So, your crypto transactions are taxable—what to do?

As a crypto user, you want to make sure that you can track your trades, see your profits, and never overpay (or underpay) on your crypto taxes again.

ZenLedger has made that convenient for you!

ZenLedger’s vision is simple: “We make it easy by providing a digital workflow to simplify, optimize, and automate the entire process.”

But before anything else…

What are Crypto Taxes?

Just like transacting with property, cryptocurrency transactions are also taxable. Selling, trading, or disposing of crypto and gaining profit is when taxes should be calculated.

For example, if you buy $100 worth of crypto and sell it for $150, a report is needed to pay taxes on the $50 profit. In other words, there needs to be a taxable event first for taxes to be due.

You might be wondering if you can avoid paying taxes, too.

The short answer: no, unless you happen to have tax residency in one of the world’s crypto safe havens.

Now, let’s get back to ZenLedger and dig deeper into what it has to offer.

Easy as 1, 2, 3

It may sound complicated on how to use and get your taxes calculated by ZenLedger.

But, guess what? There are only three easy steps for you to follow to get started.

Start your ZenLedger journey by clicking on the ‘Get Started for Free’ button either on the top right or on the homepage screen.

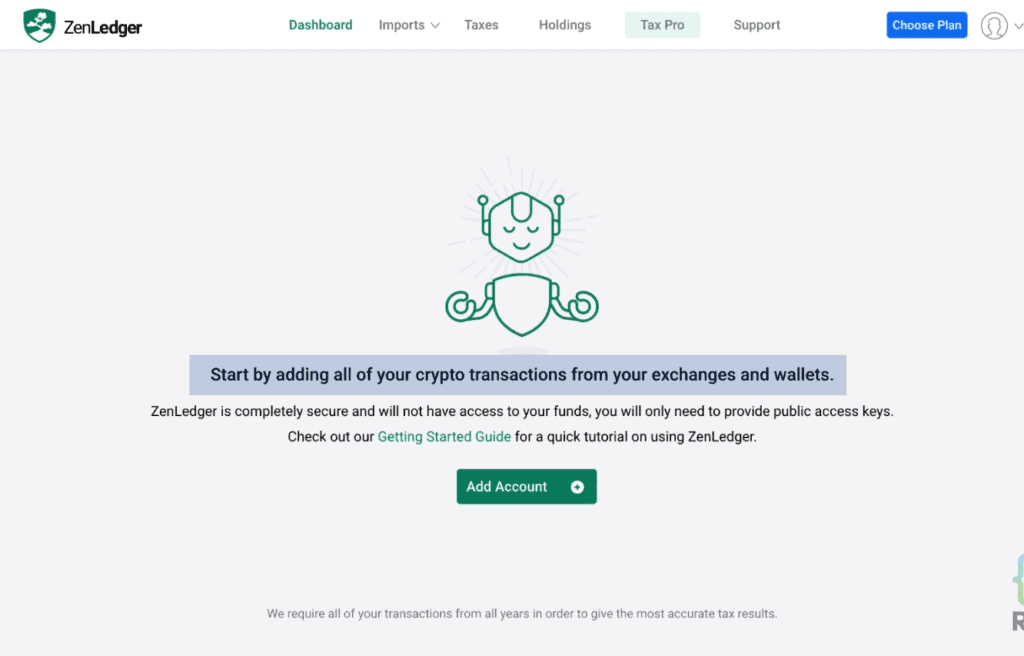

Import

First off, you’ll need to import your crypto trading history from when you’ve started trading. This includes connecting ZenLedger with the exchanges and wallets you’ve used. This process is completely safe, as you’ll only be connecting your read-only API key for exchanges (which doesn’t allow trading), and providing your public address for wallets like MetaMask (no connection needed!).

Once done, your cost basis, fair market value, gains, and losses will all be calculated and summed up in your transaction history.

To do this, let’s start by adding all of your crypto transactions from your exchanges and wallets.

If you wish to know the detailed instructions on how to get started, you may click on the ‘Getting Started Guide’ link.

Otherwise, you can proceed by clicking on ‘Add Account’.

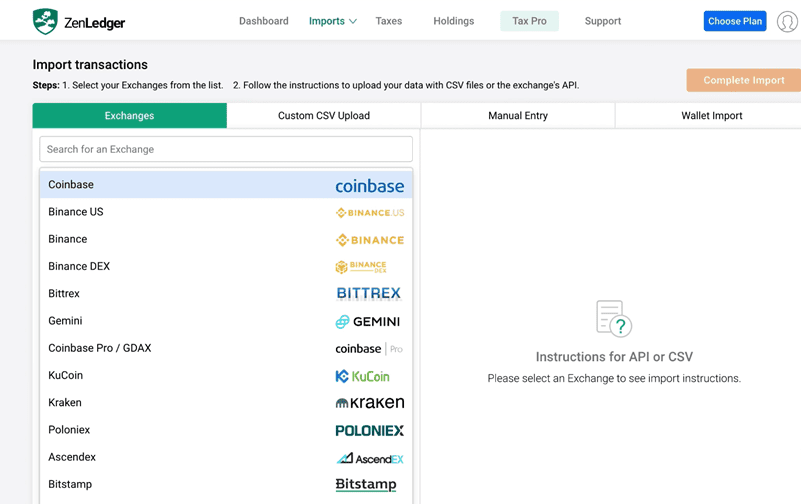

After clicking, you’ll be presented with a screen where you’ll be able to import your exchanges or wallets.

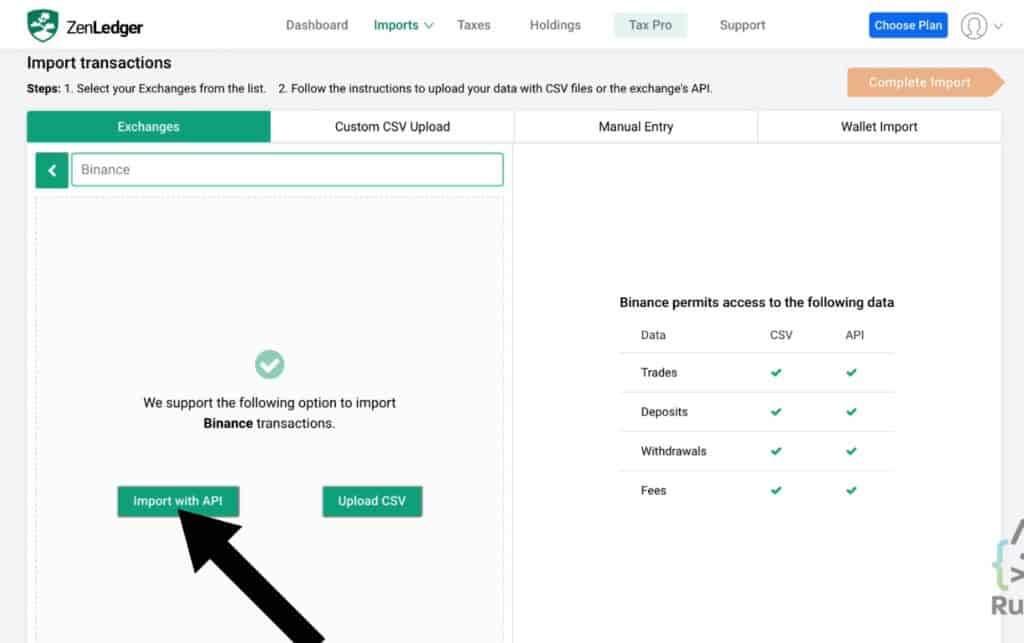

For instance, let’s import our Binance account by selecting it for importing to ZenLedger. If you don’t have a Binance account, you’ll follow similar steps to connect on your own exchange’s account.

