PancakeSwap is a decentralized finance protocol initiated by anonymous developers who had a penchant for breakfast foods… and rabbits? Despite the eccentric theme, PancakeSwap has managed to give Ethereum’s SushiSwap a run for its money.

If your expressions resemble the ones Mark Wahlberg had in The Happening after reading the above paragraph, you’re not alone.

In this article, we will go over the basics of the exchange medium along with how to get started with PancakeSwap, its main features, risks, benefits, and more to help you get a better understanding of how you can benefit from this crypto farm and expand your cryptocurrency wallet.

How Did PancakeSwap Become Binance’s Most Popular Farm?

PancakeSwap might give off an amateur-ish outlook (perhaps because of the rabbit or potentially furry reference). However, it is more than just a food-themed DeFi protocol. It is a decentralized exchange (DEX) with a Binance Smart Chain base that is easier to operate, faster, and inexpensive.

In short, you can swap crypto assets via PancakeSwap with other owners by creating a liquidity pool generated by the same users. This ability to increase liquidity has been preferred by many individuals as assets valuing over $1 billion have been migrated to PancakeSwap since September 20, 2020.

Because of the rewards you get and the liquidity increase, PancakeSwap is growing in popularity unlike ever before and is Binance’s most popular farm. On top of the farm yields, the return on investment, the easy-to-use interface, and smooth design are the icing on the CAKE.

What Is PancakeSwap Financing?

If you are familiar with Uniswap or SushiSwap, you can skip this section since the two are the same. PancakeSwap is easier to understand in comparison. The latter uses an automated market maker (AMM) to help you trade with other members.

