Think of yield farming as a vegetable garden in your backyard. You can plant seeds that will grow to give you more vegetables. As time passes, you can continue growing to have more and more vegetables and seeds.

However, yield farming (and leveraged yield farming) is quicker than growing spinach or tomatoes. It is becoming more popular now as the number of crypto owners has also increased and offers a much more lucrative return on investment.

Instead of seeds, you get to earn more currency!

Known as double-sided leveraged yield farming, this feature gives users more farming options, enables them to create new lending and hedging strategies, and mitigate risk in the process.

A Brief Overview of Yield Farming

When yield farming, you earn more crypto by loaning your assets to others via the blockchain; this is done through smart contracts. When the borrower returns the loan, they do so with a fee and interest in crypto, which is eventually distributed among the ‘farm.’

This is all fun and games on paper, but, in reality, there are many risks involved with yield farming. That is why the need for leveraged yield farming arose. These farms allow different currencies to be hedged in them, letting you borrow in a currency specific to your needs and more.

You may need to couple different currencies together for yield farming to get a farming token, as we discussed in our PancakeSwap guide. Some of these pairs, which can also be used for leveraged yield farming, include:

- BNB-BUSD

- BNB-ETH

- ALPACA-BUSD

- ETH-BUSD

- BTCB-BUSD

- USDT-BUSD, and more.

What Is Leveraged Yield Farming?

Leveraged yield farming is like bounty hunting but with a contingency; if you fail in catching the bounty, the sheriff will still pay you for your efforts. With crypto, it’s not that simple; but it’s also not as difficult as people make it to be, either.

Earning by yield farming isn’t a new concept. The concept found roots in the DeFi sector allowing users to interact with each other through an internet connection, supported wallets, and smart contracts. There was no reason to ‘trust’ each other or the farm since the risks weren’t as significant as the rewards. However, the risks were still there, hence a reason to be cautious.

Leveraged yield farming offers a relatively safer way to farm. It is the practice of using borrowed money for yield farming. It allows farmers to improve their yield farming position by borrowing external liquidity (money from liquidity pools) to increase their overall liquidity, resulting in a higher return volume.

Let’s say you combine 1 DOGE and 10 BUSD (at a rate of 1 DOGE = 10 BUSD) in a liquidity pool on PancakeSwap. For investing in this combination, you will receive a reward in the form of a new token (let’s assume it was a BNB-BUSD token), along with a share of the trading fees earned by the farm at its current APY percentage. The trading fee share would come from interest against loans and trading fees paid by borrowers.

To earn more rewards, you can borrow a DOGE-BUSD token, which will increase your portfolio to 2 tokens, even if the second one is currently a liability for you. However, this increase will result in more liquidity for you in the yield farm, more rewards in the form of BNB-BUSD tokens, and a larger share of the fees and interest rewarded.

As the above example shows, you earn more by leveraged yield farming than yield farming. The ratio is determined by how much liquidity you have invested compared to the amount loaned. For example, if your original tokens are valued at $500 worth of crypto, but you have borrowed crypto worth $1,000, it means that you have a 2:1 leverage. Of course, how much you can loan out varies with farm, token, and platform.

Once your rewards are greater than your loaned amount, you will gain a handsome profit and be rich (somewhat)!

There are several leveraged yield farming protocols out there, and each has its features to boast.

Alpha Homora is one of the most popular leveraging DeFi farming protocols, making leveraged yield farming easy for even those who don’t know much about crypto. The platform allows a leverage ratio of 2.5:1, and, currently, this ratio is much higher than what any other platform in the market offers.

As explained above, this higher leverage ratio lets you earn more trading fees within the pool and more tokens because of the increased liquidity.

You get to increase your liquidity by at least two times, earn more trading fees and tokens, and get to show more assets in your crypto portfolio without worrying about the loaned tokens and their fees. You will be earning more and, therefore, be able to pay back quite easily.

All this seems great, right?

However, leverage comes at a risk.

DeFi leveraged yield farming with Alpha Homora or any other platform introduces a liquidation risk. If the price of your token or the base cryptocurrency used falls, there is a chance you might lose all your assets. It’s like margin trading in real life (borrowing money from a brokerage company to buy stocks from them).

