One of the hottest topics of the year is DeFi. As more and more people continue investing in cryptocurrency, the promise of DeFi is starting to show. There the option of crypto staking, the already-increasing prices of the currency, and yield farming; it all combines to create the perfect money pool to dive in; quite literally.

Yield farming is a great way to take a bit from the pool for free and is considered safer than crypto staking. However, that is not to say that there are no risks involved with yield farming, either. It’s as they say, there is no reward without risk.

Think of crypto staking as trying to climb the Empire State Building… from the outside… without a harness… during a storm. You get to the top; you’ll be nothing short of a legend. At the same time, if we are to put yield farming in the same example, it would be like trying to climb the building from the outside but WITH a harness and WITHOUT a storm.

The risks involved with yield farming can be distributed into three broad categories;

- Scam risks. This involves a situation where a third party intentionally introduces risk into another person’s portfolio.

- Code risks. This includes risks that aren’t in anyone’s control; i.e., unintentional bugs in the system, and

- Ethereum fee risks. These are risks introduced because of transaction or conversion fees.

In this article, we’ll take a closer look at these three categories first and then move towards specific risks, followed by what you can do when facing the risk of drowning in the money pool!

Yield Farming Risk Categories

Before getting into the specifics, let’s look at what yield farming risks are in general.

Yield Farming Scam Risk

Yield farming can be done on different networks that involve putting your virtual assets to ‘work’. Let’s say you use one of the most common one; Binance smart chain. It uses programs called smart contracts to lend your funds to others. Think of these contracts as nothing more than lines of computer code that runs on the blockchain structure, handling money (cryptocurrencies) on behalf of the owner.

When you pool your cryptocurrency liquidity into a farm, you enable the borrowing and lending protocols of the currency, leaving your liquidity at the developer’s mercy. The developer programs your currency to gap the bridge between centralized and decentralized currency to enhance the currency’s scalability ultimately.

Since the developer has control over your currency, there is a risk that they might end up running away with the liquidity. There is a very high risk of this happening when the developers are unknown. Hence, it is a good idea to make sure that the pool you are investing in has been audited by a team that you trust. However, even with the pool being audited, the risk doesn’t get eliminated.

In every liquidity pool, your currency is taken up for bids.

Here at RugDoc, we do our best to find and educate people about the risks of yield farming. Keep up-to-date with the current yield farming calendar, which has newly released farms as well as our personal “risk ratings” for each farm.

Yield Farming Bug Risk

The thing about computer code is, be it for a website design or something as functional as a blockchain cryptocurrency infrastructure, chances are that the developer may miss out on something. Even missing a single “;” can lead to a range of issues in the final build.

In many cases, these issues aren’t as major. Perhaps a click won’t work, a color may change on its own, the layout may not be symmetrical, etc. However, sometimes these bugs have been known to be rather serious, allowing cybercriminals to exploit the bug and take advantage of it.

This is an entirely unintentional bug, something that may take quite a while to be figured out if the bug isn’t as widely misused.

Ethereum Fee Risk, a.k.a. Gas Risk

Ethereum fee risks aren’t as significant for major investors in a farm, considering the amount invested and the returns they will get would mean that these fees would be a simple rounding error. For smaller investors, though, these fees can take away a major chunk of their earnings.

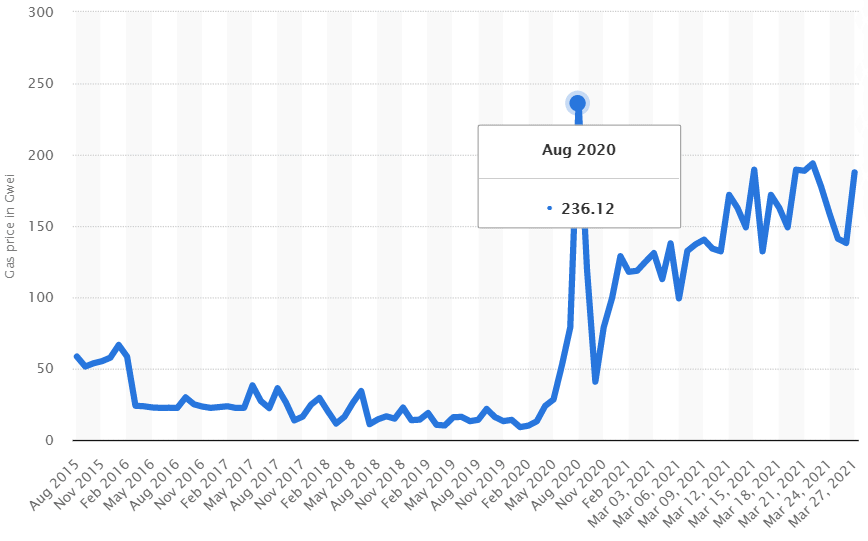

For example, in Q3 of 2020, the Ethereum fee rose to 236 Gwei as more and more people started investing in yield farms, as shown in the graph below.

For smaller players, the earnings weren’t nearly as high as what they had to pay in the form of gas fees, resulting in them losing money.

One way to avoid this risk is to use farms that don’t rely on Ethereum and therefore don’t cost as much. Luckily, many farmers like to use alternative blockchains like the Binance Smart Chain or Polygon Network for farming. For example, PancakeSwap uses Binance Smart Chain, using BNB as a fee, which doesn’t cost an arm and a leg.