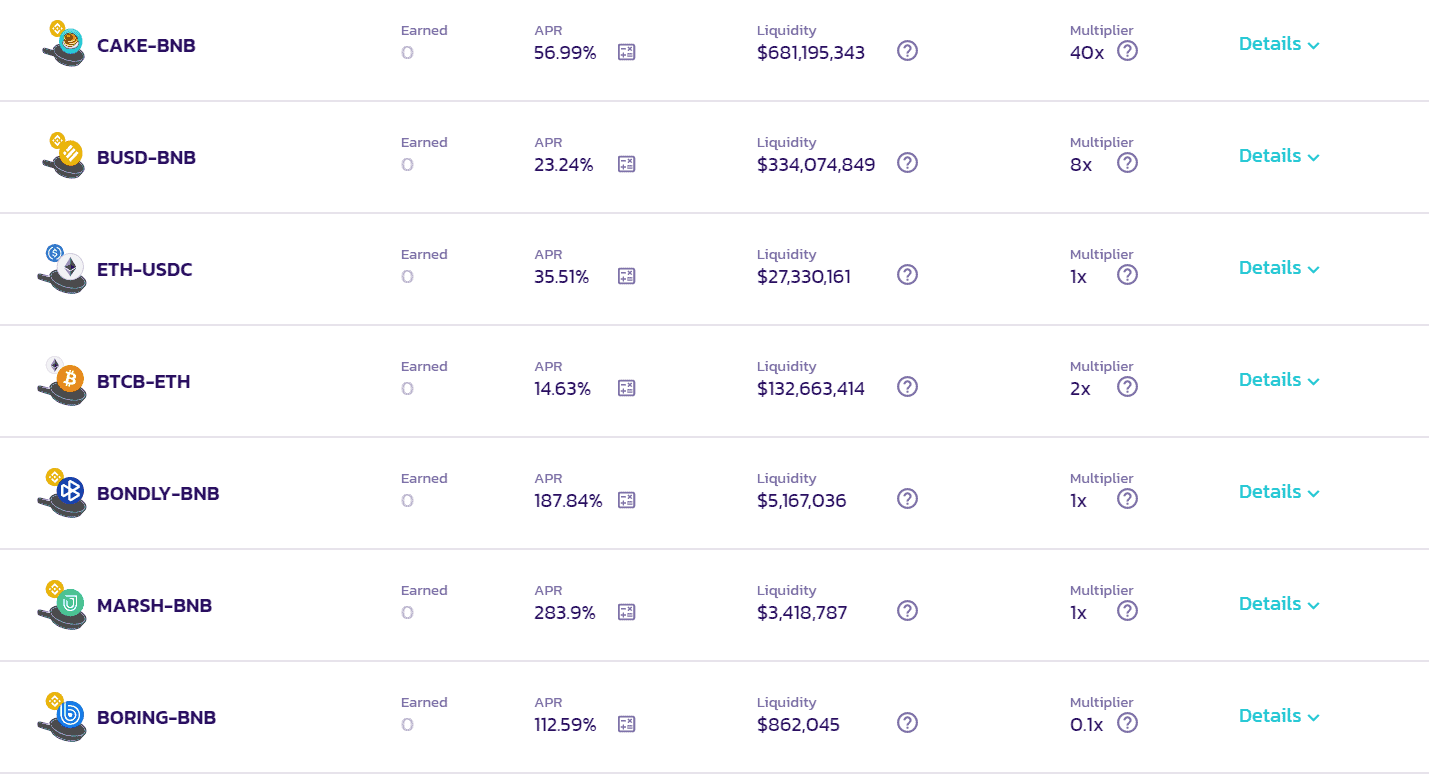

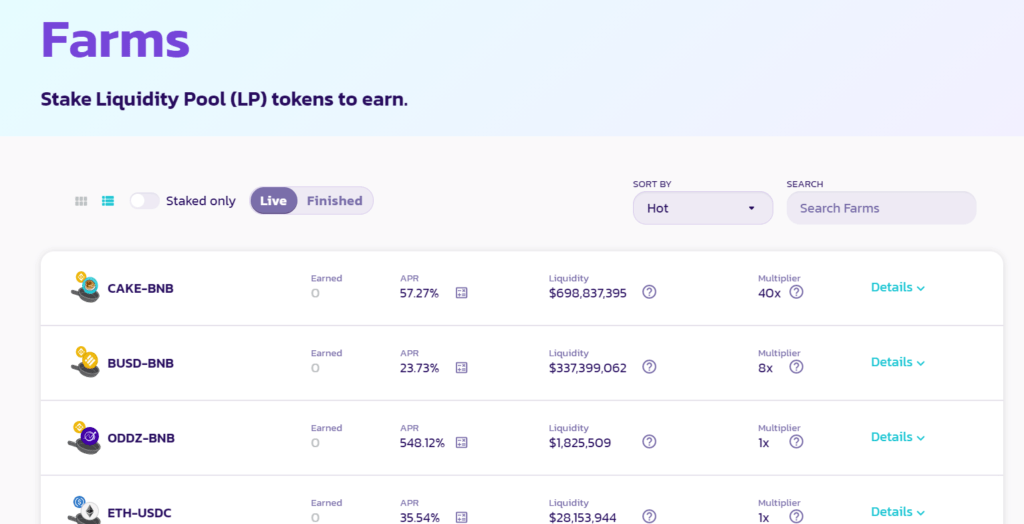

Instead of listing your assets on a register or roster, you add them into the liquidity pool. While adding assets into the pool, you receive liquidity provider (LP) tokens. You can use these tokens to buy other assets from the pool, and as you sell yours, you will receive more tokens in return. The tokens you get reflect the currency you added into the pool. For example, adding Binance USD (BUSD) and Binance Coin (BNB) will give you BUSD-BNB LP tokens. You can get the CAKE-BNB, ETH-USDC, BONDLY-BNB, and many more tokens as can be seen in the screenshot below.

However, if you decide to lock your LP tokens, you get a CAKE. CAKEs have very high multipliers and an equally high APR, but it is a high-risk, high-reward venture.

There is also the SYRUP pool where you get to stake your CAKE tokens and earn more CAKE. Of course, SYRUP has an even higher rate of return, but the risk is higher as well.

Now that you’ve got the basics, let’s go over how to trade on PancakeSwap.