However, there is no hedge fund manager to make decisions for you, nor are any buffers present like those in the stock market.

You might have heard about the market crashes that happen when too many people sell their stocks at once. This is a failsafe that the blockchain, unfortunately, doesn’t have. If the crypto you are using is subject to an exploit and the price falls, you will likely lose everything. The chances of this happening are very remote but again, this is the wild-west of DeFi, and anything can happen.

Carry Trade & Leveraged Yield Farming

When you take a low-interest loan and invest the money in an asset that provides a better rate of return, you basically ‘carry’ the earnings from your venture and pay the interest through it while generating a profit.

Leverage yield farming works on a similar principle.

For example, the liquidity of 1 DOGE and 10 BUSD (assuming 1 DOGE = 10 BUSD) to a DOGE-BUSD liquidity pool on PancakeSwap may help you get 1 BNB-BUSD token and a share of the trading fees, which would be higher than the interest and fee you would have to pay against the amount you would have to borrow.

Not every farm is suitable for a carry trade. So, you will need to do a little due diligence to find a leveraged yield farm that offers more rewards. When trying to identify a carry trade farm, the slightest omission or mistake can result in your farm turning against you pretty quickly. Yikes.

For Alpha Homora, leverage yield farming capabilities went live on May 19th, 2021, and it has been used and applauded by many for its lucrativeness. You can also use Alpaca Finance and Kalmar to get practical experience in leveraged yield farming.

We now have a basic understanding of the concept.

Let’s consider how leveraged yield farming actually works…

The Process of Leveraged Yield Farming

To understand the process, we first need to understand the role of all players involved in the process. There are three major roles that you can assume on Alpha Homora, Alpaca Finance, or Kalmar:

- Liquidity Providers

- Lenders

- Yield Farmers

Liquidity Providers

Liquidity providers (LPs) supply assets to a liquidity pool and earn a passive income from the pool – sort of like lenders. Without these people, leveraged yield farming or regular yield farming won’t remain feasible. The investors are also known as market makers since, without them, the value of farms would be next-to-nothing and therefore lead to a complete halt in trading.

Think of them as the people who throw ice into the water before throwing it on farmers.

Liquidity Providers deposit an asset of a fixed value in crypto into the pool and are given LP tokens in return. These tokens represent their ownership of the pool.

LPs earn a passive income from the transaction fees in the pool. How much they earn is directly proportional to the value of their asset and how much liquidity it represents in the pool. These providers are required to provide two different assets and, therefore, trade in pairs, such as DOGE and BUSD.

Lenders

These are the people who supply tokens to a liquidity pool. Think of them as the people who pour water for the farmers and borrowers.

Lenders deposit cryptocurrency into the pool and are given tokens in return. These tokens represent their ownership of the pool. For example, by adding the DOGE-BUSD token into the pool, you add Doge Coin and Binance USD into the pool.

Against your investment, you will be given a share of the fees for every swap in the pool. The share you get from the transaction depends on the protocol you use. For example, Uniswap deducts 0.30% as its cut and divides the rest among other lenders based on their respective shares.

To further incentivize liquidity providers and lenders, they are issued DeFi governance tokens. Let’s say you are a liquidity provider on PancakeSwap, regardless of the currency you have invested in. By filling the pool, you will be earning a fixed amount of CAKE per day, depending upon how much you have invested. The CAKE you earn will be independent of the number of swaps that occur.

Here’s a tip for you: LPs and lenders often accumulate a certain number of specific governance tokens and dump them on the market, trading them for more liquidity tokens and, therefore, improving their position. They may have to pay gas fees for multiple transactions, though, which is where low-cost chains like the MATIC (or Polygon) network can come in handy.

On Sushiswap or Uniswap, you should only do this if you are in a position where you are set to earn a large yield – such that it will render the gas fees insignificant. Apart from MATIC, some providers go with layer 1 chains, such as Binance Smart Chain (BSC) or layer 2 Decentralized Exchanges (DEXs) due to low fees.

