*Paid Advertisement. Not financial advice. RugDoc is not responsible for the projects showcased here. DYOR and ape safu.

Search Results for: seed

UPDATE 2:

Allegedly, the dev intentionally drained to return funds to users who had deposited. In any case, it is curious to see that the dev has decided to drain the contract in the way that we have warned that the project could steal funds and not simply let the users themselves withdraw their funds. Anyways 🚨🚨🚨 Do not interact with the new contract 🚨🚨🚨

UPDATE:

Project has re-deployed its contracts with a supposed fix to the issue mentioned in the first review. It is insufficient, the start function still allows the dev to drain the contract at any time. This possibility exists even after the function has been called with the correct parameters the first time. 🚨🚨🚨 Do not interact with this contract either [0x54cbB0...4De8] 🚨🚨🚨

⚠️ FYI, the dev has drained ~317 OP token from the first reviewed contract [tx1 | tx2 | tx3].

🚨🚨🚨 Contains hard rug code that allows the dev to drain the contract funds before setting the start time. Even the function intended for such work could allow the dev to drain the funds from the contract in a different way. Do not interact with this contract [0x29b0e3...5a96]🚨🚨🚨

Update 2:

- 6 Hour timelock added to MC

- Pools added to MC

UPDATE 1:

- The project has locked the following liquidity with RugDoc:

- AVAX-SEED LP tokens (~53% at time of review) - Txn Hash: ...0cf0

- The project has redeployed their contracts :

- MC: identical

- Token:

- Owner transferred to MC

- Max Transfer Tax: 5%

- Anti Whale minimum: 1%

- Maximum Wallet balance: 2% of the total supply

Panther fork

⚠️ Masterchef currently not behind a timelock⚠️ No pools added- ✅ Max 4% deposit fees

- ✅ Correctly accounts for transfer taxes on any token pool

- ✅ Token operator changed to the MC

- MasterChef uses per-time emissions

- 5% transfer tax

- SwapAndLiquify is turned off -> 2% gets burned, 3% will be sent to the token address

- 2% anti-whale

- 2 hours harvest lockup

- An extra 10% of emission rewards are minted to the dev address

⚠️Triple check the contract you interact matches the one reviewed here (..76e8 / ..4D96)

SPONSORED AD

Panther fork with automatic liquidity removed.

- Deposit fees capped at 4% ✅

- Automatic liquidity code and updatable router removed ✅

- Antiwhale 2% (min 0.5%, max 10% ✅)

- 4% transfer tax (max 10% ✅)

- Harvest interval (max 2 days ✅)

- 3% referral rate (max 18%)

- No tokens minted to dev address

- Docs specify buybacks every 12 hrs

- No pools had been added at time of review

UPDATE Token ownership transferred to masterchef and masterchef is whitelisted from antiwhale. No token has been connected to the website, and in light of the recent PolyOrca incident, we'll mark this as Some Risk until the token's been connected and actively trading, and MC is still the same.

UPDATE 2 Pools have been added, token connected to the website, the Masterchef contains 22 pools. Masterchef is under 1 day Timelock. Token owner is also the same Timelock but they claim to have renounced ownership (Which is still the wrong move anyway⚠️. This means that no rewards will be given to stakers when farming starts until they transfer ownership of token to the MC but that's in 1 day at least⚠️. They have queued a Timelock transaction to transfer token ownership to MC, so in about 22 hours we'll see if it's been done correctly.

UPDATE 3 Token owner is now Masterchef, so staking rewards can theoretically be minted ✅.

Panther fork

- 3% referral commission capped at 18%

- Initial emissions 50/block

- Has a harvest lock based around block harvest times. The initial harvest lock is 24h

- Differences in start block and emissions structure

- Deposit fee capped at 4%

- 2% transfer tax with 1% burn.