First Things First…

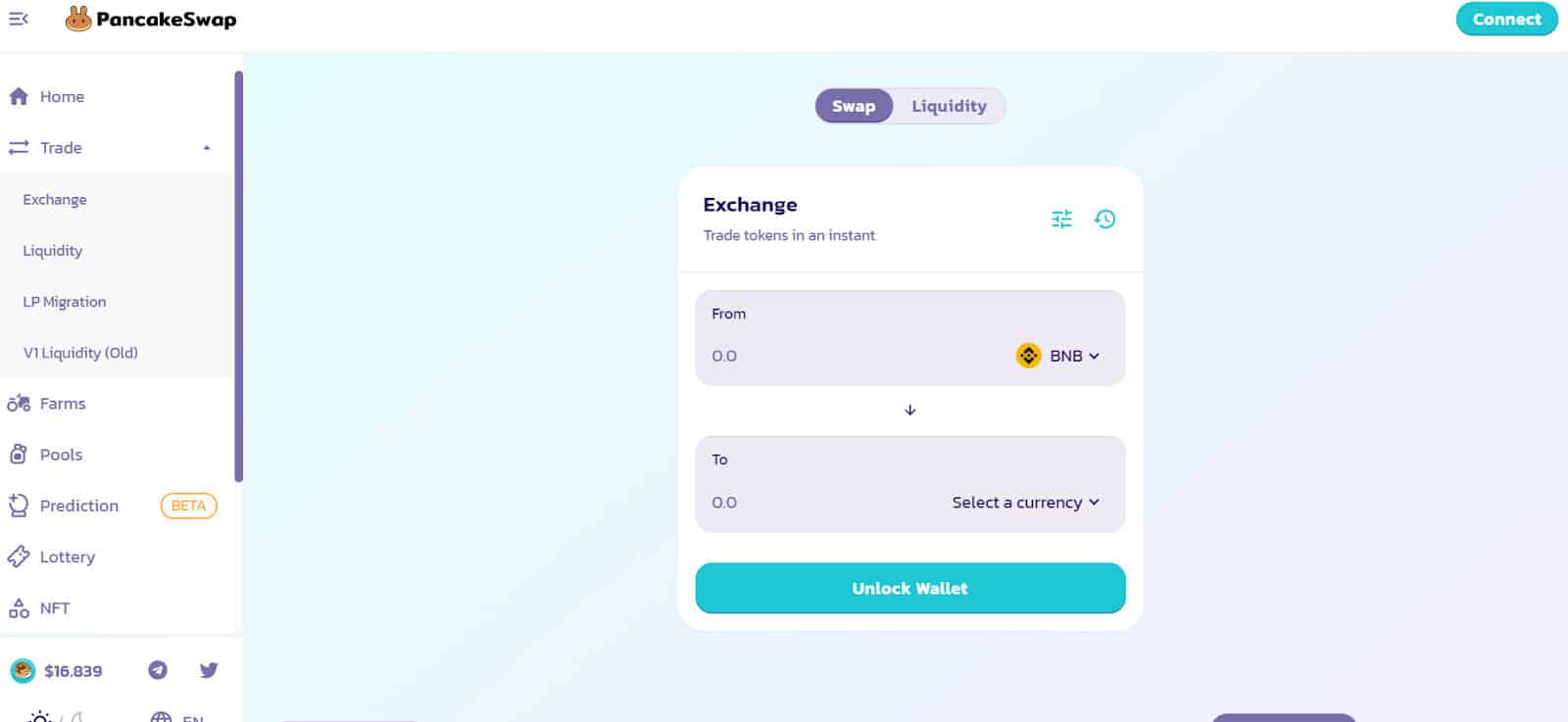

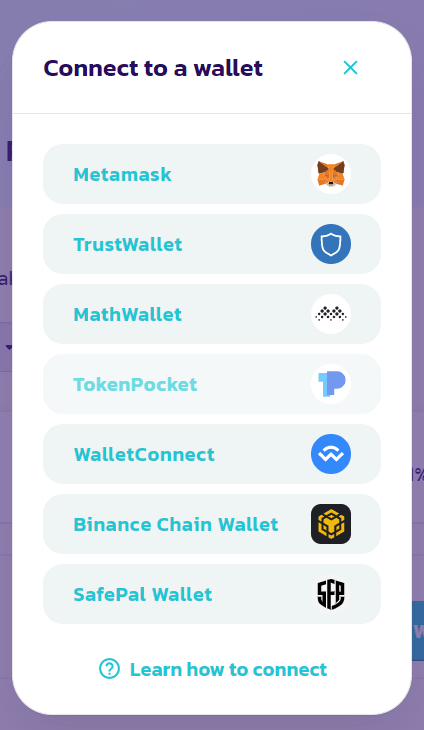

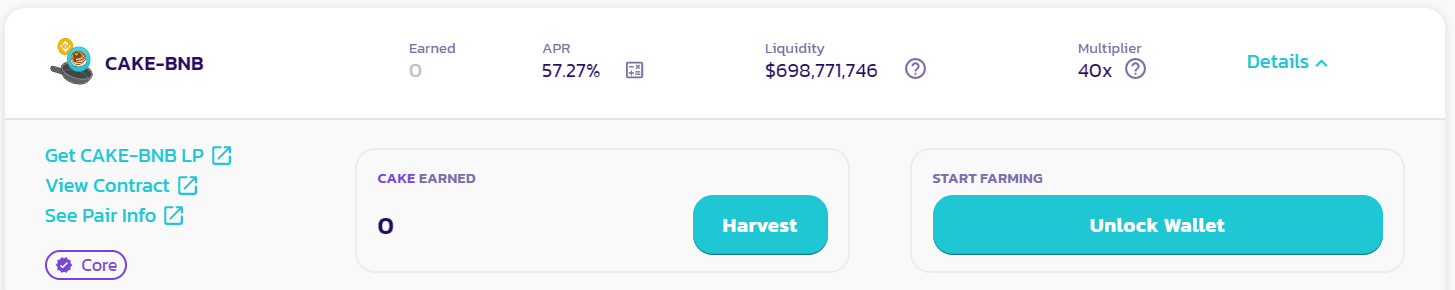

The first thing you need to do is to get a wallet that is compatible with the platform. To see which ones are compatible, simply click on the “Unlock Wallet” button.

TrustWallet and Metamask are known to support the platform, but you can go with any of the above wallets. If you have none of the above wallets, we recommend going with either of the two we mentioned.

