, NFTs, and dApps in one place. Explore the decentralized web on your phone or browser and benefit from world-class security services over all your coins and app connections.

DappRadar

DappRadar is known as the world’s dApp store. Through the platform, search, track, and trade everything in the realm of DeFi, NFTs, and crypto-based gaming applications.

The platform’s portfolio functionality allows for a user to manage all their wallets in one place. The Industry Pulse page features a comprehensive dApp industry overview, updated every 24 hours for the # of smart contracts, functional dApps, and protocols available through DappRadar on the market.

Currently, users in the Games and DeFi categories dominate the space, each with millions of users respectively.

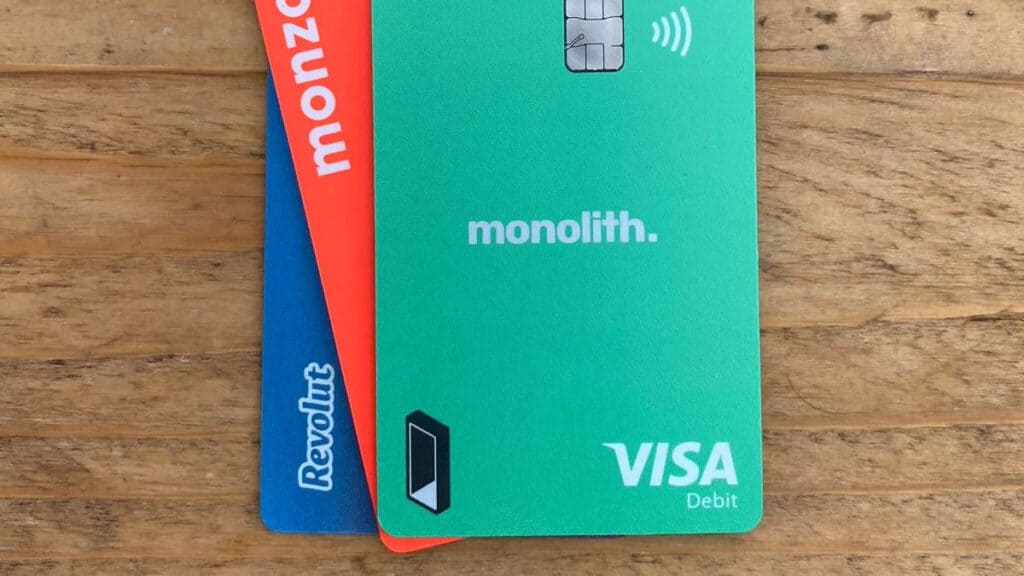

Monolith

Monolith is a decentralized banking solution based on Ethereum. The platform is non-custodial (meaning: you have full control of your crypto funds through a private key) and open-source. The Monolith “contract wallet” pairs with a Visa debit card to allow for easy fiat currency exchanges (such as Euro(€) or USD($)) within the app.

The partnership with major financial institution Visa gives the Monolith brand global recognition, and it is currently available across over 30 countries in Europe.

The Monolith token (TKN) gives holders a proportional share of the community’s contributions, encouraging growth in the functionality of the Monolith card and the population using it.