- Has an antiwhale feature which caps the max transfer amount to 5% supply. Min antiwhale of .5%

- No tokens minted to dev address

- Timelock: 0xa9673038a89146e57d3bD8A9cB9e05185228Fc7C

- No pools are added at time of review but will be added at launch

We received reports they absolutely stuffed up their launch and the project is currently in limbo.

FarmersOnly fork identical to CroFarm with a Panther-style token and a max supply of 20,000

- ⚠️ Transfer-tax liquidity tokens are sent to the operator wallet. Please clarify with the project on how they plan to use this.

- ⚠️ Token router can be changed. Please check to ensure they are always using the TraderJoe router if set.

- ✅ Max 4% deposit fees

- ✅ Masterchef behind a 6 hr timelock

- ✅ Correctly accounts for transfer taxes on any token pool

- Initial liquidity has been locked with RugDoc

- An extra 10% of emission rewards are minted to the dev address

- 5% transfer tax (max 5%)

- 1-2 hr harvest lockups (max 2 hrs)

⚠️ TRIPLE CHECK the contract you interact with matches the one reviewed here (0x2615A799...6194)

UPDATE:

- The project has redeployed an identical Masterchef, token and timelock with the following addresses and connected them to front-end:

- Masterchef: 0x71756...51594

- Token: 0x8cb6...F1cC27

- 6 -hour Timelock: 0xF05F7...3cc14

- Emissions have been increased to 0.01/second instead of the previous 0.005/second.

RugDoc KYC: Project owner has KYC’d to us, and has signalled his transparency and commitment to this project. We have also confirmed that the project owner has access to the privileged addresses of the project, and shall retain full responsibility over them and any actions taken by them.

Panther fork

- MC and Token identical to their L1

- ✅ Masterchef under 6 hours timelock

- ✅ Max 4% deposit fees

- ✅ Correctly accounts for transfer taxes on any token pool

- MasterChef uses per-time emissions

- 5% transfer tax

- up to 1% Anti Whale

- 2% maximum balance per wallet

- 2 hours harvest lockup

- An extra 10% of emission rewards are minted to the dev address

⚠️Triple check the contract you interact matches the one reviewed here (..9faA / ..1594)

🚨🚨🚨 Contains HARD RUG code that can approve withdrawals to the owner for any token out of the masterchef. DO NOT STAKE in this contract 🚨🚨🚨

From the same dev as AppleSwap (Crypto Spot account 0x358b...ed3b seeded AppleSwap account 0xe5bd...316e)

Simple BEP20 token implementation with 100.0 Million MMETA Premints

- ⚠️ 43% of tokens are held by the deployer of the token contract. These tokens are not vested nor are they protected by a multisig or masterchef.

- ⚠️ Only 2% of total supply was available in the presale, while seed and private investors and the team together hold 67.5% of the tokens with no certainty of vesting. There is a risk where holders can get dumped on.

- ⚠️ 29% of tokens are held in a proxy contract that points to an unverified contract (0x8894a5711ee4c3354c76e44cc42ae6c6858d5c47).

- Pre-mint distribution:

- 47.5 million MMETA for seed/private/strategic sales, and ecosystem

- 2.0 million MMETA for public sale

- 20.0 million MMETA for team

- 9.0 million MMETA for advisors and partnerships

- 5.2 million MMETA for Liquidity Pool 1

- 0.3 million MMETA for Liquidity Pool 2

- 6.0 million MMETA for reserves

- 10.0 million MMETA for marketing

⚠️ Triple check the contract you interact matches the one reviewed here (0x7a9c...351f)

UPDATE: One of the scanners was able to check the bridge interactions to explicitly link these two addresses. Confirmed to be the same dev, stay out.

A community member reached out that the telegram account of this farm was the same account as a telegram account of PolyRiver, which soft-rugged yesterday. Usually we don't partake in these softer issues without proof so we gave a quick look at the PolyRiver scammer wallet who moved out funds using a bridge ending in ..d2e9, and this same bridge and currency was used shortly after to seed the creator account for PolySecond.

aYield Finance fork

Hard rug code not found and this particular contract has a Paladin audit, HOWEVER this project is High Risk because the same creator is responsible for a number of other projects that swapped out contracts to malicious unverified ones after being reviewed, including:

Blockchain transactions confirm that the same creator has seeded all of these accounts.

