What are P2E NFT Games?

Play-to-earn (P2E) blockchain games are all the rage these days.

Already a multi-million dollar industry, these games incentivize users by offering real-world, crypto-based financial rewards for playing. These rewards can take the form of both native tokens and non-fungible tokens (NFTs) that players can then sell over the blockchain.

While dozens of games are now available, two, in particular, stand out in terms of popularity and money-making potential: CryptoBlades and Axie Infinity.

But which one’s better? Let’s dive into the nitty-gritty of both and find out.

CryptoBlades & Axie Infinity: A Brief Overview

| Game | Blockchain | Users (last 30 days) | Trading volume (last 30 days) | NFT marketplace trading volume (last 30 days) | Native token(s) | Estimated startup costs |

| CryptoBlades | Binance Smart Chain | 558.09k | $91.52 million | $25.71k | SKILL | Roughly $114 |

| Axie Infinity | Ronin (Ethereum sidechain) | 242.88k | $690.97 million | $690.97 million | SLP, AXS | Roughly $1,050 |

CryptoBlades

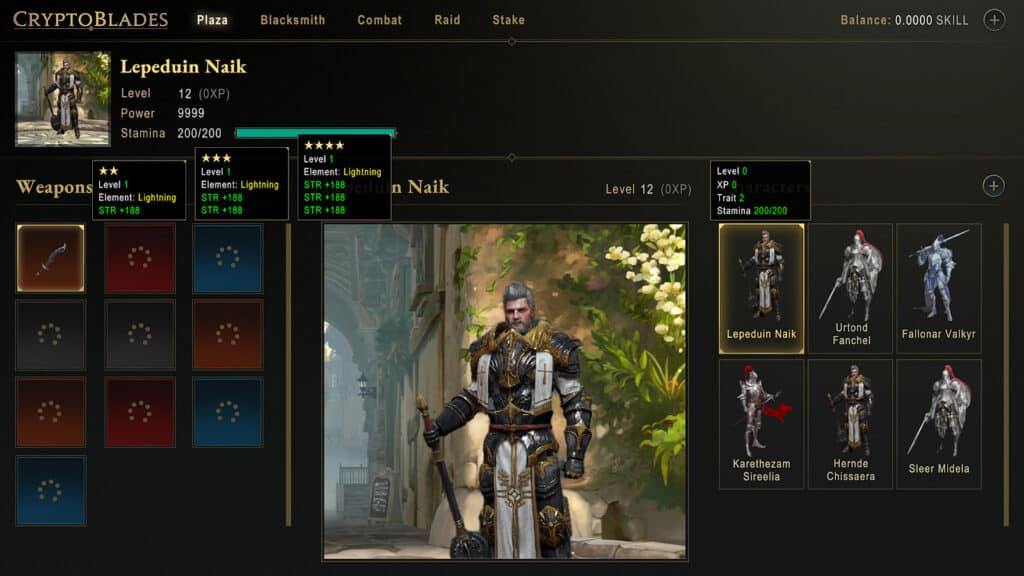

If you like Skyrim, World of Warcraft, and the like, CryptoBlades will be right up your alley.

Built on the Binance Smart Chain, this fantasy RPG revolves around its native governance token, SKILL, which you’ll need to buy to recruit your first characters and forge your first weapons. From there on out, you can earn more SKILL by battling enemies, selling NFTs, forging and reforging weapons, and staking. Both characters and weapons are NFTs that can be traded on CryptoBlades’ proprietary marketplace–the biggest NFT marketplace in blockchain based on the number of users.

As of this writing, CryptoBlades is the #2 blockchain dApp by number of users over the past month and has also dished out the most rewards of any blockchain game (over $1.2 million, according to their official website).

Axie Infinity

While CryptoBlades pays homage to fantasy RPGs, Axie Infinity clearly takes inspiration from Pokemon.

In this Ethereum-based dApp, you collect little critters called “Axies”. By completing adventures, battling opponents, and acquiring land, you can earn Smooth Love Potion (SLP) and Axie Infinity Shards (AXS), the game’s two native tokens.

Both are required to breed Axies, a mechanism built on a complicated genetic algorithm. The rarer and more powerful your Axies, the more they can fetch on the Axie Infinity NFT marketplace.

As one of the most popular blockchain games on the market, Axie Infinity’s bustling ecosystem and high trading/breeding fees have made it by far and away from the most profitable protocol in the entire blockchain space. From the period of July 2nd to August 1st, Axie Infinity raked in $194.3 million in revenue; for comparison, the second highest earner, PancakeSwap, only pulled in $12.2 million in the same time frame.