You should note that the interest earned through lending crypto can be fixed or variable and decided on a farm or platform level. For example, Compound rewards the lender and the borrower its native token along with interest.

There are usually certain conditions that lenders or borrowers need to follow to engage with each other. These requirements may include:

- A minimum balance to be maintained in a wallet, i.e., the maintenance margin

- The “value” represented by the loan amount

- Collateral, if any, and more.

At any time during the transaction, if the value of collateral given is about to get significantly lower than the loan amount, the smart contracts within the system automatically liquidate borrower accounts, paying the principal and interest directly to the lender.

Leveraged Yield Farmers

Also known as the borrowers, leveraged yield farmers are the users of a farm that borrow a specific token or currency and pay it back later. By borrowing, yield farmers can improve their positions and earn better returns (for example, up to 2.5 times the APY on Kalmar). Think of lenders as people on whom the water mentioned above is being thrown.

As mentioned above, lenders also get to earn by trading on the platform. It takes no more than 20 minutes to sign up for yield farming.

Leveraged Yield Farming – How-To

Depending on the platform you use, the process of leveraged yield farming will differ. For example, leveraged yield farming on Kalmar only requires users to supply a pair token and/or BNB to choose the leverage level.

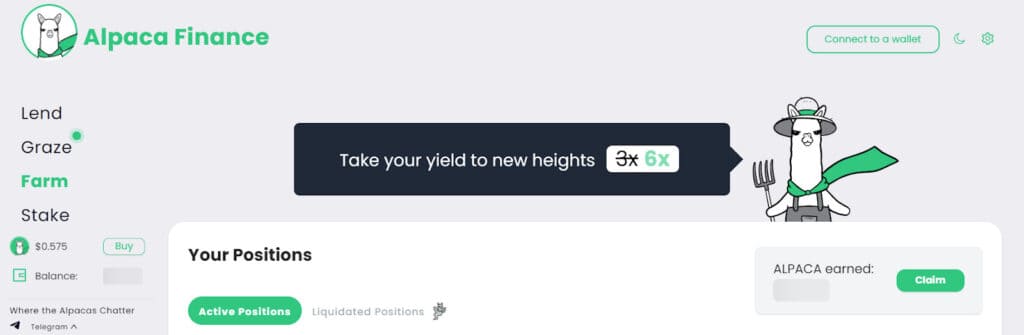

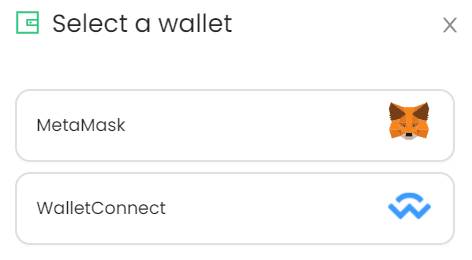

On the other hand, Alpaca Finance allows you to sign up for a leveraged yield farming position on PancakeSwap and WaultSwap pools. Simply head to Alpaca’s Finance Farm page and connect your wallet(s) to the platform.

You can connect MetaMask directly or use WalletConnect to connect other wallets. We recommend MetaMask for a more native experience.