IF you choose to ape into this project anyway, you will need to 100% VERIFY that the contract you're approving and/or staking in matches the one reviewed here: 0x46655CE994041664163489B278CF0eE576322118

NEVER interact with an unverified contract and NEVER interact with a contract that doesn't match the one in our review(s)

Dev has the ability to mint tokens using manualMint() function, though this is limited to 500k tokens each time it's called, and up to a maximum of 10.5million tokens as constrained by the MinterGuard contract. This function is delayed under a 2 day Timelock. Dev has stated that this function was called prior for seeding liquidity, and its future use will be only in emergency cases to cover one-time expenses or for potentially upgrading to a DAO.

- Token owner is Minter, which itself is under MinterGuard to constrain afore-mentioned mint abilities

- Has been around for a month so far without issues

- Would recommend having an audit as, according to its whitepaper, it's a rather complex Asset Management project with various novel features to be implemented.

Goose fork

- ⚠️ Token owner has NOT been set to the Masterchef, so they're still able to pre-mint tokens (Possible for presale or seeding liquidity)

- ✅ Max 4% deposit fees

- ⚠️ Masterchef is NOT behind Timelock

- ✅ Correctly accounts for transfer taxes on any token pool

- An extra 10% of emission rewards are minted to the dev address

- ⚠️ Currently max transaction size for token transfers has been set to 0, though this can be changed to any amount. Looks like they're still setting things up.

⚠️ TRIPLE CHECK the contract you interact with matches the one reviewed here (Ends in fE8a)

- UPDATE 4: All socials have been deleted and the Banshee dev account (0x96ac...e6dd) – which, again, was created by a Grim dev account – has withdrawn nearly all funds ($83k) to a Coinbase wallet: 0xf190...3708

- UPDATE 3: The new account has moved a large amount of funds (~$24k USD) over to Polygon and withdrawn to crypto.com: 0x45dc...a844. This wallet was seeded by, and received many transactions from, 0xdce6...ec69 which was seeded via Shade from the account mentioned below (0x093c...e424)

- UPDATE 2: Funds have been transferred out and the strong ties to Grim Finance continue:

- After rugging, the Banshee dev account has withdrawn 53k FTM to a new account, 0x009d...8303 (including 10k FTM via Shade cash)

- This new Banshee account then sent $1000 USDC to 0xaf97...5927 and $700 USDC to 0x1f99...dbce. Both of these accounts were seeded from 0x093c...e424

- This seeding account (0x093c...e424) is connected to Grim in a number of ways, including:

- It created the account 0x5c3a...7926, which is the dev account for a GrimTable contract

- It received $1200 from the Grim strategy account

- It received $925 from a Grim dev account

- It received 20,000 REAPER from the Grim treasury

- TLDR; The Banshee account has sent funds to addresses seeded by a wallet with multiple Grim connections.

- UPDATE 1: 🚨 As we warned, the project pulled their liquidity, which represented more than half of the total liquidity, and sold a bunch of tokens:

- https://ftmscan.com/tx/0x584d51fa99beb2ed543c268e53060d9e4fd7e8f8df952f1e20e40326b7c1ceef

- https://ftmscan.com/tx/0x7627debfe67b3a79661e49e85fd6e049fc7c34590536709249993b8cceccd34f

- https://ftmscan.com/tx/0x77fb4ec77a441d1617fe770374d055f559f89d4c9fc871f21457cd67c17f5e70

- https://ftmscan.com/tx/0x5db73b741288769c2ecf295c3437d18a00f2759d9b0bd9f6d2fd0ad10bb2b2c4

- There was no warning of this, and no announcement afterwards. We do not recommend participating in this project, there's a high likelihood they've rugged.

Goose fork with capped deposit fees.