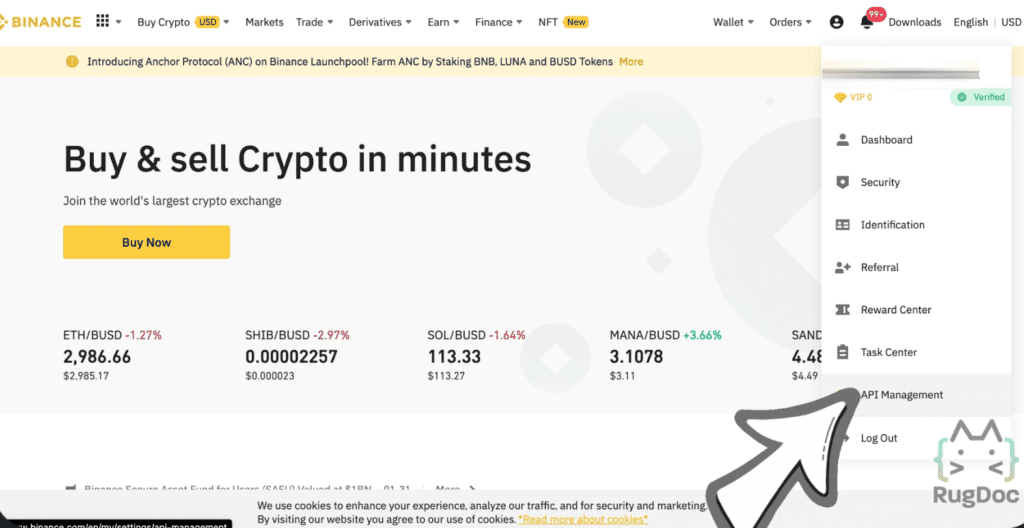

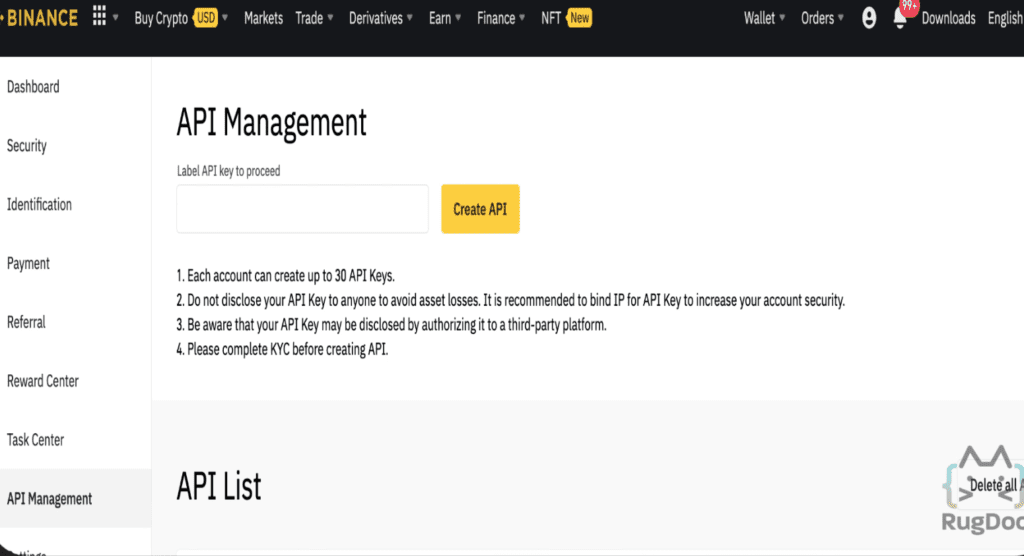

You may have to head over to your Binance account and fetch your API key by clicking on the API management option on your account.

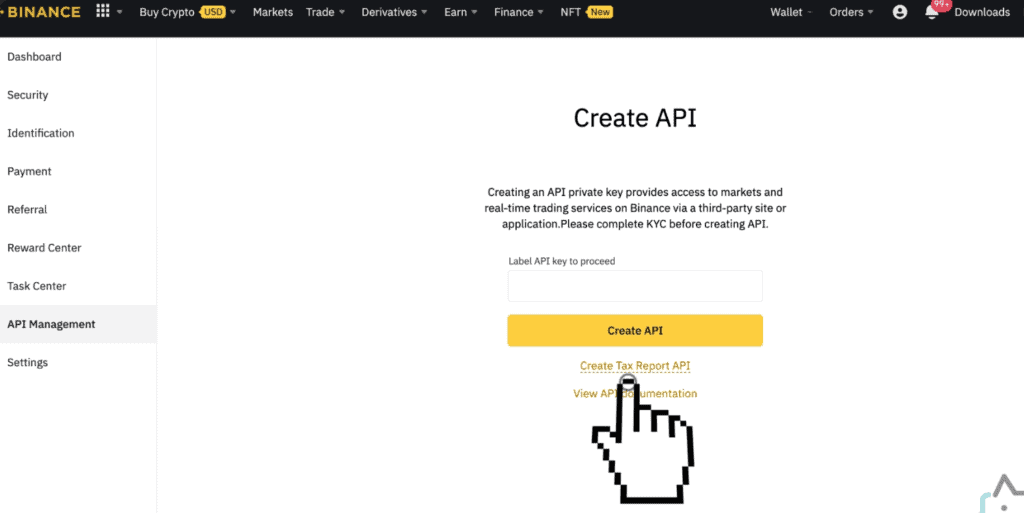

Once you’re on your API management dashboard, click on the ‘Create Tax Report API’ option.

This will create a ‘Read Only’ API key so that ZenLedger can look at our transactions.

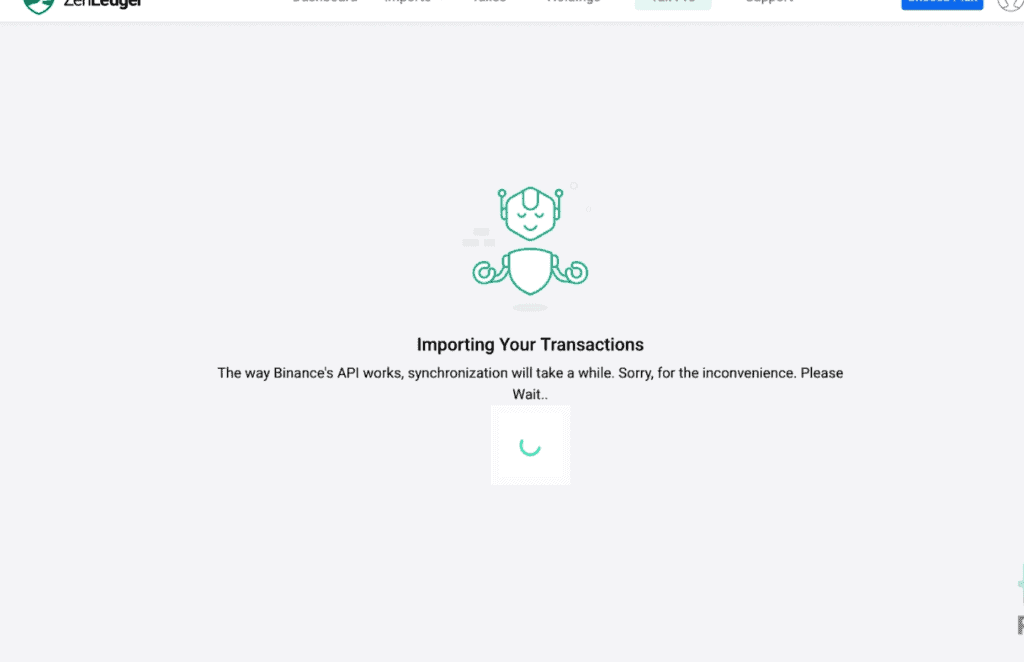

Once the API has been generated, you then copy and paste it onto the ZenLedger page. Once done, the screen will then prompt that ZenLedger is importing your transactions.

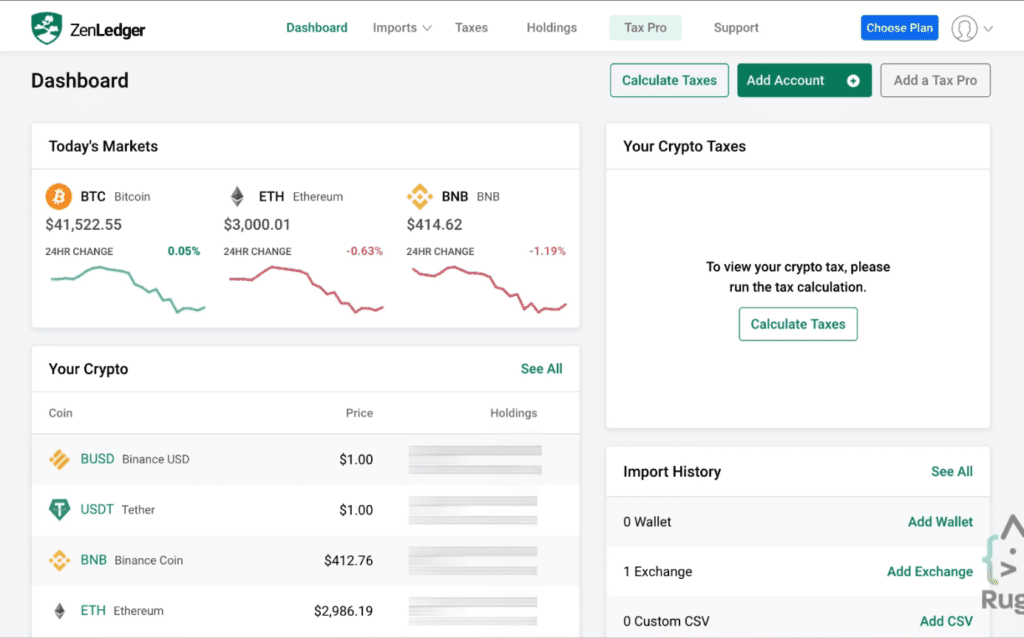

Once that’s done, you can head on to your dashboard and you’ll be able to see your imported tokens as well as the amount.