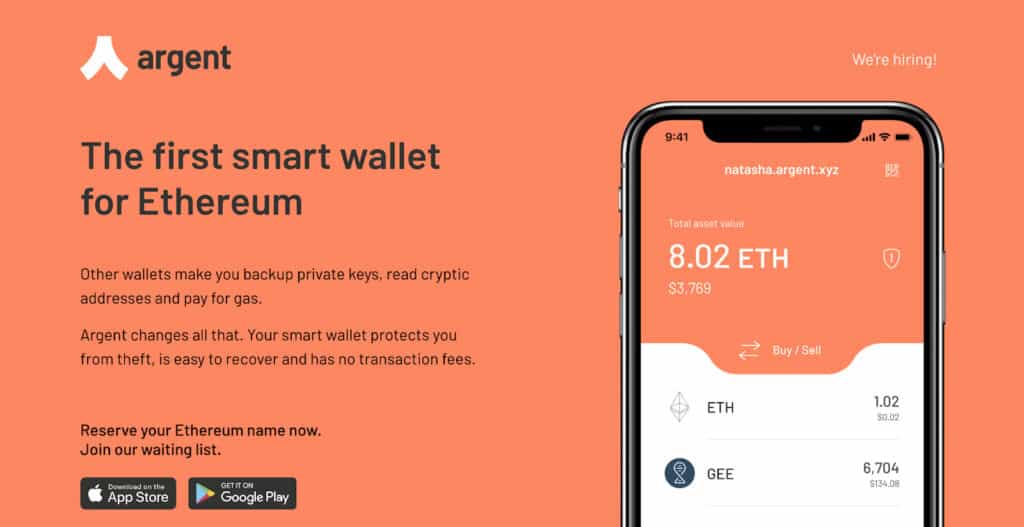

Argent

Argent heralds its platform as “the most simple and secure Ethereum wallet.” Designed for beginners and with user-friendliness in mind from the jump, Argent takes all of the complicated crypto terminology and concepts and simplifies them for anyone to understand. Additionally, on assets such as Yearn (YFI), Aave (AAVE), and Compound (COMP), users can earn (very high!) 20%+ annual percentage yields.

Argent features a non-custodial wallet and an easy recovery mechanism titled “Argent Guardians.”

These Guardians are people and devices (you get to choose) that help with your crypto wallet’s security. They do NOT have access to your cryptocurrency itself but can perform certain actions on your profile, such as lock your wallet, approve a wallet recovery, or approve an untrusted transaction for you.

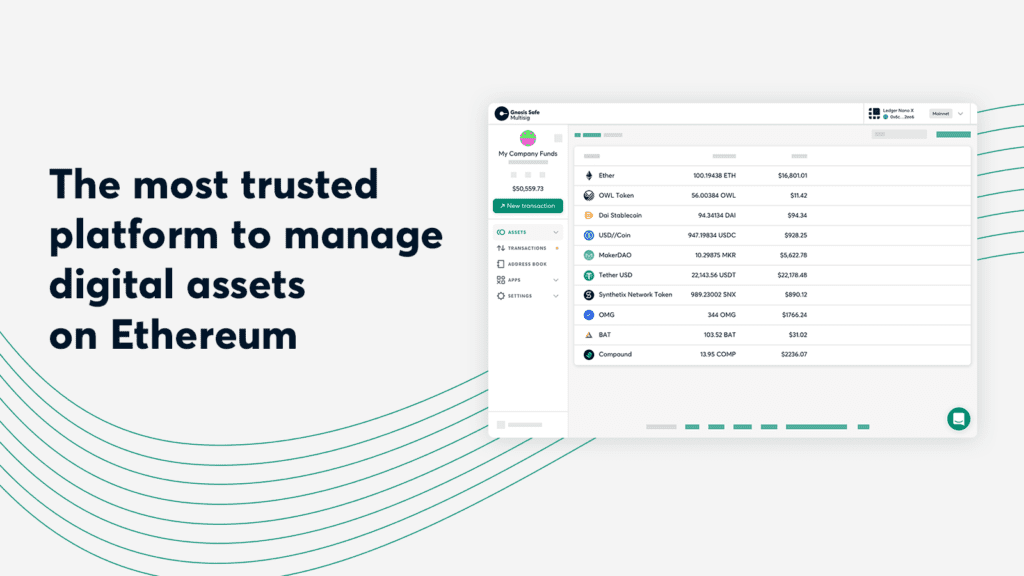

Gnosis Safe

Gnosis Safe is a well-known and highly trusted crypto management platform. It features a multi-signature wallet, with a high degree of customizability, for Ethereum smart contracts.

Using hardware wallets, EOA-based wallets (EOA = Externally Owned Account), paper wallets, or some combination, Gnosis Safe users are given the option of requiring multiple devices to confirm any transactions.

Gnosis Safe is unique among DeFi platforms in that it more efficiently allows a user to set up complete self custody of their crypto funds in these ways. More control means more security – and responsibility – for the user.

Zerion

Zerion is a DeFi tool for all-in-one, non-custodial management of your crypto portfolio. With the platform, users can navigate the DeFi market under the major categories of Yield Farming, Top Gainers, and Liquidity Pools (a diverse, foundational technology for the DeFi ecosystem).

Users can search, filter, and evaluate every single DeFi asset on the market with Zerion.