Initially, you would have to connect your MetaMask wallet to Binance Smart Chain (BSC). However, now PancakeSwap will automatically set everything up for you. Connecting your wallet is now actually as simple as a few clicks.

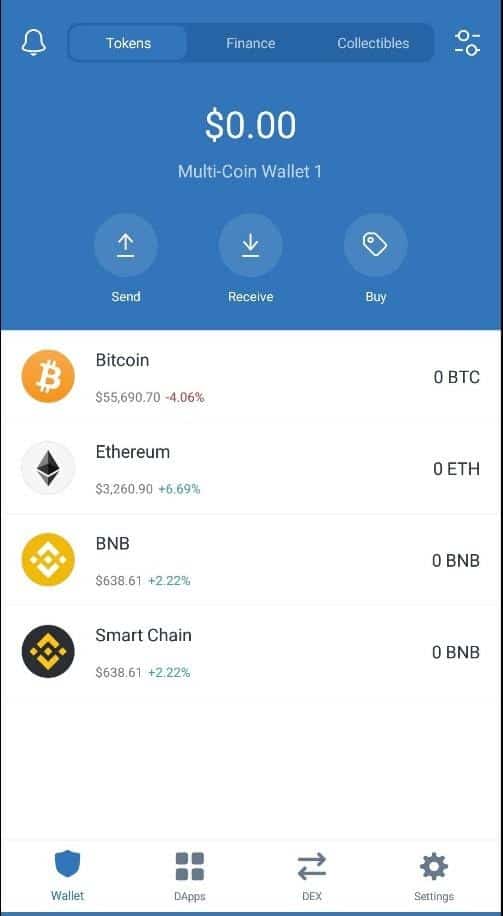

Once that is set up, you will see the option of setting up your ‘rabbit’ profile. Take your time here because this will be your virtual portfolio that others will see. Once done, your wallet will load up on the main dashboard, ready to help you begin exchanging, staking, farming, taking part in lotteries, and other capabilities offered by PancakeSwap. Remember, your goal is to make some CAKE.

