DeFi is short for “decentralized finance”, a movement that seeks to disrupt traditional, centralized financial systems using blockchain technology and cryptocurrency.

DeFi applications are built on blockchains, immutable databases made up of “blocks” of data that are—you guessed it—”chained” together in chronological order.

When it comes to cryptocurrency, blockchains serve as digital ledgers containing irreversible, publicly verifiable records of every transaction ever made.

Importantly, most blockchains are also decentralized, meaning no single person or entity controls it or the data it contains. This is in stark contrast to traditional financial systems, in which centralized intermediaries (e.g., banks and brokerages) must be trusted to oversee transactions and other financial instruments.

Instead of intermediaries, DeFi protocols utilize smart contracts—pieces of code that lay down the law for financial activity. Currently, the vast majority of DeFi applications are built on the Ethereum blockchain, allowing individuals to trade, lend, borrow, invest and earn interest without relying on financial middlemen.

The History of DeFi

Maker

The history of DeFi can be traced back to the creation of Ethereum in 2015, which was designed to address Bitcoin’s limitations as a foundation for fully-fledged decentralized finance infrastructure.

Launched in 2017, the first DeFi application to be built on the Ethereum blockchain was Maker, a platform that allowed users to lend and borrow Dai—a stablecoin pegged to the US dollar—in a decentralized manner.

A host of DeFi projects followed suit, most of which utilized a crowdfunding launch model called an Initial Coin Offering, or ICO, to get off the ground. In an ICO, a DeFi project offers their native token in exchange for Ethereum. In the period between January and June 2018, $7 billion were raised via ICOs, pointing towards the growing interest in DeFi.

COMP token and the DeFi Summer of 2020

In June 2020, borrowing and lending platform Compound Finance began awarding its users, in addition to typical interest payments, a new cryptocurrency called the COMP token—both a native governance token and a tradable token on exchanges.

The innovation sparked a flurry of new interest in DeFi as many other protocols quickly jumped onto the bandwagon of offering reward tokens, leading to the advent of a new phenomena called “yield farming”—the practice of leveraging distributed tokens like COMP across different platforms to maximize yield. Massive annual percentage yields (APYs) outstripping those provided by banks by orders of magnitude became commonplace.

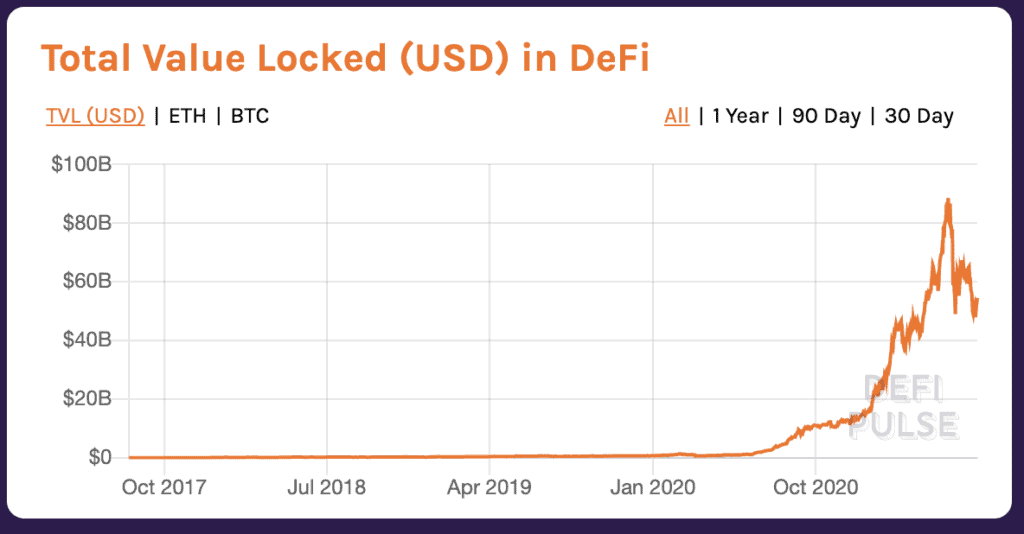

By the end of what is often referred to as the “DeFi Summer of 2020”, the total value locked in across all protocols in the DeFi space had increased from $800 million in April to roughly $10 billion in September.

But it wasn’t all rainbows and butterflies: throughout those months of DeFi mania (and beyond), a considerable number of DeFi protocols were either hacked or rug-pulled, resulting in the loss of millions of dollars in user funds. Many others simply failed, with their tokens crashing to zero.

The nascent DeFi space had become a gold mine—as long as you were okay with the possibility of the mine collapsing without a moment’s notice.

DeFi Applications (dApps) and Uses

So what exactly do DeFi protocols offer for their users?