CryptoBlades vs Axie Infinity: Head to Head Comparison

From purely a gameplay perspective, it’s hard to judge which of these blockchain games is “better” than the other. Different strokes for different folks and all that.

What we can judge, however, is each one’s potential for earning. Let’s look at some factors that might affect that.

Startup Costs

Blockchain NFT games may be play-to-earn, but you have to pay-to-play first! What are the startup costs like for both of these games?

CryptoBlades

Because SKILL is a volatile asset, the starting costs for CryptoBlades are constantly fluctuating. As of this writing, the cost to recruit your first character is 0.3677 SKILL, or roughly $21.70, while the cost to forge your first weapon is 0.1132 SKILL, or roughly $6.68. It’s recommended that you have a team of 4 to start playing, so you’re looking at a minimum investment of around $114.

Axie Infinity

To begin playing Axie Infinity, you need to invest in a starter team of 3 Axies. As of this writing, the cheapest Axies go for around $350, meaning you’re looking at a minimum investment of around $1,050. Luckily, the devs have introduced a “scholarship” program that allows established users, or “managers”, to lend out their extra Axies to borrowers for a cut of the borrower’s earnings.

Verdict

Axie Infinity is really expensive to start playing. If you’re limited in startup capital, CryptoBlades is the way to go.

Time Until Profitability

As with any game, you’re gonna suck when you start out. In the P2E NFT game world, that means you’re not gonna be earning anything at the beginning. So how long does it take to recoup your investment and start making money?

CryptoBlades

As a beginner, the amount of SKILL you earn per winning battle is so low that you’ll actually be losing money on gas fees. The time it takes to reach the levels where you start making a profit varies depending on how much you play, but it can be reduced if you invest a larger initial amount on higher-grade weapons and stronger characters.

Once you reach those profitable levels, CryptoBlades has created a handy calculator (pictured below) to help you see how much you can make given your character and weapon parameters.

Axie Infinity

As with CryptoBlades, spending more money on a better starting team will drastically reduce the time it takes to recoup your investment and start making a profit. Here’s a handy guide on picking out a synergistic starting team.

Verdict

Both games require patience and diligence to see a return on investment. And with Cryptoblades’s hard time keeping the SKILL token anti-deflationary, it might take a while to earn back your profits.

Potential NFT value

Aside from earning native tokens, a major way of making money in blockchain games is to mint rare NFTs. In both CryptoBlades and Axie Infinity, doing so costs money, with the value of the NFT ultimately determined by pure chance. In essence, it’s gambling. But if you want to take your chances, let’s take a look at how much rare NFTs go for in each game.

CryptoBlades

The most expensive 5 star weapon currently listed on the CryptoBlades marketplace, as of this writing, is going for 2199.99 SKILL, or roughly $130,000. The game states that there is a 1% chance of minting a 5 star weapon, but not all 5 star weapons are created equal. In fact, the vast majority of 5 star weapons sell for much, much less than the most expensive one.

Axie Infinity

On Feb 28, 2021, a piece of land on Axie Infinity sold for $1.5 million–currently the 7th most expensive NFT of all time. Meanwhile, the most expensive Axie sold to date went for $131,970 on Nov 7, 2020.

Verdict

While minting rare NFTs in both games comes down to mostly luck, Axie Infinity NFTs fetch a much higher price. However, it also costs a lot more to breed valuable Axies, so we’ll call this one even.

Future Features & Implementations

Blockchain games are still in their infancy. As such, new features and implementations are in development as we speak. What can we look forward to in both of these games?

CryptoBlades

The CryptoBlades devs are currently working on CryptoBlades Kingdom, an expansion of the current game featuring a host of new features. These include land, guilds, raids and player vs player (PvP).

Axie Infinity

The Axie Infinity devs are working on improving land gameplay, PvP, an AXS governance system, Axie progressions (leveling and achievements), and a mobile app.

Verdict

Both dev teams are hard at work improving their games, boding well for wider market penetration and the future value of their native tokens.

Conclusion

Both CryptoBlades and Axie Infinity are at the forefront of the rapidly developing world of P2E NFT blockchain games.

And while we pitted them against each other here, Axie Infinity sticks out as the overall winner in terms of game development roadmap, potential profit, and future potential.

Also, the decision mainly comes down to two things: your gaming preferences and your available startup capital.

Once you’ve figured those things out, make sure to keep in mind that P2E NFT games (and crypto more broadly) are still inherently risky investments. CryptoBlades and Axie Infinity may be the most popular and reputable apps in a nascent, unregulated industry… but it’s still a nascent, unregulated industry! Only invest what you can afford to lose–then go have some fun!