Specific Yield Farming Risks

Now that we have covered the general categories let’s go over some specific yield farming risks as well.

Liquidation Risk

There is always a risk of zero liquidity in farms, albeit rare.

Banks receive cash from customer deposits and, therefore, always have enough liquidity to keep themselves afloat. In the world of yield farms, however, that isn’t the case. The amount of liquidity in farms depends on its users and the team behind the project.

If you ape into a farm’s pool with high liquidity, you might be surprised that at the end of the day, there’s no liquidity left… including your own LP tokens, which have miraculously dropped to zero.

An example of this exploit is the Iron Finance exploit on March 17, 2021, where exploiters made their way with $170,000 worth of SIL tokens by draining liquidity pools and sold them for BUSD. In the aftermath, the Iron Finance team claimed that there was no flaw in their smart contracts and took complete responsibility for the incident. This is because the team reportedly made a mistake while updating the system, changing the reward rate integer, which ultimately lead to an inflated return in liquidity pools. During this inflated period, the attacker drained all SIL rewards and sold them, resulting in the loss.

Smart Contract Risks

As mentioned above, DeFi relies on smart contracts, which inherently introduces an intentional risk. An example of this is when the Yam finance token dropped from $167.66 to roughly $0.97. The drop was the result of a bug in the smart contract, resulting in $500 million getting locked within 24 hours. However, that wasn’t the end of it. This was soon followed by the SushiSwap scandal happened; another example of an intentional risk.

Developer Risk

Chef Nomi and anonymous developer for SushiSwap released the platform, inviting investments in its farms. A week later, Chef Nomi sold his Sushi tokens, though, resulting in $14 million worth of tokens worthless for the rest. There was a lot of backlash from the community after that, and luckily, he took the high road, apologizing and tweeting;

“I have returned all the $14M worth of ETH back to the treasury. And I will let the community decide how much I deserve as the original creator of SushiSwap.”

The investors got lucky here, but the same might not always be the case. Rugpulls have the potential to ruin portfolios completely.

Price Risk

Considering the Yam Token price fall again as an example. Even if an investor earned a significant profit a few hours before the pitfall, even a profit of 200% wouldn’t have been enough to cover the loss he/she had sustained after the token dropped so much. Of course, this was a one-off, but there is still a slight possibility that history may repeat itself.

A prime example of price risk is the incident of 20th May 2021 involving the DeFi protocol PancakeBunny. The long and short of it; the exploiter manipulated the automated market maker algorithm (that dictates the price of tokens) by sending the price up artificially via eight consecutive flash loans. At the increased price, the exploiter managed to pay off the loan quite easily and siphoned $45 million from the scam. Although new tokens were minted instead of the exploiter stealing existing tokens, $BUNNY fell from $170 to $9.30 after the flash loan attack.

Something similar happened in June 2021 to SafeDollar (SDO), which wasn’t so safe after all and nested at $0.000000035 against its high of $65 in the year. In the incident, a total of $202,000 in USDC and $46,000 in USDT were siphoned off by the attacked as gamed rewards. The total $248,000 doesn’t seem like much, since SafeDollar’s total market cap was $248 million, but it’s important to note that its exit liquidity was just $250,000. The withdrawn amount meant the coin’s price plunging down to $0 almost instantly.

Yield Farming Strategy Risk

In our previous guide about crypto staking, we mentioned how important it is to have a strategy for crypto staking. But just like staking, yield farming also requires extensive strategy and planning. Four key factors to keep your eye on include:

- Lending

- Arbitrage trading

- Loan pool participation

- Setting earning goals

There is no fixed yield farming strategy as it keeps on changing in line with the market and products out there. This is precisely why crypto staking and yield farming are both said to be iterative processes. What works one day might not work as effectively the second or third day, and so on.

If strategies aren’t scaled or changed according to market conditions, such as farm saturation, liquidity within a farm, liquidity on the platform as a whole, yield percentage, price inefficiencies, and most importantly, currency volatility.

Investors must maintain a proactive attitude towards their yield farming ventures. The more laid-back approach you take, the higher strategy-risk you introduce into your portfolio and wallet.

Dealing With Yield Farming Risk After It Has Happened

If you manage to find yourself having stepped in some nasty bit, sticky substance (you know what we’re talking about), the only option you have is to pull out your funds quickly. Depending on whether you’re using a Polygon network or BSC, you will need to take different steps to protect your investment.

For Polygon:

- Identify your MasterChef address

- Navigate to the contract

- Connect your wallet to the explorer

- Call the Emergency Withdraw function.

For a more detailed guide on how to withdraw Polygon funds, follow our detailed guide here.

On the other hand, if you need an emergency exit for Binance Smart Chain funds, you can follow our guide here.

Is Yield Farming Worth It, Then?

As with any other type of investment, yield farming also has its own set of risks. However, that is not to say that the risks outweigh the benefits. Yield farming remains one of the safest ways to earn free cryptocurrency with minimal risk. All you need to do is stay mindful of the risks highlighted above and devise a strategy accordingly.

By maintaining a realistic approach instead of a completely optimistic one, you will be able to manage your finances better, making the venture well worth your efforts. If, however, you take a pessimistic approach to yield farming, you’ll most likely lose out on a very lucrative earning option. So, knowing the risks, would you invest? Would you take a deep dive into the virtual pool and take the chance of coming out the victor? Let us know down in the comments, or get in touch with us directly on Telegram!