The platform allows investors to see how much interest they’ve earned, track the performance of their investments over time – and search for new investments along those same criteria. Transaction histories can also be presented easily on the basis of protocol, transaction type, address, or asset.

Zapper

Zapper is a DeFi portfolio manager with over $11B invested through the platform since May 2020. With over 200 DeFi platforms supported, the Zapper DeFi “dashboard” creates a place for easy tracking and visualization of the DeFi assets within your personal portfolio.

An easy-to-read interface to help users understand their current crypto investments means a better handle on what actions you may want to take in the future. Additionally, the Zapper site has a Learn page that aims to define and teach DeFi concepts in a more understandable way through articles and tutorials.

Debank

Source: https://defiprime.com/product/debank

Debank is a crypto asset management service focusing on analytics. It partners with many decentralized lending protocols, exchanges, stablecoins, and margin trading platforms.

The platform’s goal is to close the gap between (sometimes very complex) DeFi technologies and the many potential end-users out there looking to get involved.

New features are added over time to Debank’s overall banking service ecosystem. Users can now track 695 DeFi protocols across 14 blockchains. Debank’s “Ranking” panel on the website’s dashboard allows for a nifty scorecard feature for various categories and their relevant functions.

DeFi Saver

DeFi Saver is an asset management software focused on automation. Through the platform, users can automatically boost or reallocate their DeFi and crypto positions based on your predetermined inputs.

Through “DeFi recipes”, users are able to combine various potential DeFi actions to create unique protocol transactions that execute on their own once certain conditions are met.

DeFi Saver provides “everything you need in one app”, including:

- portfolio management,

- leveraged longs & shorts,

- loan refinancing tools,

- lending & borrowing,

- decentralized exchanging,

- and the aforementioned custom transaction builder.

Though its functionality may be more complex for the average user, DeFi Saver offers an expensive investment product. The platform partners with many of the most popular Ethereum wallets, including Coinbase and Metamask.

APY.vision

APY.vision hopes to be the go-to DeFi source for analytics and monitoring around liquidity pool providers and yield farmers in the crypto space.

The app lets users efficiently find the most profitable liquidity pools currently available in the market, and automatically calculates risk and performance metrics for them. Monitor your vault and your farming activities – and clearly see the net profits accumulated on your investments thus far.

The platform is integrated with Automated Market Makers (AMMs) and chains such as Ethereum, Polygon, Fantom, Binance, Uniswap, Balancer, and more.

DEFIYIELD

Branded as a “safe space” for DeFi access, DEFIYIELD lets you manage digital assets with a full suite of tools for both innovation and user-friendliness. Enter in your ENS (Ethereum Name Service) domain, or a valid ETH or BSC address – or connect your crypto wallet directly – and you can get started on the platform.

DEFIYIELD focuses on informed investment decisions through a complete DeFi management toolset, including tracking of your portfolio, transactions, and pools through a simple dashboard view.

The app’s developers boast of the app’s top-notch security, with over 50 audits completed on various DeFi tools, and 500+ vulnerabilities identified for investors to see.

RugDoc

RugDoc is a community platform for browsing DeFi tools and project reviews. Use the site to securely search through DeFi projects and investment opportunities, categorized by risk ratings and featuring in-depth descriptions.

You may filter by type, network, risk, or even whether or not the DeFi project has been audited (independently verified by crypto investment experts). With RugDoc, users can scan the whole DeFi environment and choose potential investments exactly how they want to.

DeFi Llama

DeFi Llama shows the up-to-date price levels of cryptocurrencies based in DeFi apps. As of 2021, 500+ crypto coins are tracked on the site, along with the blockchains they use, recent price changes, and total locked value (TVL). TVL is the balance of crypto assets currently staked for a longer time horizon.

Essentially, higher TVL balances indicate a more secure investment into the crypto coins and their related DeFi projects and applications – as more people are invested for longer durations.

DeFi Llama aspires to be a foundational resource for every DeFi protocol investor to have bookmarked.

DeFi Opens a New World of Investment Opportunity

Though perhaps initially complicated to try and get in on the action of, the many DeFi wallets and asset management platforms provide a comprehensive home to clarify your current cryptocurrency investments while planning on future ones.

We hope this list of some of the best and most popular DeFi tools – for beginners especially – helps you get started in the world of decentralized finance. And please, continue to do your own research before making any major investment decisions!