Among the more common cryptocurrency exchanges, Kraken and Binance are pitted against each other fairly often. Think of the Kraken vs. Binance comparison like comparing two spider men.

Seemingly, the two aren’t very different as they perform a (somewhat) similar function, but are they the same? The nostalgic among you would remember the episode of 1967 Spiderman, “Double Identity”, where a villain tried to impersonate our hero.

Neither Kraken nor Binance is the villain here, and both platforms have their pros and cons.

The main difference between Kraken vs. Binance is that Kraken has lower transaction costs and has never faced a website-wide security breach so far, while Binance offers quicker transactions and a better UI (especially for beginners).

Binance has seen tremendous growth since its launch, becoming one of the largest cryptocurrency exchanges by volume. Kraken is now one of the most trusted exchanges.

Here, we will take a closer look at both platforms and see which one is more suitable for you, and which Spiderman is your hero. You wouldn’t want the wrong one webbing your pizza away, right?

Video tag: 2:45 – 2:47

Binance – A Quick Overview of Its Popularity

Currently ranking at the top in regards to the trading volume, Binance has been one of the most popular crypto exchanges out there because of its ability to handle high-performance traders and large transactions. The platform calls to veterans and particularly to “newbies” because of its easy-to-use and understand user interface.

The low fees and constant availability of trading pairs have been essential for its popularity. Think of Binance as a muffin with lots of chocolate chips in it. You won’t have to pace your bites in such a way that you get a chocolaty bite at the end since you’ll have a choco-filled bite every time!

Binance Pros & Cons

| Pros | Cons |

| Trade capacity of up to 2 Bitcoin (over $60,000) per day without providing personal information | No bank-account connectivity yet |

| Very high liquidity | Reliant on Stablecoins |

| Roughly 600 trading pairs | Has had some bugs and exploits in the past |

| Competitive fees | |

| Very saturated, hence better returns when farming (in most cases) |

Releasing The Kraken – A Quick Overview

Ranking as the 14th best exchange as of July 2021, Kraken has proven to quite literally be a monster in the dark for hackers, providing a crucial feature to its users; not getting hacked. Since its release in 2011, the exchange has improved quite a bit, offering a range of crypto trading options, improve UI, and do anything that needs to be done to keep their space safe.

Kraken hasn’t shied away from delisting altcoins in the past, thus offering a safer place for investors to put their money. However, this comes at a price; it doesn’t have as many cryptocurrency pairing options and hence, might not be suitable for everyone.

Kraken Pros & Cons

| Pros | Cons |

| Unmatched security in the crypto industry | The UI can be confusing for new users |

| High liquidity | Unavailable to several states in the US |

| Cryptowatch platform for trading across exchanges | |

| Low transaction fees |

Taking A Closer Look At Binance

Let’s put Binance, the current industry leader, under the microscope first. As mentioned above, the exchange has seen significant growth over the years and helped several newcomers make the most of their cryptocurrency wallets.

Exchange Fees

One of the most prominent benefits offered by Binance exchange is its low fees and low account minimums. As of July 2021, the transaction fees on the exchange range from 0.1% to 5%. It’s like pulling a single chocolate chip out of a muffin that already has a lot in it.

Furthermore, the low account minimum of just $10 makes the exchange much more accessible for newbies just looking to learn and people who have constricted savings but don’t want to lose out on ‘free money.’

There is a flat 0.1% spot trading fee on every transaction – a crumb from the muffin – which is much lower than almost every other exchange. For example, the second-ranking exchange, Huobi, charges a flat spot trading fee of 0.20% for both sides (traces and makers). Coinbase, the third-ranking exchange, charges 0.5% plus a flat fee of up to $2.99 per trade. Of course, higher trade amounts mean higher fees as well.

Binance has a special “Instant” buy and sell feature, where it charges 0.5% per transaction.

If you try to make a debit card transaction, Binance will charge you an additional 4.5%. However, this facility isn’t available for Binance.US. ACH bank transfers are free of charge, while bank wire transfers will cost $15 per transaction, regardless of the side.

