The biggest difference that comes up when doing a BlockFi vs. Celsius comparison is that the former adopts a monthly payment model while the latter pays out every week.

However, that’s not all there is to the BlockFi vs. Celsius debate. The two saving accounts yield high annual interest rates because of the long-term investment schedules. Your money in these accounts is loaned out against collateral, making these investments fairly safe.

In this article, we will consider BlockFi and Celsius, two leading crypto lending platforms from different angles to help you understand which one is the “hotter” investment.

A Quick Overview

| Feature | BlockFi | Celsius |

| Special Offers* | Up To $250 Bonus in BTC | Flat $40 BTC Sign Up Bonus |

| Currencies Supported | BitcoinEthereumLitecoinChainlinkPAX/PAX GoldUSDC/BUSD/GUSDBATDAIUNI | Bitcoin/Bitcoin SV/Bitcoin Cash Ethereum/Ethereum Classic USDC/BUSD/USDT Gemini Dollar Paxos Standard/PAC Gold LINK BAT COMP UMA SNX AAVE Litecoin Mana Uniswap Polygon Livepeer Kyber Network EOS TrueCAD TrueHKD TrueAUD TrueGBP TrueUSD 0x DAI OMG Network Stellar Ripple Dash |

| Countries Supported | Worldwide (except sanctioned/watch listed countries) | 100-120 countries |

| Fiat Support | USD Only | ARS AUD BGN BRL CAD CHF CLP COP CZK DKK EUR GPB HKD HRK HUF IDR INR ISK JPY KES MYR NOK NZD PEN PHP PLN RON RUB SEK TRY TWD USD VND ZAR |

| Transaction Fee | No | No |

| Transaction Spread* | 0.75% – 1.55% | 1% |

| Interest Rate* (Earnings) | Up to 7.5% | Up to 18% |

| Interest Rate (BTC)* | 0.25% – 4.0% | 3.51 – 6.20% |

| Interest Rate (ETH)* | 0.25% – 4% | 5.05 – 6.35% |

| Interest Rate (LTC)* | 2% – 4.5% | 4.08 – 5.33% |

| Interest Rate (USDT)* | 5% – 7.5% | 13.19% |

| Interest Rate (USDC)* | 5% – 7.5% | 10 – 13.19% |

| Mobile App | Yes | Yes |

| Web Interface | Yes | Yes |

| Transfer Fee (ACH) | None | 0.1% |

| Transfer Fee (Wire Transfer) | None | 0.5% |

| Loan Fee | 2% | None |

| Credit Card Fee | N/A | 3.5% or $10 or £2.99 |

| Insurance | FDIC Insured on Cash (upto to $250,000), Digital Assets, or Cryptocurrencies | Un-lent crypto only |

| Trading Cap (Single Transaction) * | $1.2 million | None |

| Withdrawal Limitations* | 7-day limit. 100 BTC5,000 ETH10,000 LTC $5,000 Direct Bank Withdrawal | $1 minimum to $600,000 USD per day |

| *As of August 2021. |

What Are Crypto Lending Platforms?

You will find several crypto lending platforms out there, but they can all be divided into two main categories; centralized and decentralized. Celsius and BlockFi are centralized lending platforms. Although cryptocurrency holders tend to shy from the word “centralized”, here centralized platforms mean better returns, and are therefore preferred.

Having said that, decentralized lending platforms have their set of pros as well.

Think of centralized crypto lending platforms as Home Depot; they act as middlemen between lenders as borrowers. As someone saving their crypto with these platforms, you store your hammers and tools with Home Depot, and it lends it out to borrowers to help you earn interest.

It’s just like what banks do, but with crypto. You supply your currency to the bank and start earning interest almost immediately, except that that “crypto banks” yield a much better return than traditional banks. As you can see above, the interest you earn can even be in double figures (with the right currency, of course 😉).

The two best centralized ‘banks’ are BlockFi and Celsius. Both have a somewhat similar business structure. They are both dragons that hoard your money in a cave (in a manner of speaking) and give you golden eggs in return. Except, instead of slaying the dragon to get your riches, all you have to do is ask.

You can except both of them to provide;

- Crypto-backed and collateralized loans

- High-yield interest rates

- Crypto exchange services (to an extent)

- Services to allow you to use crypto as cash

Let’s take a closer look at the two platforms.

What is Celsius?

Founded in 2017 by Alex Mashinsky, Nuke Goldstein, and S. Daniel Leon, the goal of this platform was to allow crypto to be used more like fiat and allow people to save via high-interest incentivization.