You’ll want to connect every exchange you’ve used to get a clearer picture of all your transactions.

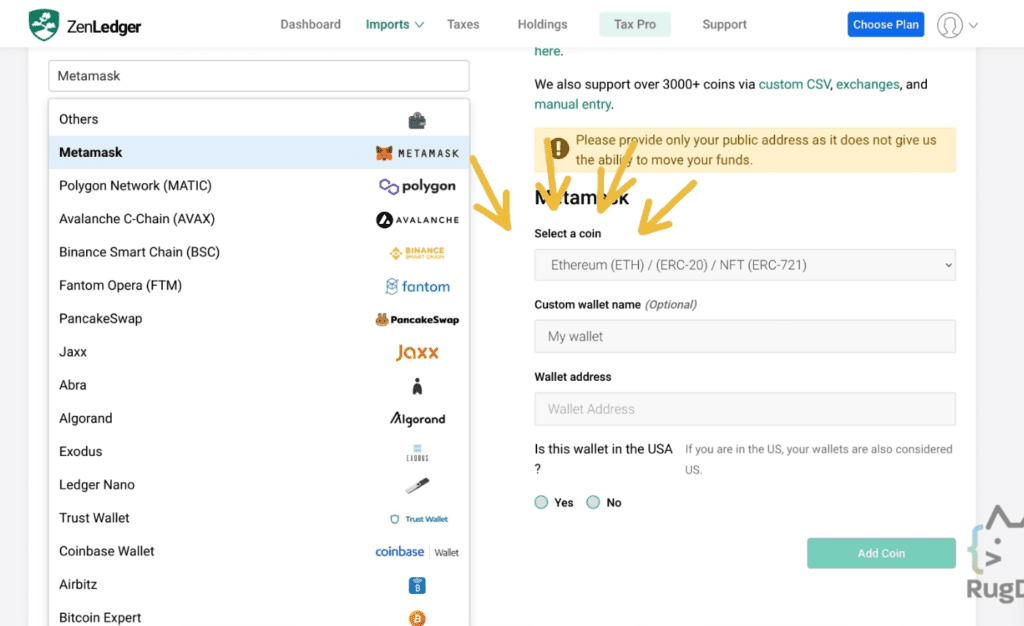

Next, let’s integrate our wallet’s transaction history. For example, we can import our MetaMask wallet.

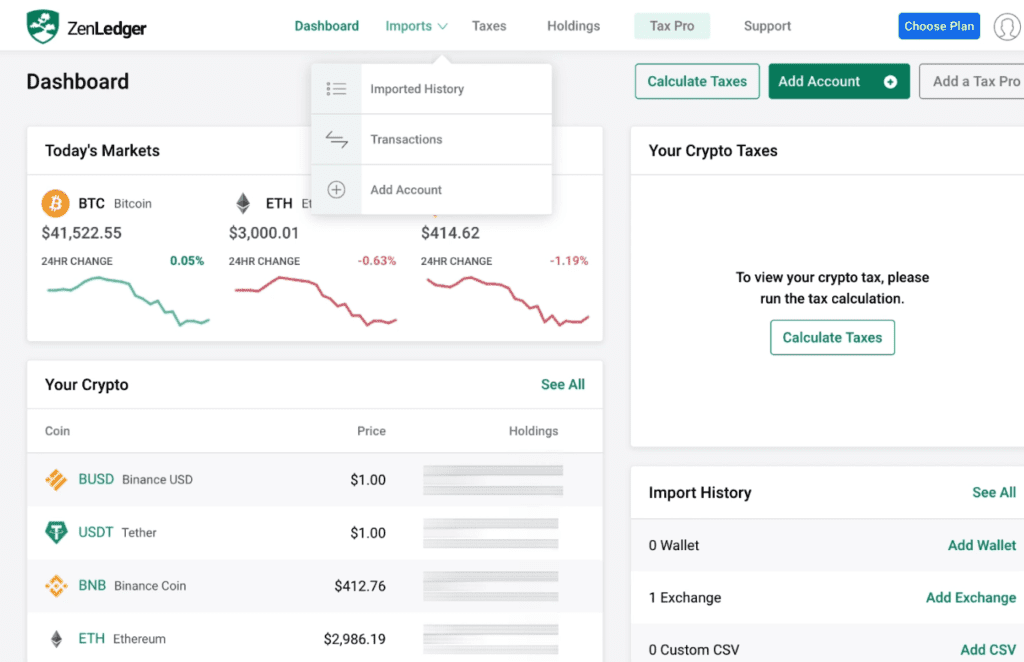

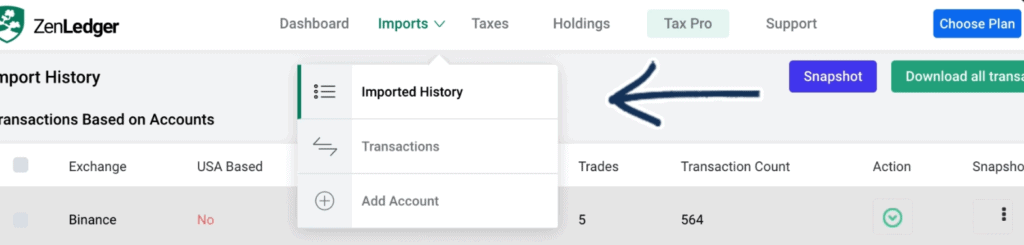

We can select ‘Import’ then ‘Add Account’.

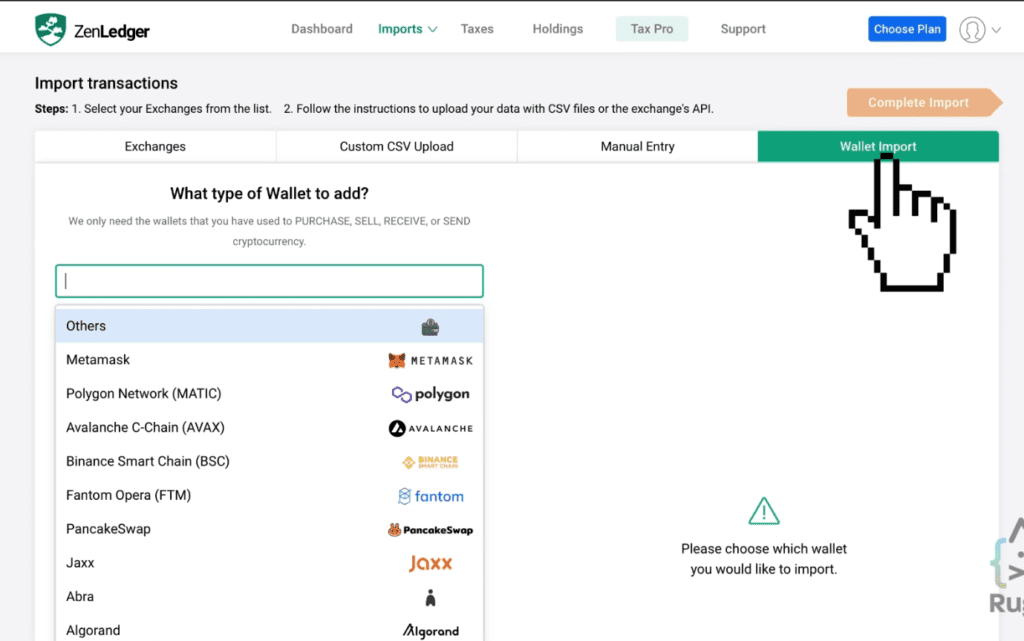

Click on ‘Wallet Import’.

Then select ‘MetaMask’.