⚠️ There was no hard rug code found, so your non-native funds will be safe if you stake them in the correct contract, but there are many warning signs with this project including its shady origins (Ed. I see what you did there), so exercise extreme caution if you wish to invest here.

- ⚠️ The project blatantly lied about its origins. The dev is a Grim Finance developer (0x45a0...950f, which seeded 0xc4a7...5f3b, which seeded the Banshee dev account 0x96ac...e6dd) and the project was funded using Shade cash from that same Grim developer account (100 FTM from 0x45a0...950f), as well as the Grim strategy account (1000 FTM from 0xaa42...142c). When asked about this, project leads specifically said there was no connection to Grim, that the funding came from themselves, and that the transactions in question weren't related to them at all. Lying about the origins of the project is an obvious warning sign. It strongly increases the chance of the contract being swapped out, or the project soft rugging by adding hidden pools, messing with emissions, dumping tokens and liquidity, etc.

- ⚠️ Liquidity is just staked in the masterchef and can be removed and dumped at any time. Please clarify with the project on liquidity locking or burning

- ⚠️ Masterchef uses per-block emissions instead of per-time. This is an antipattern on networks with variable block times like Fantom and Avalanche

- ⚠️ Does not support deflationary/transfer-tax token pools, just clarify with project that none will be added

- ⚠️ Dev address can be set to the zero address, which would block regular withdrawals and harvests

- ⚠️ Masterchef currently not behind a timelock

- ✅ Max 4% deposit fees

- An extra 10% of emission rewards are minted to the dev address

⚠️ TRIPLE CHECK the contract you interact with matches the one reviewed here (0xae5b...409e)

They present themselves as a next-generation cryptocurrency exchange committed to offering alternative financing and non-bank asset management solutions outside of traditional financial systems and banking establishments with integration into the NFT Marketplace.

Most of the sections are still unfinished or not directly available at the time of this review.

🚨🚨 The MultiSwap Section [link] requests your 12-word seeds and notifies you that once imported your balance will be "restored" and your funds may disappear. This is definitely weird. First, if you have to restore a wallet, it would be enough for you to do it in the original app; Second, the restore process never involves anything with the funds, as it only restores access to them. 🚨🚨

⚠️⚠️ Please always keep in mind that you should NEVER and under NO circumstances provide your seeds to any person/website. If you still do not understand the importance of what is stated here, we invite you to read our article on this topic [link].

$BLN Token

- Simple implementation of ERC20 token that uses role-based access control.

- They have two audits by InterFi Network and Solidity Finance. It is worth clarifying that in both cases, it is only an audit performed on the Token contract.

- 🚨 At the time of this review, the token owner maintains their Minter role. Therefore, in the event that tokens are burned, they are deducted from the total supply, which would allow the minter to mint those tokens again later and dump them.

- ✅ No transfer tax.

- ✅ No anti-whale.

- Max Supply: 300M

- PreMinted: 300M [see holders]

- 150M (50% of total supply) locked until 7 Jan 2023 [tx].

- 750K for Crowdpooling on Dodo [tx | link | read more about crowdpooling].

- 375K tokens for sale.

- 375K for the initial liquidity that will be locked for the next 30 days after the end of the launchpad.

- ⚠️ They have used 1K to add liquidity in a router of their own [ tx1 | tx2 ]. Clarify with the project the reason for this.

- Their Router is a simple PCS Router fork [ 0x24264b...1c74 ].

- ⚠️⚠️ ~ 150M tokens remain in the dev wallet. Clarify with the project about their destination. There is a risk that they will be used to dump them on you.

- Payout Method: None

- Auto-Liquidity: None

- Governance Privileges: Owner can mint new tokens up to max supply, The owner can grant the Minter role to any user address

⚠️ Triple check the contract you interact matches the one reviewed here (0xE90334...19dd)

Goose fork with capped deposit fees.