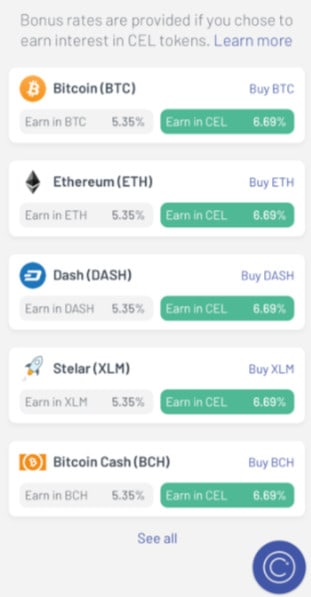

Within the year, they issued their coin, the CEL Token, which users can use to get an even higher interest rate and loan products.

Celsius is headquartered in London. In a recent interview, Alex Mashinsky explained how Celsius is a ‘revolution’; a video that has inspired a large number of individuals to jump on the platform.

What is BlockFi

Also founded in 2017, BlockFi had a similar goal but was more cost-effective right from the beginning. If we look at the history of BlockFi and Celsius together, Celsius could be considered as an “extrovert” platform while BlockFi would be its introverted twin.

That is not to say that the services are lacking, just that its banking services aren’t as widespread nor are they marketed so rigorously.

It was founded by Zac Prince and Flori Marquez, CEO and SVP Operations respectively. In a recent short interview, Flori Marquez impressed upon the fact that BlockFi is doing everything it can to “make it easier for users to earn crypto”, and as far as we can tell, BlockFi actually manages to do that, and then some!

BlockFi is headquartered in New York but serves clients across the world. Having said that, the number of currencies it accepts is much less than that of Celsius.

How It Works – Earning a Passive Income from BlockFi & Celsius

A discontinued network that you might have heard of a few years ago, Bitconnect, promised users a very high rate of interest. It offered a structure similar to arbitrage bots but ended up being a scheme to acquire new user deposits. Of course, they got caught and now they have the SEC all over them.

Celsius and BlockFi adopt a different approach, lending out the money you and I invest to other institutions and companies. To make sure that the investment remains sound and viable, the two ask for some sort of collateral that covers the loan amount and discounted interest.

This is exactly what traditional banks do, except that they have a large number of lenders compared to these “crypto banks”. The most common institutions or businesses they lend out crypto to are crypto exchanges.

BlockFi and Celsius are aggregating your crypto deposits and lends them out, who then repay the loan over time with interest. This interest gets divided into all the people who had stored their crypto on the platforms. This is known as rehypothecation.

It is important to note at this point that while traditional banks do tend to have a large number of individuals demanding fiat-based loans, exchanges need A LOT more liquidity and therefore need a much bigger loan volume. This, in turn, translates to increased risk for the two, which means more interest rates, which means better yields for you.

As the number of exchanges increases, the demand for crypto loans will further increase, sparking competition and can potentially increase the rates of return significantly in the upcoming years, benefiting you in the end.

BlockFi vs. Celsius: How Much Can You Earn?

The table in the overview section above shows the difference between the interest rates of BlockFi and Celsius. Of course, Celsius allows you to earn on a much wider range of currencies, including 12 Stablecoins.

For those of you who aren’t as well versed with crypto, you can get a good rate of return from these platforms, such that it could potentially eliminate the need for Stablecoin yield farming (please do your diligence first). Other than using your dollars or pounds, you can also buy gold tokens and potentially earn commodities in return.

On the other hand, BlockFi has a much smaller range of stable coins at play, just one gold token (PAXG), and six cryptocurrencies. The more diverse your portfolio is, the better off you’d be with Celsius. Just be ready for relatively higher fees from time to time.

Why would you want to save specifically on BlockFi, then? Lower fees, lower spread, easy accessibility.

Interest Rates

The higher rates on Celsius are lower for US users, though, compared to the rest of the world. You’ll be able to pick an interest rate of 8.88% against your savings in the US, considering the same stood at 5.8% for UK residents.

CEL, however, gets an interest rate of a whopping 11.5% throughout the globe, regardless of the Stablecoin used (except a few).

BlockFi interest rates work in tiers, though. The higher your investment amount, the lower your interest rate will be, which is a bit of a turnoff for large-scale investors/savers. BlockFi is extremely friendly towards DAI, though. As of the time of writing, BlockFi offers 8.6% interest on DAI savings/investments.

Then there’s BTC. BlockFi offers a 4.1% interest on the 0.25 BTC and 1.5% on subsequent BTC until 5 BTC. After that, you get just 0.25% if you go above the 5 BTC threshold. Celsius, on the other hand, offers 6.2% interest up to 1 BTC.