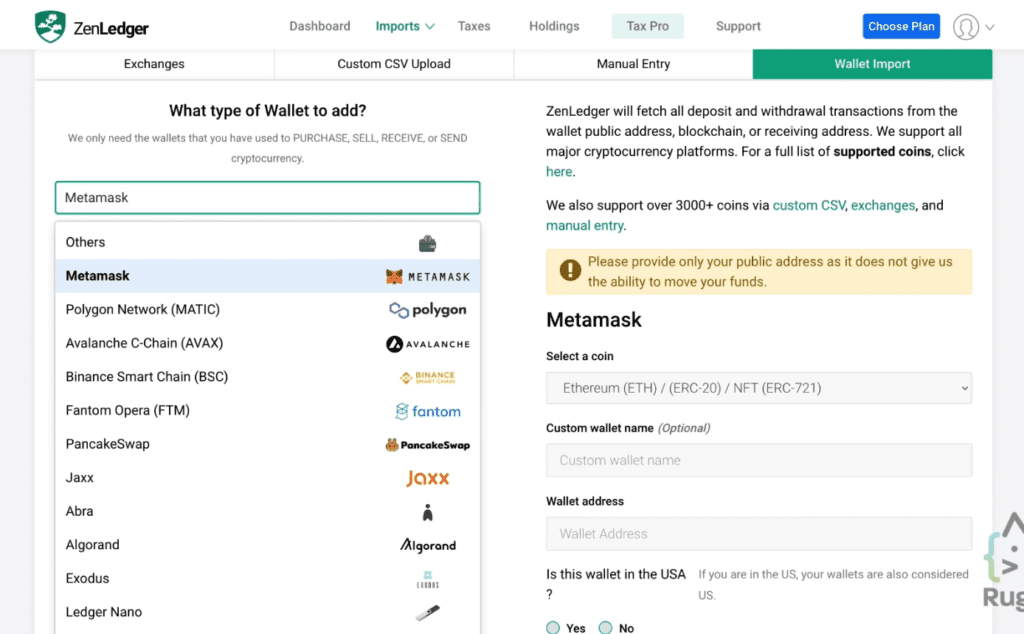

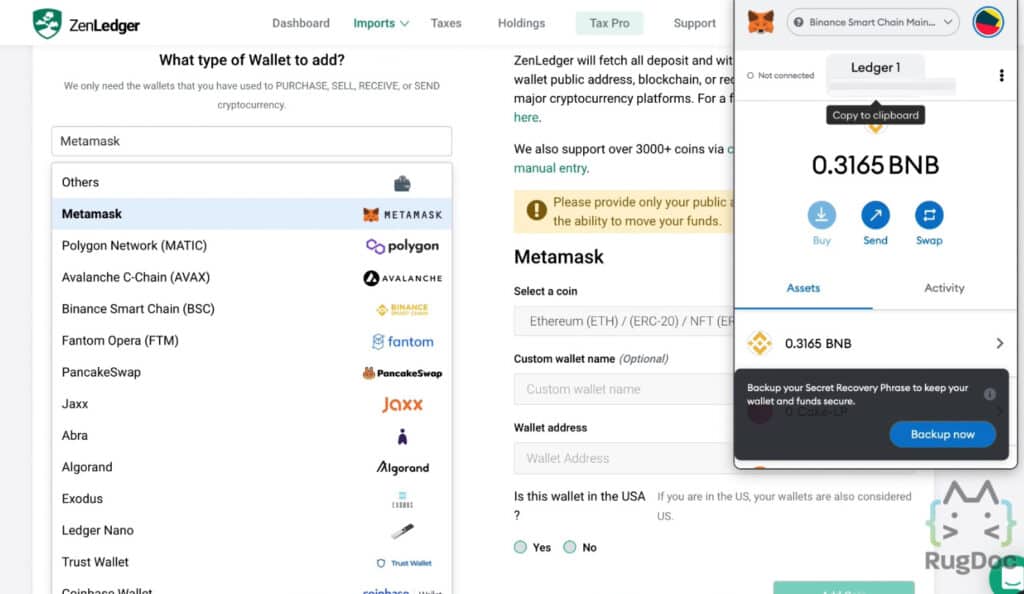

Now, all you have to do is to provide ZenLedger your public address. Click on the MetaMask logo on your screen and click on copy to clipboard.

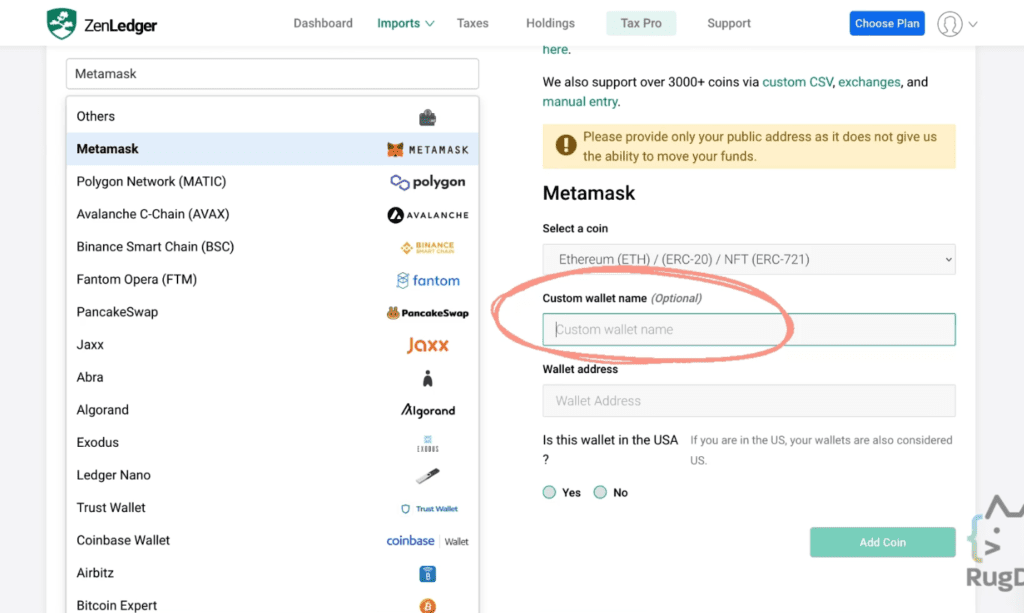

Afterwards, you can give your wallet a custom name.

Now select the type of network you want to import from.

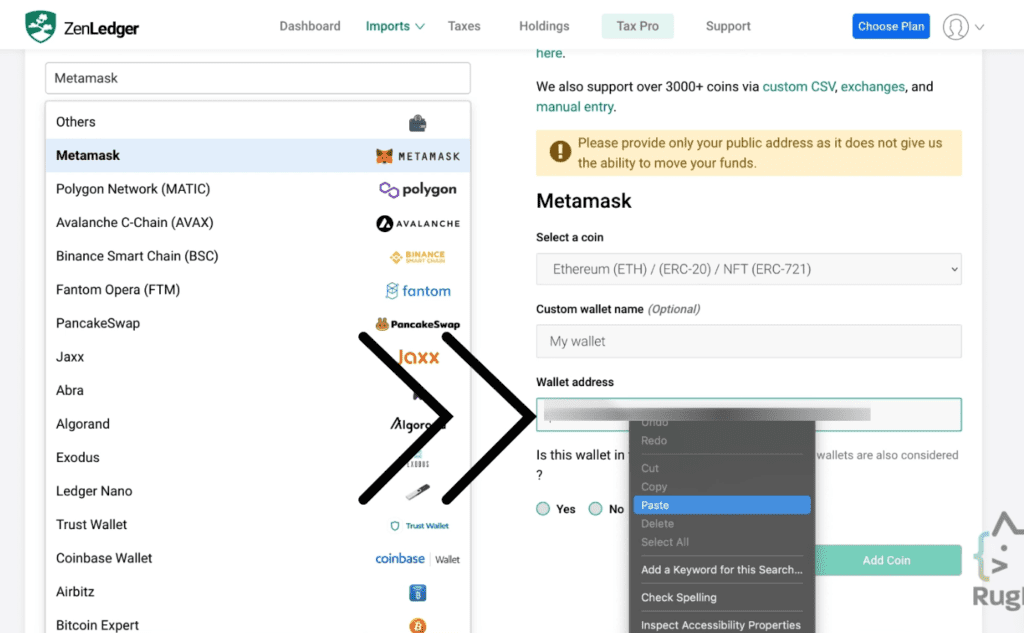

Next, paste your public address on the ‘Wallet Address’ section.