When withdrawing, Binance will charge 0.0005% of the total value. This way, you get a bigger piece of the pie, no matter when you choose to liquidate your assets.

History & Founders

Binance was founded in 2017 in China by Changpeng Zhao, and within a few months, Binance saw a massive increase in its liquidity and volume. The exchange isn’t without its fair share of troubles in the past, though.

Before Binance, the founder has created software that matched orders for high-speed traders.

The company has been in search of headquarters in different countries and states in search of an area with favorable regulations. The exchange found it troublesome to come to the US because of the stricter regulations. Its head office moved from China to Japan, but in May 2020, Zhao suggested that Binance doesn’t have a headquarters because “Bitcoin doesn’t have an office.”

Instead of updating its base policies, Binance decided to create a new app for US residents. The application wasn’t as robust and unfortunately, opened users to a range of different hacks and exploits. Despite this, Binance keeps on getting back up with an upgraded app, rising to the occasion almost every time.

Since its release, Binance has upgraded its high-speed trade execution tremendously.

Throughout its operations, Binance has developed and released two cryptocurrencies; Binance Coin (BNB) (June 2017) and Binance Smart Chain (BSC) (September 2020). The exchange is one of the few rare ones out there that allow users to pay the fees with Binance Coin. You know that tax candy you had to pay to your parents whenever they bought you candies?

The same concept applies here. You don’t have to pay cash or any other currency for Binance fees.

Security

When compared to Kraken, Binance (much like any other crypto exchange) finds it difficult to compete. As mentioned above, Binance headquarters has shifted quite a bit, trying to find a country that isn’t as strict in terms of crypto.

The exchange is currently under investigation by both the United States Department of Justice (USDJ) and the Internal Revenue Service (IRS) for alleged money laundering and tax offenses. Similarly, UK’s Financial Conduct Authority (FCA) has also ordered Binance to stop all regulated activity. Since June 2021, Binance isn’t available to UK residents. If the current flow of operations continues, Germany will soon follow this example.

Germany tendered a formal warning to Binance in April 2021, threatening fines as it offers offered digital tokens to investors without issuing a prospectus. It is safe to say that Binance isn’t making any friends in the UK and US government right now.

Binance has also been subjected to exploits and hacks, with one of them being back in 2019 where hackers stole $40 million in Bitcoin. Binance reported that the hackers were able to use phishing attacks and bypass their 2FA (two-factor authentication) systems.

Even if Binance has been a bit rocky in the past, their smart chain ecosystem, Binance Smart Chain, has been even rockier. For example, on July 12th, 2021 Chainswap protocol was exploited.

The attack took place over the weekend, targeted towards Chainswap protocol again. The protocol helps ensure maximum functionality of Ethereum tokens on Binance Smart Chain (BSC).

In the attack, the hacker(s) took control of BSC contracts of different projects and minted tokens directly to their address. The hackers minted the coins and sold them on PancakeSwap quickly.

PancakeSwap, as you might know, is Binance Smart Chain’s leading decentralized exchange.

Over $4 million ETH were minted and sold in the exploit. Before the loss amount exceeded the threshold or damaged the value of ETH too much, the Chainswap team pulled out its liquidity immediately.

Something similar happened on June 22, 2021, with Impossible Finance. In a flash loan attack, $500,000 (229.84 ETH) were exploited. The exploit involved the use of a fake token, effectively exhausting the protocol’s liquidity pool.

In the battle of Binance vs. Kraken Security, Binance is a bit shaky-especially their flagship Ethereum alternative product. If you were to symbolize Binance’s to a monster like Kraken, it would look something like this.

It is important to mention here that although Binance’s BSC ecosystem security is not as robust, that is not to say that the exchange’s security isn’t as robust. Back in 2019 was the exchange’s latest serious exploit, and recently Binance seems to have taken measures to combat further risk of exploits.