Dev address seeded from the same address as Peacedefi (⚠️ site down), Blackhole Defi (⚠️ site down), Slotmachine defi (⚠️ site down), Lucky Cat Defi (⚠️ site down). Code matches these sites too.

- ⚠️ Dev owns 50% of all circulating BANKSY and can dump at any time

- ⚠️ Does not support deflationary/transfer-tax token pools, just clarify with project that none will be added

- ✅ Max 4% deposit fees

- ✅ Masterchef behind a 12 hr timelock

- Dev address can be set to the zero address, which would block regular withdrawals and harvests

- 1/10th of emission rewards minted to dev address

⚠️ TRIPLE CHECK the contract you interact with matches the one reviewed here (0xdaF61cDD...1933)

According to their docs:

The website was taken down on Friday 7th of January due to a vulnerability that was discovered. Right now, bots continue to farm and collect $SFF tokens by interacting directly with the smart contract on the Blockchain.

Kindly check their socials before investing and make sure to DYOR.

Description

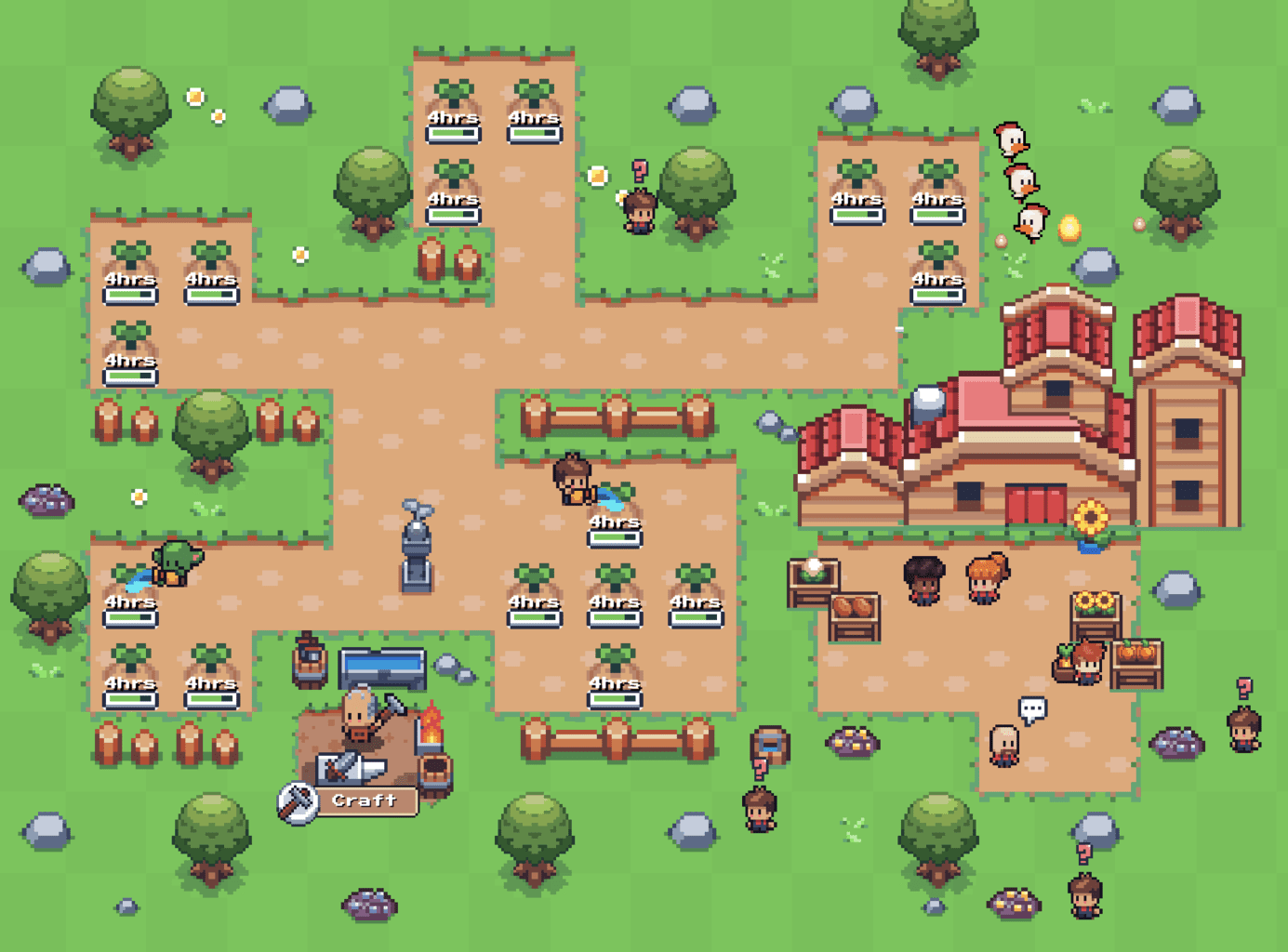

Sunflower Farmers Token was a utility token to craft in game items and grow your farm. Farms started with 3 sunflowers which could be used organically to gain in-game tokens and upgrade to more valuable crops. No purchase of $SFF was ever needed to play the game.

Max Mintable / Minted (%)

- Minting supply varies: Crafting Guide

Mint Price

- Each NFTs in the game varies in costs and can be found in their docs.

Contract

- ⚠️ Most ERC20 and ERC721 contracts used in the game are unverified.

- ⚠️ Token minter role is currently assigned to an unverified contract. Due to an unknown variable, there could be a risk where the minter role is passed to an EOA or functions to mint and dump.

Community Hypestatus

- 124 Followers @ Twitter

- 57.8k Members @ Discord

Reward Features

- Tokens are used to buy seeds, craft equipment, and mint NFTs in order to grow your farm.

- Whenever tokens are spent, rewards accumulate into the reward pool where users are able to claim every 3 days.