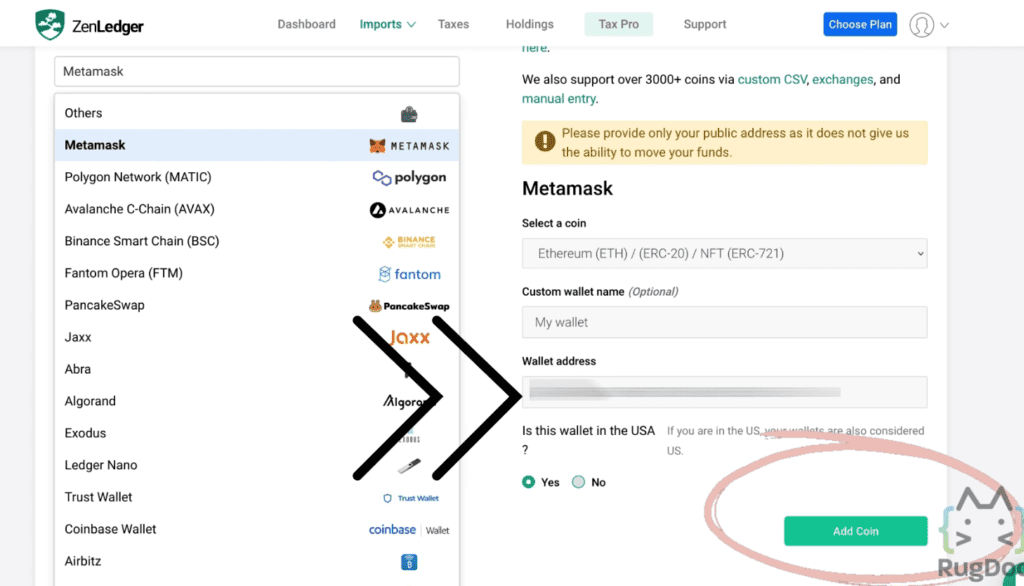

Once that’s done, you can select ‘Add Coin’ on the lower right of the screen.

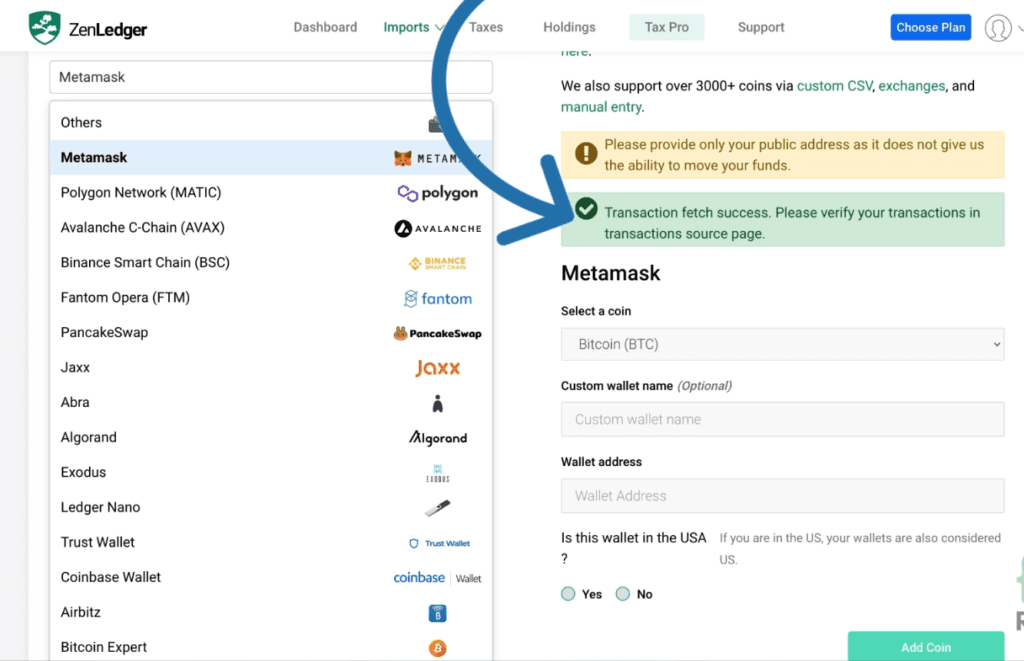

You’ll be able to see a green check mark indicating that the transaction fetch was a success.

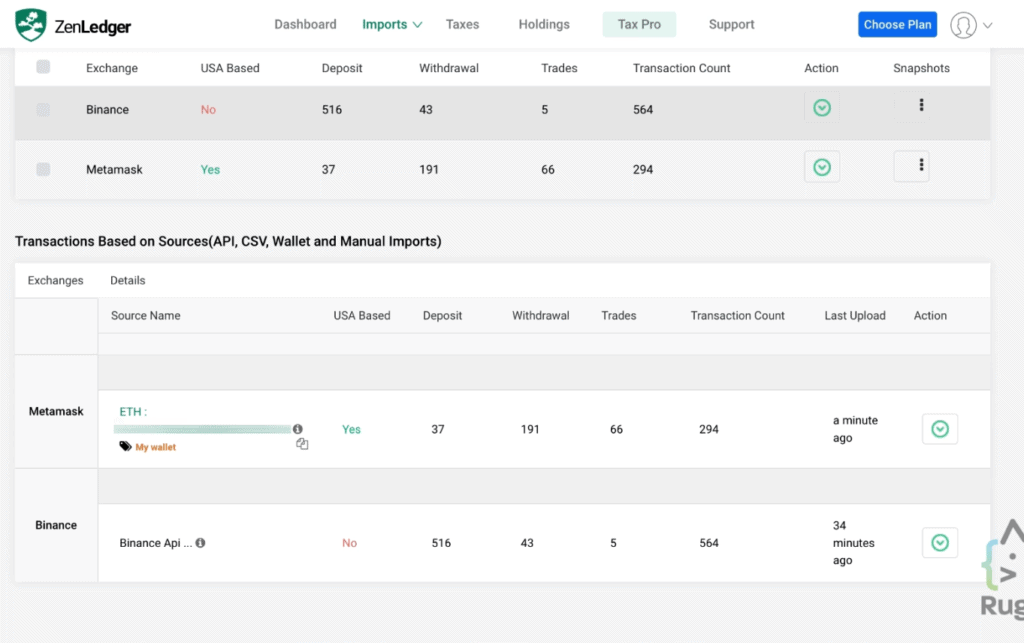

Once you check on your import history, you’ll be able to see both Binance and MetaMask added to ZenLedger.

Due to ZenLedger being trusted and rated one of the best tax software, it supports over 400+ exchanges and 30+ DeFi protocols.

And believe it or not, the numbers continue to rise.

Below are some of the exchange integrations supported by ZenLedger:

· Binance

· Blockchain.com

· BlockFi

· Coinbase

· Coinswitch

· Compound

· Bibox

· AAVE

· Airswap

· Balancer

· Huobi

· Liquid

· Nexo

· Uniswap

· Zerion

· Tokens

· Oasis

· SushiSwap

· PancakeSwap

Here’s the list of the supported wallet integrations:

· Abra

· BRD

· Bitlox

· Bitpay

· Coinbase Wallet

· Coinomi

· Copay

· Daedalus

· Edge

· Electrum

· Exodus

· Freewallet

· InfinitoWallet

· Jaxx

· Keepkey

· Ledger

· Ledger Nano x

· Metamask

· MyEtherWallet

· Mycelium

· MyCrypto

· Trezor

· Trust Wallet

For a complete list, head on over to the website.

And if you’re wondering, what if you don’t see your exchange or wallet on the list?

No worries! ZenLedger can help you upload your transactions manually, or you can request for an exchange on the website.