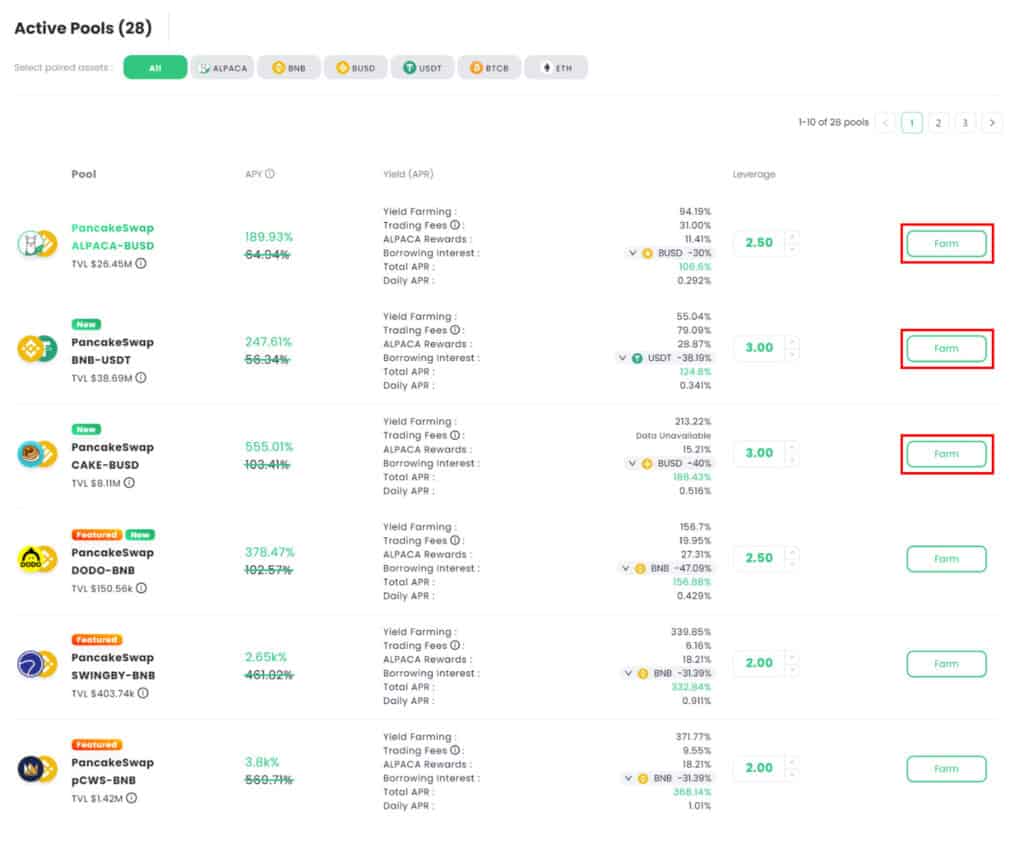

Set the network to Binance Smart Chain in your wallet and select your desired farming pool. There are two pool types on AlpacaFinance — PancakeSwap Pools and WaultSwap Pools.

PancakeSwap Pools

- PancakeSwap CAKE Syrup Pool

- PancakeSwap ALPACA pairs

- PancakeSwap BNB pairs

- PancakeSwap BUSD pairs

- PancakeSwap ETH pairs

- PancakeSwap USDT pairs

- PancakeSwap BTCB pairs

WaultSwapPools

- WaultSwap ALPACA pairs

- WaultSwap BNB pairs

- WaultSwap BUSD pairs

- WaultSwap USDT pairs

- WaultSwap ETH pairs

- WaultSwap BTCB pairs

Choose a farm that suits your wallet and what you’re looking to invest in.