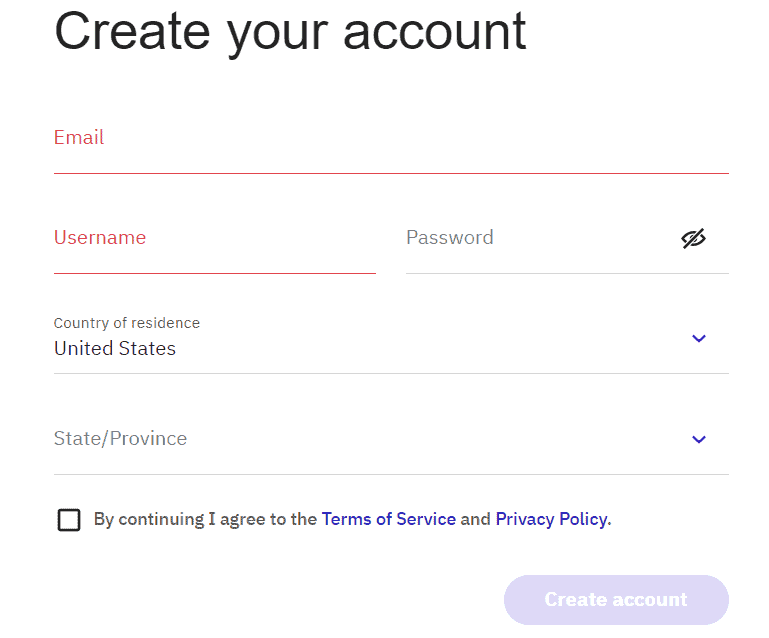

Sign-Up Process

Binance is well known for its regard for a pleasant user experience on its website and the application. This is true for its global app (and website) as well as the US-variant.

The sign-up process for Binance and Kraken is straightforward. However, US investors may find signing up a bit tedious because of the strict verification methods required by the government. Hence, sign-up may also involve a lengthy verification process (L2), sometimes taking up to 15 days, for example, in the case of Binance. For Kraken, it may take up to 5 days.

Having said that, Binance sign-up process doesn’t require any knowledge of crypto and investment. Kraken is slightly more pleasing to look at but may require you to have a basic understanding of crypto.

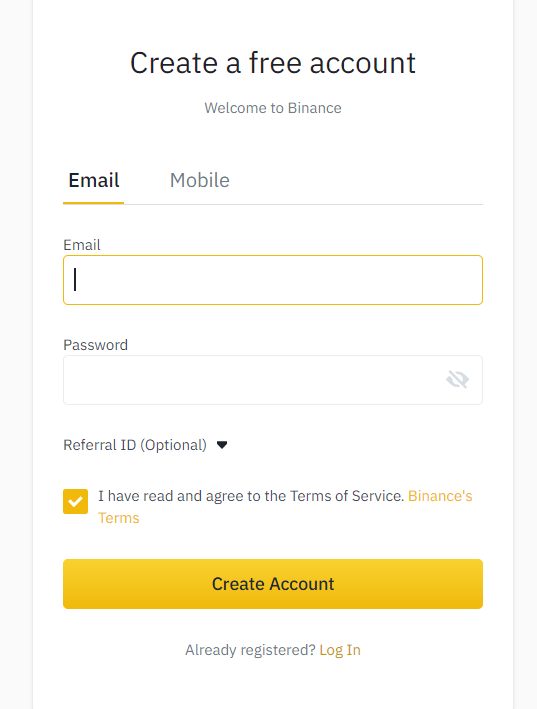

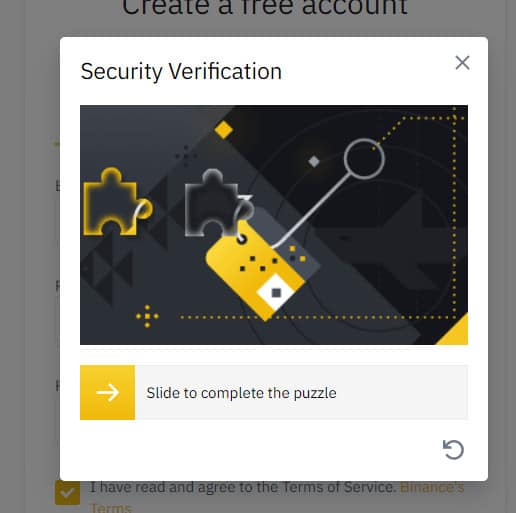

To sign up on Binance;

Click on the Register button at the top right corner of your screen (highlighted golden).