Review

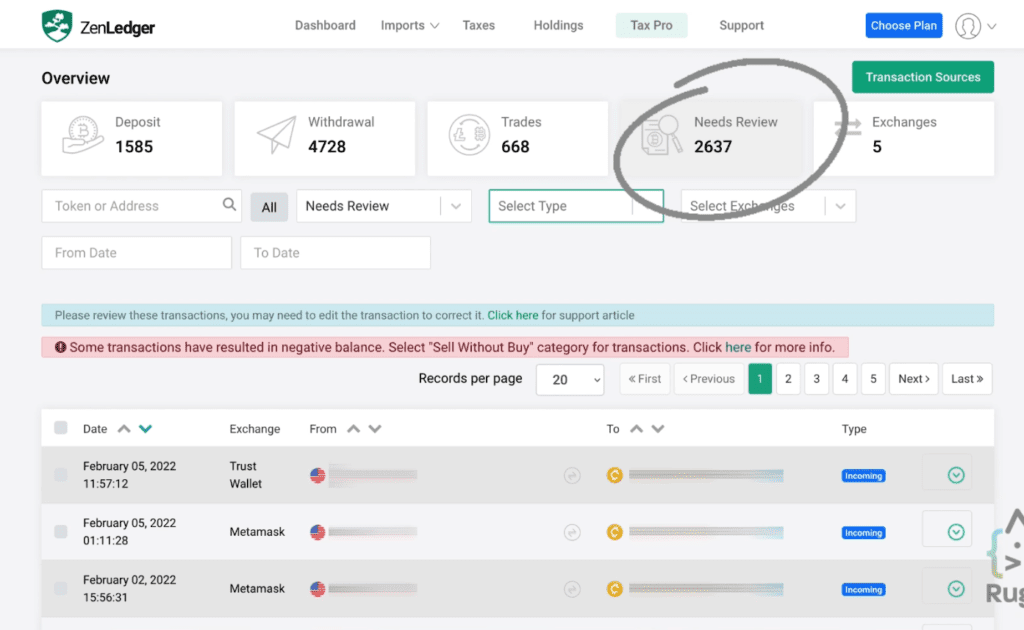

For the next step, once you’re done importing your exchanges and wallets into ZenLedger, you’ll be provided with a resolution center to make sure that you’ve successfully imported your information.

This can also help you check if there are any missing transactions to make sure the reports are accurate.

You’ll also be able to review any past cryptocurrency tax income such as staking, lending, etc.

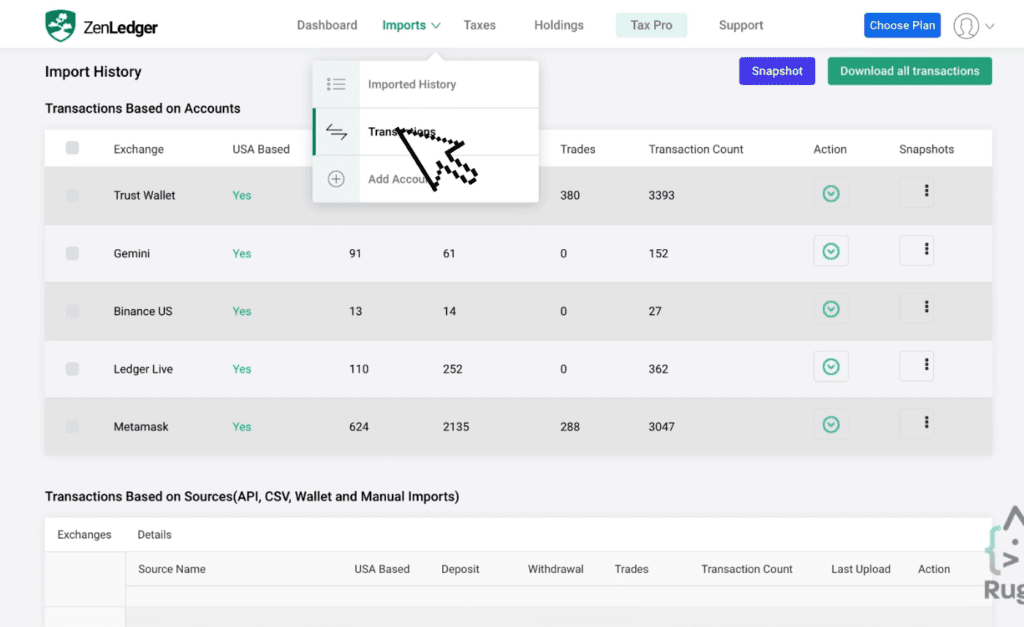

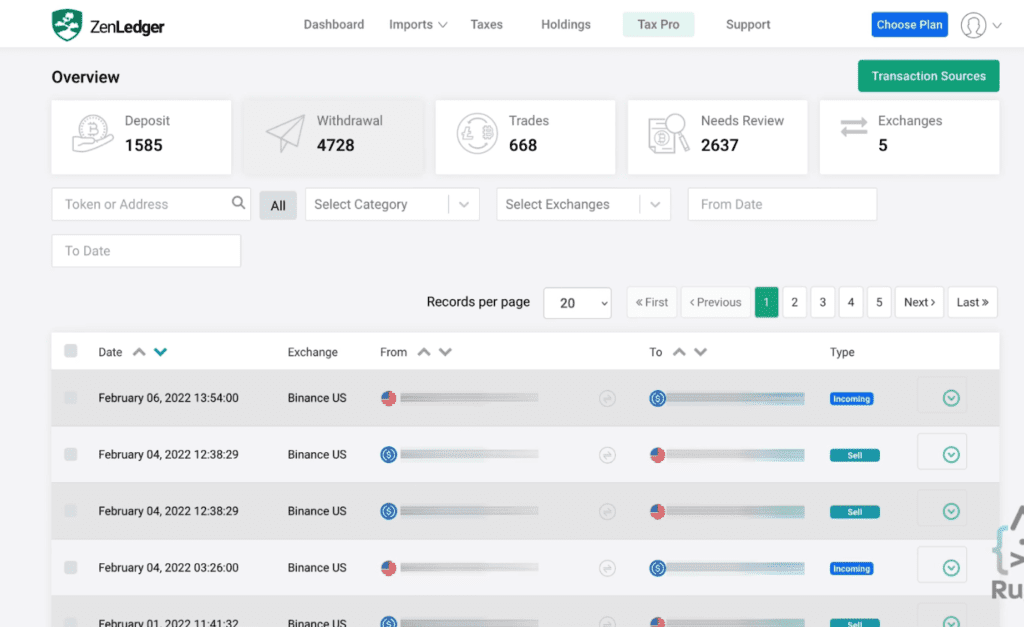

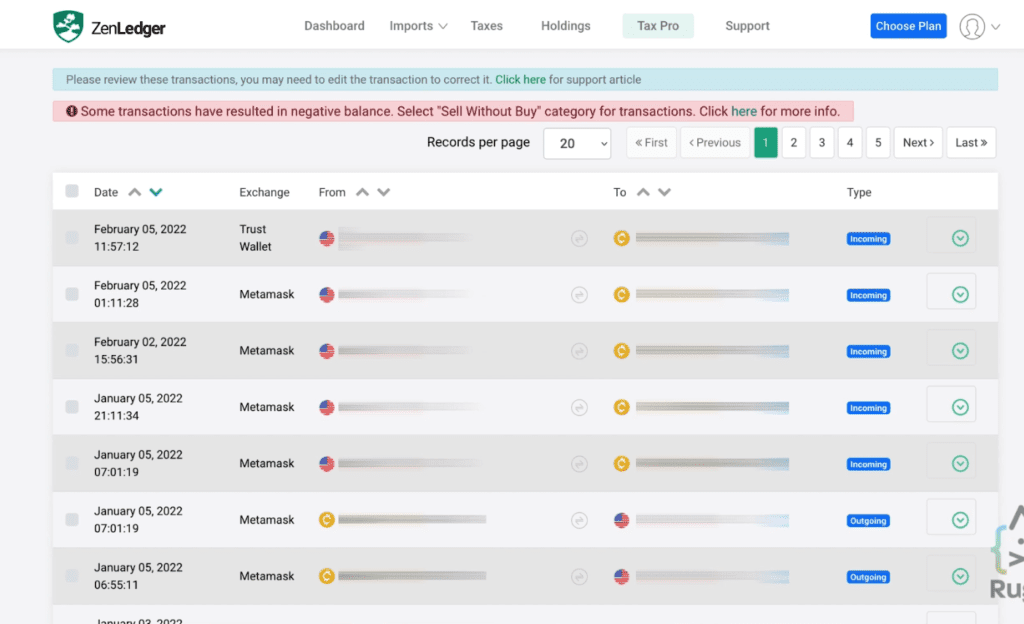

You can view all your transactions directly from the software by clicking on ‘Import’ and select ‘Transactions’.

What’s convenient is that there’s a filtering system on the software that allows you to find transactions by choosing a filter—whether it’s a type of token, where the transaction is from, exchanges, by the date, etc.

Now, instead of downloading the CSV file and going through all the transactions, there is actually a more efficient way, which is to review these transactions yourself!

For example, as you can see on the screenshot above, you can find that you have 2,637 transactions that need to be reviewed. (This number is unusually high due to several missing sources, be sure to import all your wallets and exchanges to avoid untraceable transactions.)