You can choose to do all of this either on the web platform or connect it to your wallet’s mobile application. Once set up, you will generate a seed key in your wallet and back it up. (Just write it down somewhere safe.)

We recommend putting Smart Chain, BNB, and BUSD on your wallet’s dashboard so you can keep a close eye on it.

Trading on PancakeSwap

You will find that trading on PancakeSwap is much easier than most exchanges out there since you won’t be bombarded with jargon right from the beginning. PancakeSwap handles the calculations for you.

Set up a Binance Exchange account at binance.us if you are in the US and install an extension for your browser for easy access. You will then need BEP20, the native tokens. You can simply convert your current cryptocurrency into BEP20 on binance.us (or binance.com for the rest of the world).

Trading & Adding Liquidity

Liquidity means your ability to spend your financial assets, particularly cash. In the case of PancakeSwap, it means committing your tokens to a pool, i.e., telling the world you are ready to trade. As mentioned above, you will need to stake two different currencies to create a token pair. The lower value among the two (in US dollars) will be considered as the limit of your liquidity.

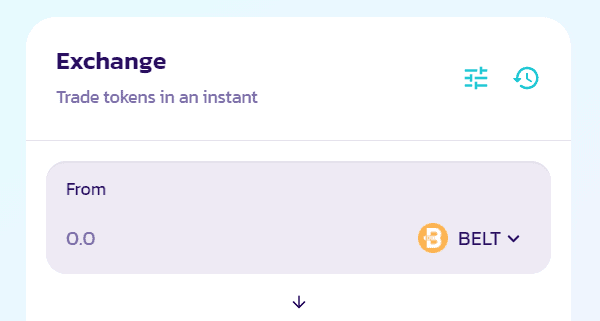

You will need to select the token you want to trade in the “FROM” menu.

Type the number of tokens you want to trade in the “From” and “To” fields and click on swap. A popup will appear, telling you the price of your new token, fee, price impact, and more. Confirm swap when you are ready.

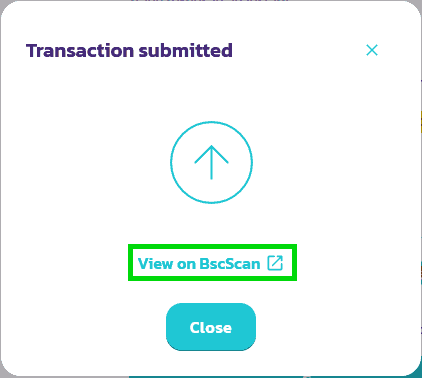

You will get another popup telling you that your transaction is successful. You have now traded your currency with trade tokens successfully.

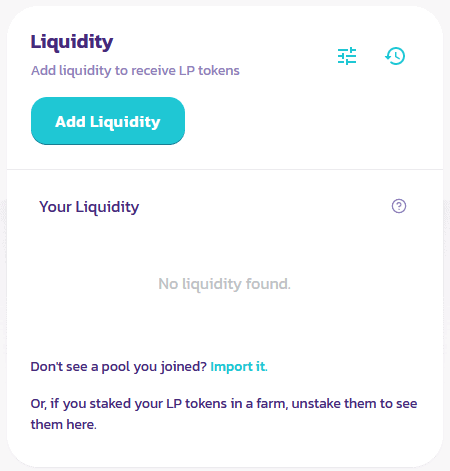

Now, visit the Liquidity page. Initially, you won’t have any liquidity. Click on the “Add Liquidity” button.

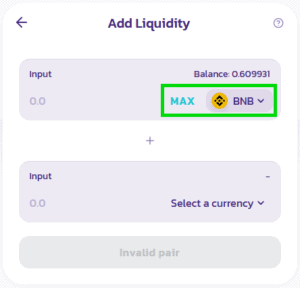

Initially, the input will be at max. For the sake of this example, we will leave it as is.

Select a currency and pick the second currency you have. Proceed to enter an amount of the second token that you want to pit against the first input. For example, if you choose CAKE as the second input, you will be pitting CAKE per BNB. When the button changes from “Invalid Pair” to “Insufficient CAKE balance,” reduce the number of CAKEs you are inputting.