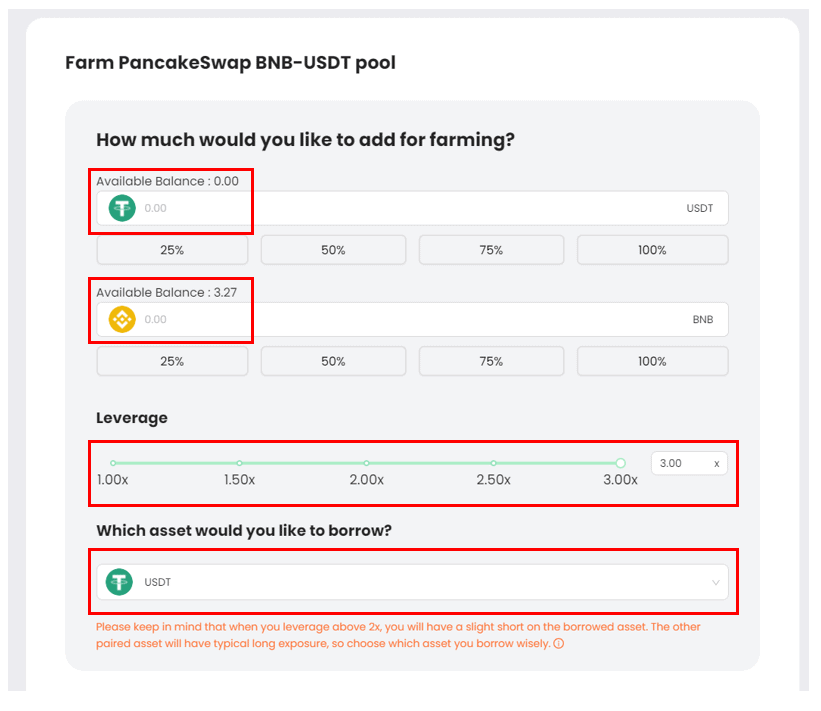

You will see a pop-up asking for the amount you’d like to farm with. Supply a combination of any two suitable currencies or assets, and form a pair. The platform’s smart contract will automatically convert the deposited and borrowed assets to get an equal value-split and list them in the farming liquidity pool. We chose the BNB-USDT pool here for reference.

Choose the desired leverage you want to be associated with your pool. As you can see, this pool has a maximum of x3 leverage. Some may have more – some less. Choose the asset you want to borrow from the dropdown below, and you’re good to go.

We recommend having deposit vaults for both assets you want to invest in so you can borrow either asset. Click on Farm when you are ready. You will automatically see a notification in your wallet to accept the transaction.

Click accept. The transaction should take a few seconds to a few minutes to complete, depending on your wallet and the type of currency you chose. Once done, you will see where you stand under the “Your Positions” section of the Farm page.

For a history of your activities, click on the Liquidated Positions tab.

Risks of Leveraged Yield Farming

As mentioned above, leveraged yield farming might seem smooth sailing, but the seas aren’t always calm. Just like any investment, there are risks involved with leverage-yield farming as well.

It carries the same risks as that of yield farming apply with a few more on top. One of these risks is presented by smart contracts. They may get hacked, present developer risk, or turn into impermanent or divergence loss.

You incur this loss when you sell or trade your assets, but the venture would have been more profitable if you had simply held on to your tokens. The most common instance of this happening is when the price ratio of crypto assets in the pool changes, especially for the lent or borrowed assets. The more the price ratio changes from its original position, the worse loss you’ll face—this is impermanent loss in a nutshell. The loss is exponential and NOT proportional.

However, you can reverse this loss if the original price ratio is restored. Unfortunately, because of the constantly fluctuating prices of crypto assets and the currency value itself, this is more common than you think.

We recommend that all parties within a leveraged farm, i.e., the farmer, lender, and borrower, remain vigilant and set a bottom and upper limit for the fluctuations.

Top Leveraged Yield Farming

After getting a better understanding of what leveraged yield farming is, how it works, and the risks involved, you are ready to start investing. Here are some of the best leveraged yield farming platforms for the Binance Smart Chain and Matic Network.

Best Leveraged Yield Farms for Binance Smart Chain

- PancakeSwap. This platform allows liquidity providers to deposit their crypto assets into PancakeSwap liquidity pools and earn fees and liquidity tokens in return (known as FLIP tokens). You can then stake these tokens to earn CAKE.

- Venus. Here, you can use the interest earned directly to borrow more digital assets or mint its native coins.

- Bearn. This platform offers double and triple reward systems on top of the already high APYs its farms have.

- Pancake Bunny. Partnered with PancakeSwap, you can farm cake here and swap it to earn $BUNNY.

- Autofarm.

Best Leveraged Yield Farms for Matic Network

Leveraging What You Have for Better Returns – Is It Worth It?

Leveraged yield farming is the next major development in yield farming, offering a better return on investment and thus being more attractive. However, just because it offers more profits doesn’t mean it isn’t without its risks.

Just like any other form of investment, you are treading on thin ice here as well. Yes, the ice is a bit thicker, but there is still a chance that you might fall.

You must tread lightly and strategically, taking your time, because the rewards are well worth the effort. Do you think leveraging what you have is a good idea? Would you accept these odds? Let us know by getting in touch with us on Telegram, and let’s discuss the potential of yield farming and other crypto opportunities together!