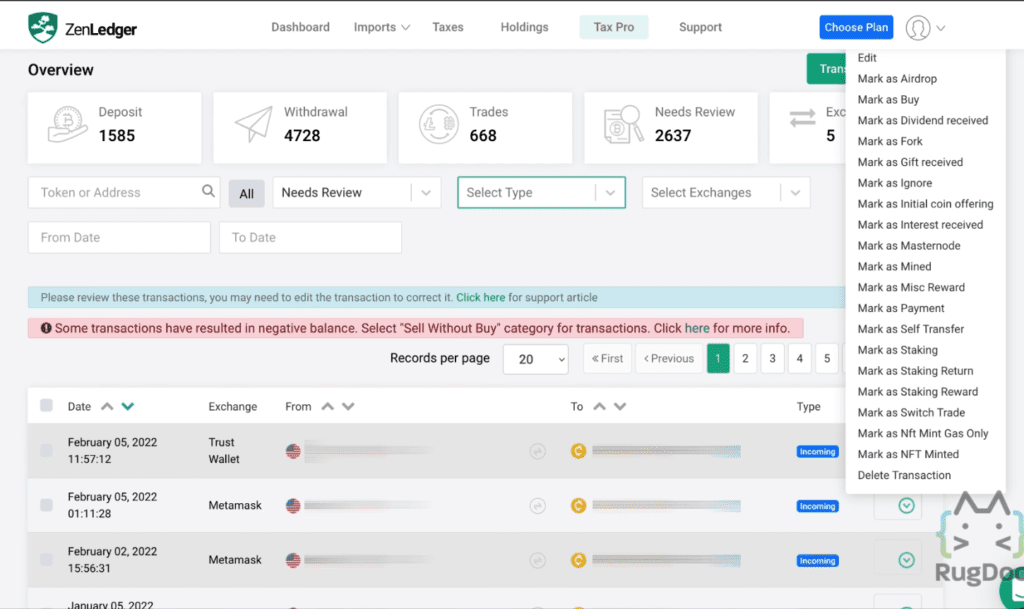

On the transaction list, you’ll be able to see the ones that need to be reviewed (in most cases, this is due to having a missing exchange or wallet involved in a transaction).

You can review your sources by clicking on the green arrow on the right side of the screen. You’ll be able to see different categories in which you can select that best fits each transaction.

Download

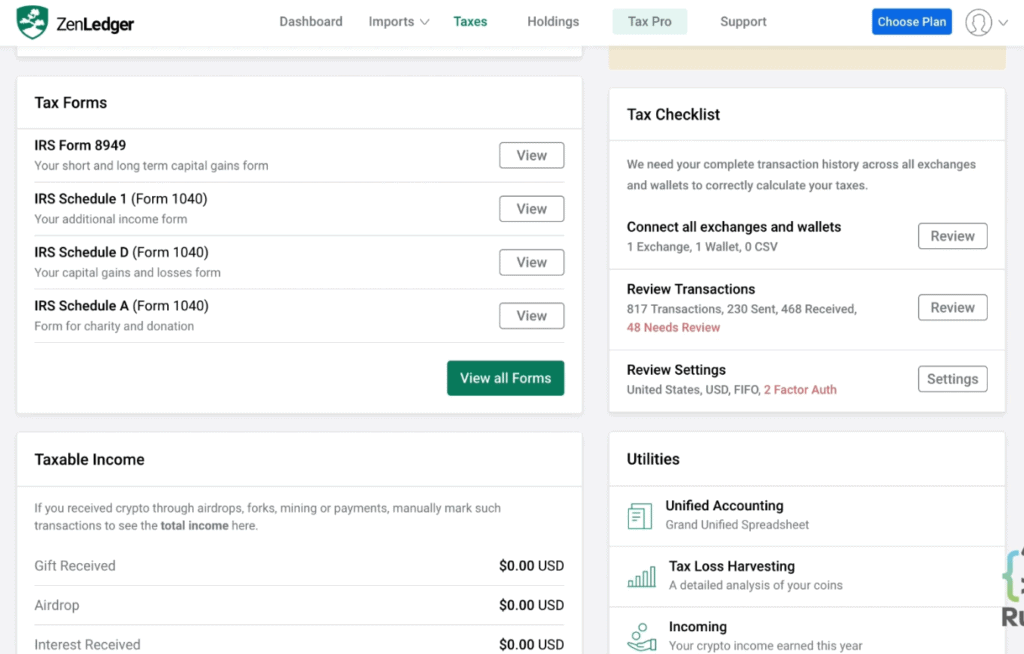

Last and definitely not the least, once you’ve finished reviewing all your reports and you’re sure enough that they are accurate, generating your tax reports is the final step. After which, the following documents are automatically created for your plan’s tax year:

· IRS Form 8949

· Schedule 1

· Schedule D

· Fincen 114/FBAR

· Tax-Loss Harvesting

· Grand Unified Accounting

· TurboTax Online Direct Report

Crypto taxes won’t be complete without the filling out and signing of these forms.

The transactions may seem like a lot, but the good thing about ZenLedger is that it always has an easy way.

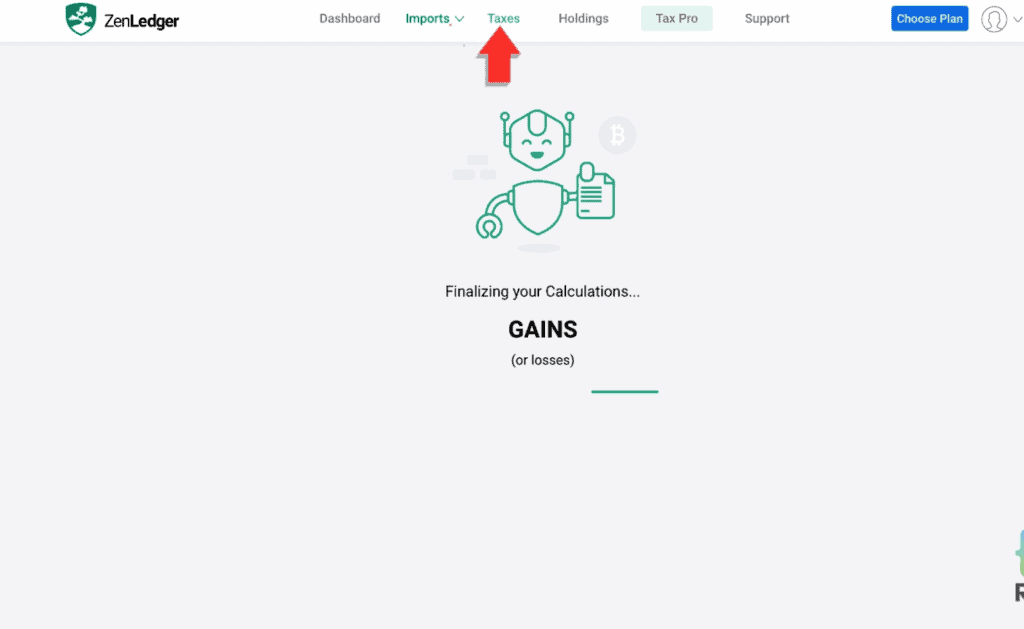

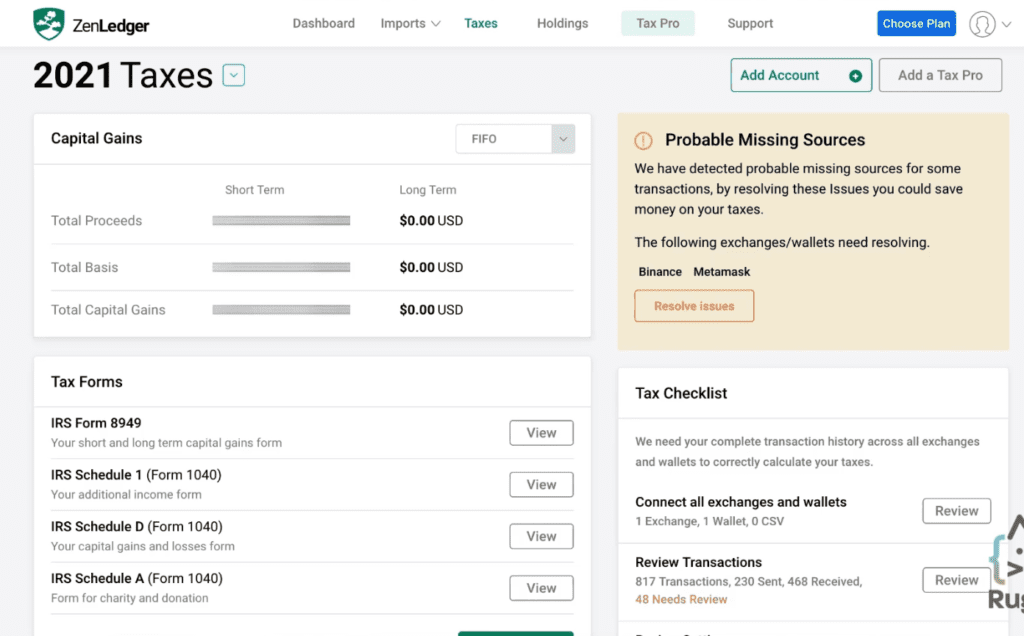

Head over to the Taxes tab and after clicking it, the friendly robot will then start finalizing the calculations and see whether you’ve gained or lost during a certain crypto season.

