As you may know — RugDoc’s ONLY mission statement since our inception has been to prevent Hard Rugs.

From the start, it was always obvious to our early users why we focused on this, but to recap, it’s for a couple reasons:

- Hard Rugs are very objectively and clearly defined. It’s like math. Nobody with any shred of intelligence can debate with you on whether 6 multiplied by 6 equals 36. The code is the code for hard rugs. Soft rugs deal with any possible reason why a farm can fail, and often devolves into mob justice, fuzzy facts, and witch hunts.

- These type of rugs are especially catastrophic because the average expected return on profit averaged out nets only about 2-6% profit per farm if you’re staking non-native coins. If you get soft rugged on non-natives, you only lose a maximum of 4% of your bet. You can make that back in 2 more successful farms. If you get hard rugged, you’ll need 20-25 more successful farms, and can completely wipe you out.

- Hiring a senior Solidity developer to look over a project’s code costs MINIMUM $1,000 – $3,000 USD for reviewing an ultra basic farm. Most people do not have the monetary resources required to do this, and this is arguably the most important piece of due diligence to apply when making investment choices in DeFi.

Over time, we’ve grown exponentially and with that comes the burden of trying to cater to many new users who don’t understand the complexities of our mission statement and who don’t read.

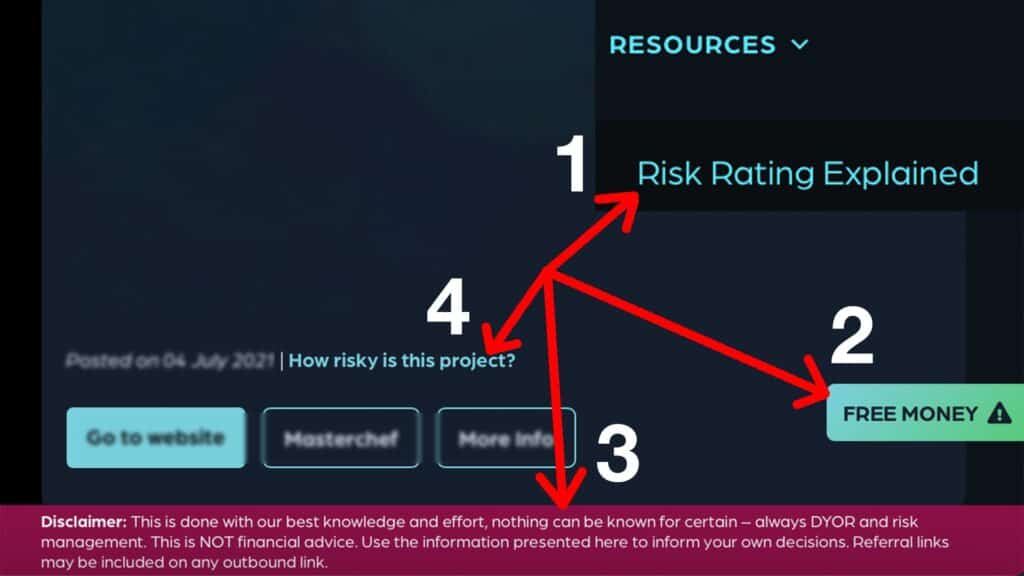

Before this, we used to grade risk based ONLY on the ability of the underlying code to be able to Hard Rug and steal 100% of funds from everyone in the project. We kept repeating this, and we even have MULTIPLE places in the site that force the reader into having to read what the different risk levels we give mean.

Despite all our efforts, we constantly are barraged with apes who don’t want to read, and so we’ve made an executive decision to revamp our risk ratings.

So without further ado, here are our new Risk Ratings, and what they apply to:

🟢 Least Risk

This is a curated list of projects that we deem to be most unlikely to result in 100% loss of funds for the end user. Typically this is achieved by having the clout, dev talent, and connections to have the most peer reviews for any new code they push out, or making so much money from their protocol that any 8 figure exploit could be compensated. This is not a comprehensive list, it’s just meant to exhibit examples of the “Least Risk” tier of projects in DeFi.

🔵 Low Risk

These projects are usually established projects in an ecosystem that have a track record of success. As a result, it is extremely unlikely for them to soft rug or hard rug their projects. The projects can still fail and the token price can go down, but usually more as a result of natural market forces.

⚪️ Some Risk

This is the default rating for projects with unknown teams but have code that is unlikely to have hard rug risk. Since the team is unknown and doesn’t have a track record of success, it’s entirely possible that they may try to soft rug by dumping tokens, abandoning the project, etc. Even a last minute contract swap to a malicious contract is possible. The only thing that is unlikely is a complete hard rug as long as you are 100% sure you deposit into the contract we review.

🟠 Medium Risk

Similar to Some Risk, but the underlying code itself is custom enough or complex enough that it warrants an elevated risk rating that needs deeper research. Make sure you read every point presented to make sure you’re comfortable with that before entering. Still unlikely to hard rug, but more chances of custom code behaving incorrectly and causing other issues.

🔴 High Risk

Project contains code or practices that are HIGHLY LIKELY to lead to catastrophic losses as they are right now. Make sure you read the description carefully as we will always warn what these issues are. If you see the words Hard Rug anywhere in the review, STAY FAR AWAY!

⚫️ Not Eligible

We reserve the right to not review exceedingly complex projects that would require tens of thousands of dollars of senior security analyst man hours. Typically these are projects that deal with leverage, lending, options, derivatives, and anything that is overly complex and which requires tons of peer reviews and audits from top audit companies.

If you’ve been paying attention, you’ll notice that our old “Low Risk” category has been relabeled to Some Risk. This signifies to the end user that there is significant risk of losing your native token gamble in any project even if the code cannot necessarily hard rug you.

Likewise, our old “Some Risk” category has been relabeled to Medium Risk, to more accurately reflect the risks more custom code presents.

High Risk and Not Eligible categories remain unchanged in definition and scope, and we’ve also clarified 2 other risk tiers.

Least Risk is meant to exemplify the highest levels of trust you can reasonably have in not losing 100% of your funds due to a hard or soft rug if you invest in the project.

These are typically cornerstone projects that are so security-minded that total loss of funds is highly unlikely. So for example: Aave, Curve, Uniswap have never had catastrophic exploits, and they all have both the funds and clout to have the best minds in crypto peer review any innovation they do.

Pancakeswap fits the criteria because it makes so much money that could comfortably compensate even 8 figure losses in an exploit.

Keep in mind that this is a hand-picked curated set of projects that is meant to show by example what the category entails and is NOT meant to be all comprehensive list of ALL projects in this tier.

Low Risk is the most notable new risk level we have introduced. These are projects that are established and well-known projects with a track record of success, notable dev teams, and for one reason or another are HIGHLY unlikely to either soft or hard rug.

For most new entrants to DeFi, entering into a Low Risk or Least Risk project is what we would recommend to gain experience.

Thank you for taking the time to read this, we here at RugDoc hope it helps clarify things for everyone even more, and wish you the best in your farming adventures!