Contract is behind a proxy. A proxy contract is high risk as the contract can be upgraded and code can be swapped to include any new code including malicious code. Team claimed that the proxy is necessary given the complexity of their protocol which comprises 15 interacting contracts and they are concerned about the ability to patch bugs without a proxy.

This is a complex protocol that has been in development since May 2020 when they did their pre-sale for 400BNB. Clam Island is an immersive 3D game/yield farm with token and NFT elements.

The earning structure for Clam Island is fairly complex. There are two native tokens: GEM and SHELL. GEM is what you generally earn farming. SHELL is a governance token which you can earn by burning CLAM NFTs. You can use GEM, the in-game farmable inflation token, to get CLAM, a NFT that generates for you and can be used to cultivate PEARL, another individual NFT, which can be used to boost rewards by burning the PEARL. You can also go to the shop and use GEM to buy CLAM (burns the GEM) and harvest them for SHELL. You can also farm CLAM to get PEARL. Each CLAM has a limited lifespan and after it makes x amount of PEARLs it cant be used for PEARL or SHELL anymore. You also get rarer PEARLs if your CLAM is older, and you can harvest for more SHELL. There is a 7 day GEM harvest lock up which locks up 50% of your earned GEM.

Team is doxxed by Tachyon, the accelerator arm of ConsenSys. There is a YouTube video from their official channel where the team present Clam Island and the team members are identified by name and photo. ConsenSys mesh is committing to their seed round together with Protocol Labs.

🚨🚨🚨 Contract UNVERIFIED and site not working. It could contain ANYTHING. It is recommended that you exercise EXTREME CAUTION if you wish to intereact with this project. To be safe, you should withdraw your funds immediately, and ask for their contracts to be verified. 🚨🚨🚨

No emergency withdraw. Unstaking fee can be 100% possible. They have the ability to set the withdrawal fee to 100% and nothing you can do about it.

Popular Links

For Farm Owners

Disclaimer: This is done with our best knowledge and effort, nothing can be known for certain – always DYOR and risk management. This is NOT financial advice. Use the information presented here to inform your own decisions. Referral links may be included on any outbound link.