Decentralized Exchanges

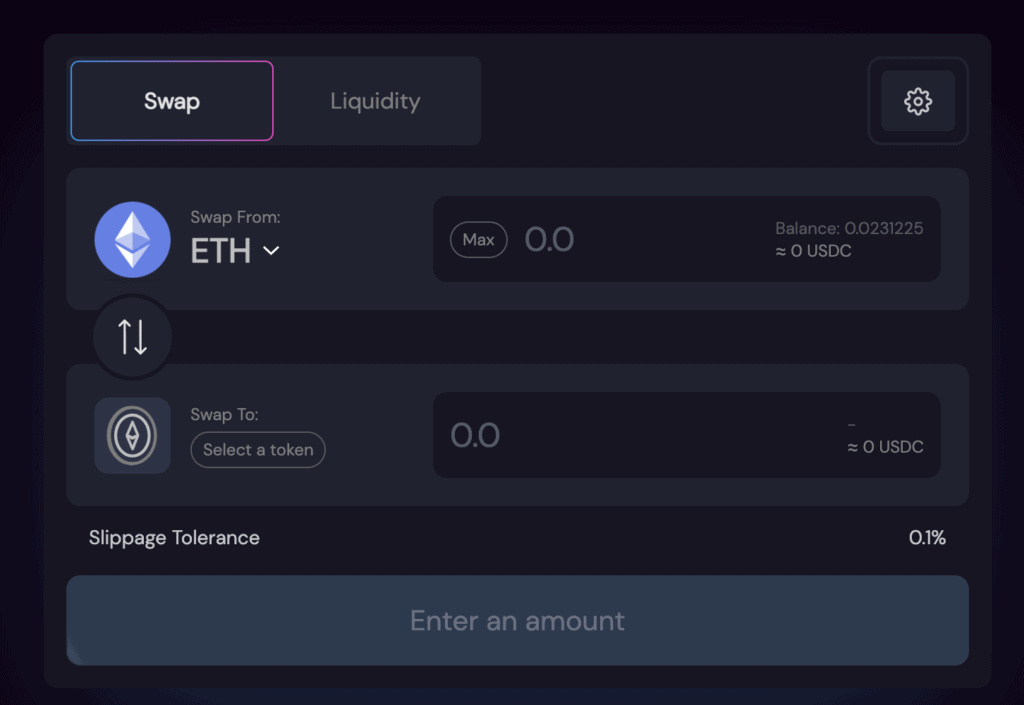

Decentralized exchanges (or DEXs) are apps that allow users to exchange coins and tokens for others (e.g., ETH for USDC) without an intermediary. This is in contrast to centralized exchanges, such as those provided by Coinbase or Binance, in which trades are processed and overseen by the company.

The first DEX to be built on the foundations of liquidity pools and automated market makers—today the gold standard for DEXs—was UniSwap, which launched in November 2018.

UniSwap remains one of the most popular DEXs to this date but faces stiff competition from SushiSwap, which was the first DEX to offer its liquidity pool providers with an extra reward token, SUSHI, on top of their transaction fee earnings as well as in-house yield farming strategies.

DEXs built on Layer 2 networks include QuickSwap, which is used for tokens on the Polygon side-chain, and PancakeSwap, which is used for tokens on the Binance Smart Chain.

Liquidity Pools

In order for an exchange between two tokens to occur, there must be liquidity—a certain amount of both available to trade at any given time. That pool of liquid tokens is called a liquidity pool.

DEXs fill their liquidity pools through their users, who can deposit funds in a 50/50 split between any given token pair. This is incentivized through payments that reward every liquidity pool provider with a fraction of every transaction fee incurred by users swapping between the two tokens, proportional to their contribution to the pool.

Lending and Borrowing

A staple of the financial world, lending and borrowing make up a significant portion of activity in the DeFi world too, where lenders can earn high-interest rates on collateral-backed loans taken out by borrowers.

Some of the most well-known lending and borrowing platforms include Aave and Compound.

Yield Farming

Yield farming refers to optimizing yields by taking advantage of compound interest, often by moving earned assets across protocols and liquidity pools.

For example, liquidity providers can take their liquidity provider token—which represents their contribution to a liquidity pool in addition to earned transaction fees—and stake it on another platform, ultimately earning interest on top of their interest.

Many platforms now exist to make this process easier for those without the time to constantly monitor interest rates and manually move assets across platforms. The first to do so was Yearn Finance, a protocol that scans the DeFi lending landscape for the best yields and automatically optimizes your investment.

Others include Harvest Finance and Beefy Finance, both of which have now simplified the process even further by allowing users to provide liquidity by depositing just a single asset (they do the 50/50 splitting for you!).

The Future of DeFi

Today, DeFi continues to be an exciting and rapidly developing space. Innovative new projects are coming out all the time and earning opportunities are as bountiful as ever.

Ethereum 2.0—an update to the Ethereum blockchain designed to address scaling issues—is just around the corner. Alongside Layer 2 solutions like Polygon and perhaps even brand new blockchains, the decreased network congestion and lower gas fees associated with these innovations will open up the DeFi world to more users, more projects and more use cases.

But for all its promise, investing in DeFi is still an inherently risky endeavour. For every great project, there are a bunch of terrible ones, and more than your fair share of scams thrown in as well. And given the speculative and unregulated nature of a new technology like blockchain, there’s no limit to the number of ways you can get rekt if you’re not careful.

DeFi may very well be the future of finance one day. For now, however, due your own due diligence and invest at your own risk!