You can use your email ID or phone number to get registered… like signing up on social media.

Input your details, and you will see a puzzle. Complete the security verification process, and a verification code will be sent to your email or mobile phone.

And you’re done!

You will be welcomed by this screen, where you can finish setting up your profile, add a payment method, buy crypto, deposit, start yield farming, stake coins, and so much more.

Notable Features

One of the most prominent features of Binance, other than speed and low transaction fees, is that it focuses heavily on altcoin trading. With more than 500 different crypto-to-crypto trading options, you get to truly diversify your portfolio; whether it’s for diversifying your portfolio or if you are looking to earn.

Since margin trading is just a click away (Wallet > Margin), users get to be lazy and make heft financial decisions with minimal risk at the same time.

Some other notable features include;

- A one-stop shop for crypto investment opportunities.

- You can use cash to buy crypto without providing authentication again and again.

- A User Center Dashboard for a bird’s eye view of your investment

- Smooth and optimized website – even for slow internets or heavy traffic

- Faster support system.

Taking A Closer Look At The Beast – Kraken

Now, let’s consider the competition. Kraken stands at the 14th position on a global scale when compared to global exchanges. As mentioned above, the exchange is well known for its security and the fact that it has never seen a company-wide attack.

To improve its security, Kraken invites people to earn crypto by pointing out bugs, which is like an invitation asking people to “bring it on.”

Exchange Fees

Kraken uses the maker-taker fee structure just like Binance, thus offering a much more lenient fee structure compared to other more popular platforms. Kraken fees might even seem lower than Binance initially, since there are some minor transactions for which the fee may even be 0% to as high as 0.26%.

New traders pay about 0.16% of their transactions (under $50,000), which reduces as the transaction amount increases.

However, the new trader with the lower volume would pay a lower fee on Binance (0.10%) regardless of the trading volume. Furthermore, Binance also offers a 25% fee discount if your transaction uses BNB or BSC to pay the fees. As you accumulate more and more BNB, your fees will also decrease.

Here is a table to compare Kraken and Binance fee structures.

| Fee Type | Kraken | Binance |

| Bank Account Transfer | $4-$35 | Free outside the US |

| Debit/Credit Card | 3.75% + $0.25 | 3% – 4.5% |

| ACH Transfer | 1.7% + $0.1 | Free |

| Wire Transfer | $4 – $35 | $15 (For US customers only) |

| Crypto Conversion | 0.09% to 0.015% | – |

| Purchases (Online) | $5 per transaction | 0.02% – 0.10% |

| Trades (30-Day Volume) | 0 – 0.05% | 0 – 0.1% |

| Miscellaneous Fees | None | 0.5% (optional) instant pay |

History & Founders

Safety above all else; that’s what Kraken offers. The exchange has maintained its trustworthiness with a robust cybersecurity infrastructure that highlights high-end security measures above being versatile. This is precisely why it doesn’t host as many trade combinations as others do.

Kraken is owned by Payward Inc., which is based in California, USA. According to the company, Kraken was established back in 2011 but wasn’t formally launched to the public yet. It was limited to just a few people until 2013 when the CEO and co-founder Jesse Powell decided that the exchange is ready.

Kraken is dubbed as the first digital asset company in U.S. history that has received a bank charter as recognized by federal and state law. Since 2013, the company has managed to uphold its reputation of being secure, all while providing a flexible money platform for all participants; including cryptocurrency. The trading account must be linked to Kraken for that, though.