Click on the Approve button and confirm. To proceed with the transaction, click on “Supply.” A window will appear, showing you how many BNB and CAKE you are depositing, their rates, and how much share of the pool you are getting.

It might not seem enough, but even 0.0000001% is enough to help you see a return in your wallet when starting out.

Confirm the supply and another window will appear, telling you the LP token balance. You can add more liquidity this way at any time.

Yield Farming on PancakeSwap

The best way to earn CAKE on PancakeSwap is by yield farming. You will need to stake two tokens here as mentioned above and then stake the combination in a farm. The CAKE-BNB LP Token we generated above should help you participate in a CAKE-BNB Farm only.

Without these tokens, you will have to provide liquidity for the pair.

Head on to the Farms Page, and find a farm that reflects your tokens. Our farm, the CAKE-BNB, is at the top in this case.

Click on a farm that corresponds o your tokens. You will see details about it below, along with the ability to harvest the CAKEs earned.

After unlocking your wallet, the “Unlock Wallet” button above will be replaced with the “Enable” button. Click on it when ready. It may take a short while, but the button will change to Stake LP. Click on it.

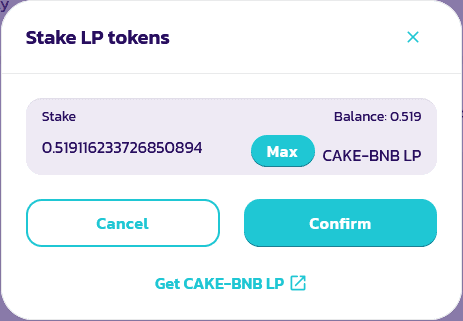

A new popup will appear, asking you how many CAKE-BNB LP tokens you want to stake.

Input the number of tokens you want to input and confirm your action. You will then be able to see the currency you have staked in the details. Over time, you will be able to collect CAKE rewards. The number of CAKEs you get depends on how many you staked, the farm’s APR, multiplier, and more. You can collect these CAKEs and stake them in Syrup Pools, play the Lottery, or convert them to cryptocurrency.

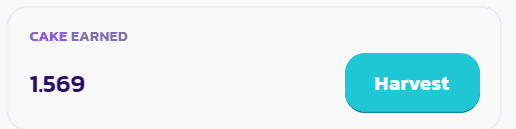

Simply find the farm you have a stake in, and click on it to view its details.

Click on the Harvest button and within a few seconds, you will be able to see the new cakes in your wallet. Remember, you may have to pay a small fee when harvesting, and the value differs according to your wallet. For better yields, we recommend leaving your farms for a week or so before checking. For the 1.569 CAKEs above, the fee amounted to 0.001.

Pros & Cons of PancakeSwap

Now that we have an idea of how the Pancakes are made, let’s consider the pros and cons of when pancakes and bunnies get together.

| Pros | Cons |

| Very easy and convenient to use | Automated market maker; hence risky |

| No congestion or unnecessary fees for Ethereum DEXs | While there are a lot of tokens you can swap with, Uniswap offers slightly more token variants |

| Quick transactions, low fees | Little to no background of devs |

| High user engagement and thus, better returns | Relatively unreliable audits |

| The lottery system is a bonus on its own | Not as decentralized and thus, higher speculation |

| Wide variety of token pairs and offerings |

And that’s all there is to farming on PancakeSwap.

Are you ready to Pancake?

The above guide to PancakeSwap shows just how easy it is to turn your crypto ventures into success stories with this platform’s help. Of course, this guide only covers the basics, and as you get into more lucrative farms or tokens, such as SYRUP liquidity and farming, you will find yourself facing some more complexities.

However, by the time you get there, we are confident you will have developed enough familiarity with the platform. If not, we will be posting regular updates here to help you trade and make the most of your farming and PancakeSwap financing ventures. We would love to hear your thoughts about PancakeSwap, how you find it and if there’s anything further that we can clear for you.

Alternatively, you can get in touch with us on a personal level by connecting with us on Telegram. Just follow the link here and let’s Swap some pancakes together!