You’ll then be presented with this screen.

It shows your Capital Gains in both short term and long term.

Now, you can easily download your forms and head on to the Tax Forms section.

What’s so efficient is that you can download the forms with all your transaction details filled out for you!

But take note, ZenLedger is just a software, so it’s best to double check the data on the form just to make sure they are accurate.

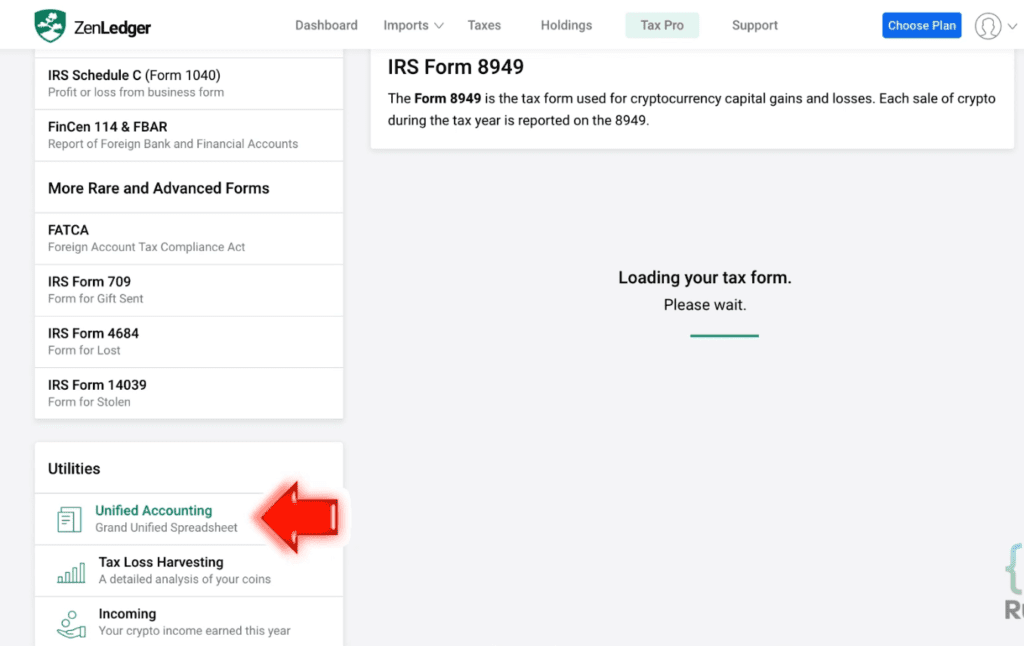

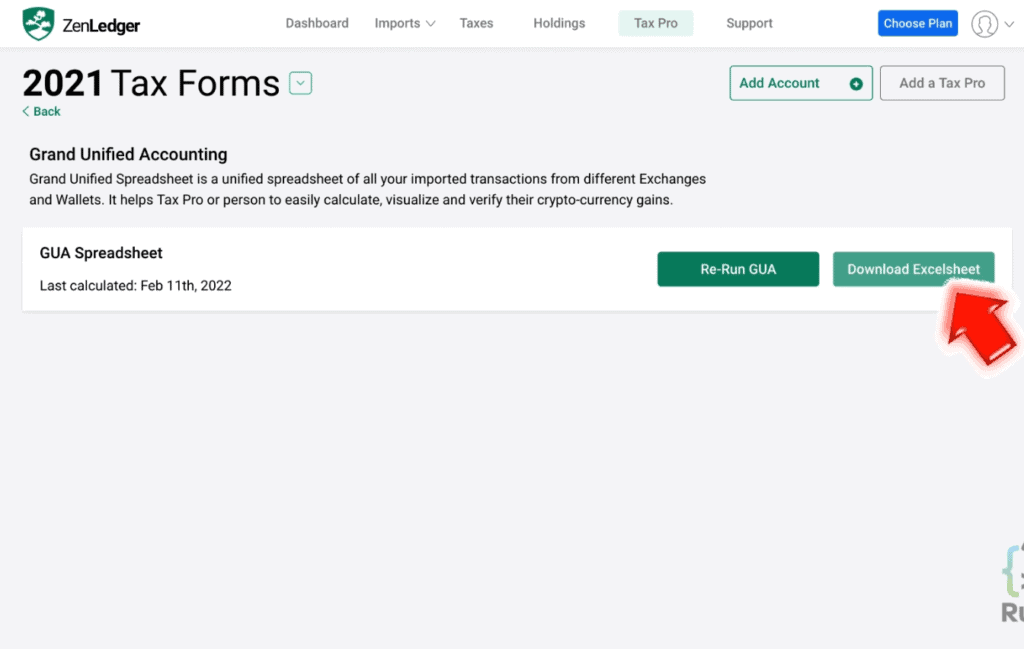

Now, if you check below the screen, you’ll be able to see a Grand Unified Spreadsheet under the Unified Accounting section.

This is beneficial to international users. It presents you with all your imported transactions from different exchanges and wallets.

You can easily download the spreadsheet and import the data into your local country’s tax forms.

So even if you’re not in the US, you can enjoy the convenience of this app.

ZenLedger: Pricing Plans

ZenLedger has arranged competitively priced plans in order to meet your budget and trading needs as well.

You’ll be able to update or add transactions before printing and filing your tax forms due to the fact that you can access your report forever! That’s right—here in ZenLedger, FOREVER is possible.

Here are the different plans you can avail according to which suits your needs:

FREE

· Annual Fee is $0 per year

· Can have up to 25 transactions

· Provides all detailed reports

· Offers premium support

STARTER

· Annual fee is $49 per year

· Can have up to 100 transactions

· Provides all detailed reports

· Offers premium support

PREMIUM

· Annual fee is $149 per year

· Can have up to 5,000 transactions

· Provides all detailed reports

· Offers premium support

· Allows you to track your DeFi/Staking/NFTs

EXECUTIVE

· Annual fee is $399 per year

· Unlimited transactions

· Provides all detailed reports

· Offers premium support

· Allows you to track your DeFi/Staking/NFTs

Take note, all plans offer a generous 1-year refund policy. Convenient!

If you also wish to have your taxes done for you, a crypto tax professional can be introduced to you by ZenLedger to get your crypto and non-crypto taxes done with the right strategies easily and quickly.

NFTs and DeFi are supported with tax professional prepared plans.

CONSULTATION

· If you wish to ask questions about your tax situation or having trouble with your crypto tax return, you can schedule a confidential 30-minute consultation with a crypto tax attorney for $195.

SINGLE YEAR

· For $3,500 per year, you can get a bulletproof crypto tax report prepared by a professional.

Multi-Year

· Offers a bulletproof crypto tax report as well, but you’ll be offered a price for a bundle of two years for $6,500.

Check out the full details of these plans on the website. You’ll definitely save time and enjoy peace of mind with these offers!

Guides and FAQs

You may have your own queries about crypto taxes and wish to know more about them.

ZenLedger has got your back! You can find crypto tax guides that can help you with your crypto tax curiosity. You can find these resources on the website:

· Blog

· Webinars

Not sure which is the right path for you? You can get in touch with the support team and be guided in the right direction.

Why ZenLedger?

There are a lot of reasons why you should love ZenLedger. The mission is to provide our crypto traders and tax professionals with the most user-friendly tax and accounting software for cryptocurrency investments, trading, and fund operations.

The platform offers not just convenient ways but also allows you to create your own plan that best suits your crypto needs with such generous offers.

I mean, what more can you ask for?

Simplifying DeFi, NFT, and Crypto Taxes for Investors and Tax Professionals with ZenLedger.