Over the years, the company has released countless updates, highlighting each one on its website. Since Kraken was released in 2013 and cryptocurrencies boomed in 2014, Kraken was among the first exchanges chosen by other companies as trusted sources of facts and figures.

The Kraken website and application are available at all times to people across the US, except New York and Washington state. On an international scale, the application is banned in the UK and all other countries have some transactional restrictions based on their monetary policy.

Security

As mentioned above, Kraken is famous for its trustworthiness and the fact that it hasn’t been compromised on a scale similar to Binance or the several other exchanges out there. The exchange saw a new, file-less attack technique that (using Microsoft Windows Error Reporting service) attack on September 17th, 2020. However, despite the newness and nativeness of the “Kraken” attack, it wasn’t able to do much damage to the exchange.

The technique isn’t exactly new and involves a phishing document. When opened this file can trigger malicious macros. These macros then spring the file-less attack. The team hasn’t been able to find the culprit involved, though.

The target URL of the malware was immediately taken down to mitigate the damage.

Despite the exchange being around much longer than Binance, Kraken hasn’t seen a sitewide hack, which makes it such a suitable candidate for high-profile traders. Having said that, personal accounts have been hacked from time to time; which is mostly due to phishing scams and poor cyber hygiene by users.

Ease of Use

The website itself is pretty straightforward but in my opinion, the application is relatively more suitable for newbies. The sign-up process is similar for Kraken as with Binance for US investors, but instead of taking 15 days to verify a person’s identity (L2), it takes a few minutes to sign up. For a Pro account, though, you may need to wait about 5 days for the verification process. You will see a clear timeline of your sign-up process and how long you have to wait while signing up.

To sign up on Kraken;

Click on the Create Account button on the top right corner to begin.

You will be welcomed by a screen asking for your email address, username, password, and location. This step is present to ensure the exchange keeps your country’s regulations in mind when letting you trade.

You will then receive an activation code. Enter this code in the next screen, and you should be able to see your dashboard. Set up your profile, connect Kraken with your wallet (this is free), and you are ready to trade.

Kraken and Binance both require a bit of knowledge on crypto and investing, but Kraken’s website and dashboard may require you to learn a bit about the delicate concepts involved with crypto beforehand. I would suggest that you avoid the charting options, else you might end up getting overwhelmed.

Frequently Asked Questions – Kraken Vs. Binance

Is Kraken better than Binance?

In terms of security, yes, Kraken seems to be better. However, when it comes to functionality and cost-effectiveness, Binance is much more versatile, fast, supports more crypto variants, and has lower transactional fees.

Is the Kraken trustworthy?

Kraken has built its whole persona around keeping your funds and information secure, and since its inception in 2013, it has upheld this promise. When compared to other exchanges, you simply can’t go wrong with Kraken.

Has Kraken ever been hacked?

Kraken has seen small-scale attacks from time to time that the exchange has successfully mitigated. It is widely recognized as a secure and hack-free cryptocurrency exchange so far since it hasn’t suffered a site-wide hack yet.

Is it safe to keep crypto on Binance?

Keeping your crypto on Binance means keeping it on Trust Wallet. It is quite safe if you are looking to store cryptocurrencies in your wallet. However, I would not recommend leaving your funds on the Exchange. It’s like throwing some seeds, hoping that birds won’t eat them in the morning.

Can I trade in Binance without verification?

To start trading on Binance, you need to activate two-factor (2FA) authentication.

Choosing Between Kraken Vs. Binance

Both Kraken and Binance have their pros and cons and are suitable for different types of investors. For example, large volume traders may find the limited options available with Kraken somewhat frustrating, while large-volume traders on Binance may find the (somewhat) lack of security challenges.

When deciding, you must consider the pros and cons separately and then compare both platforms to your specific needs. Are you looking for speed? Security? Crypto versatility and diversification? You can’t get all the good candies from one home, right? A similar principle applies here. Which option do you think is better? Would you unleash the Kraken or is Binance a better decision for you? Get in touch with me on Twitter or Telegram, and let me know your decision and the reason behind it!