You get a benefit of at least 0.42% upon investing LTC on BlockFi, though, up to 100 LTC. The interest rate on Celsius is less than 4.08%, while on BlockFi you earn interest at 4.5%. Other than this, you’ll find higher yields on Celsius. Currently, cryptos like SNX can help you earn interest at a whopping 17.9%!

This shows that if you are looking to earn and have a diverse or large enough portfolio, you should consider Celsius rather than BlockFi. However, the interest figure alone isn’t all there is to making your decision. It would be like heading over to McDonald’s because their burgers are cheaper instead of Wendy’s or Burger King, ignoring the taste and the value for money you get (sorry, if you’re McDonald’s fan).

Withdrawals and Other Fees

As mentioned right at the beginning, on BlockFi the interest is paid every month while Celsius pays weekly. However, you always have the option of withdrawing your funds at any time and there is no time lock to worry about. It is important to note, though, that the longer you wait, the more you will earn.

Celsius doesn’t charge you AT ALL for withdrawal, while with BlockFi there is just one free withdrawal per month. The detailed fee schedule for BlockFi as at the time of wiring can be seen below:

| Currency | Limit | Fees |

| BTC | 100 BTC per week | 0.00075 BTC |

| ETH | 5,000 ETH per week | 0.02 ETH |

| LINK | 65,000 LINK per week | 0.95 LINK |

| LTC | 10,000 LTC per week | 0.0025 LTC |

| Stablecoins | $1 million per week | $10 |

| PAXG | 500 PAXG per week | 0.015 PAXG |

| UNI | 5,500 UNI per week | 1 UNI |

| BAT | 2 Million BAT per week | 35 BAT |

BlockFi vs. Celsius: Ease of Use

The platforms are very similar in terms of their function and usage.

Depositing and withdrawing crypto, using the exchange, converting currency, or applying for a loan is easier than ever on the platforms.

How to Use Celsius

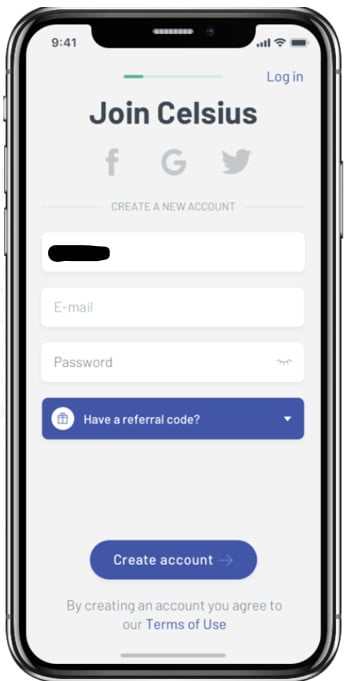

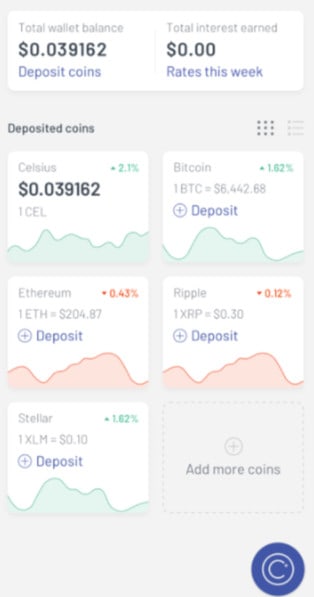

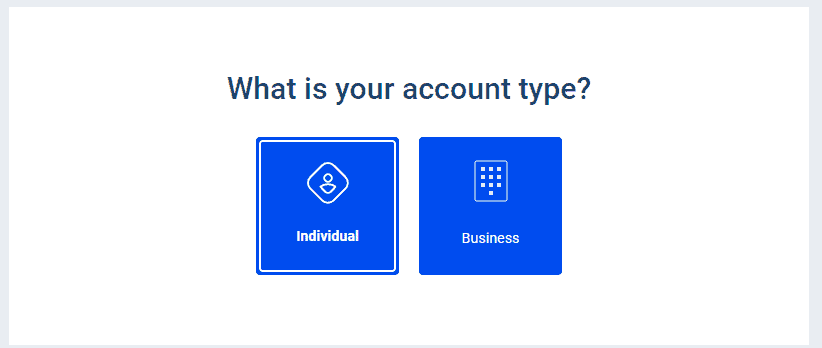

You will need to sign up on the application to start saving crypto on Celsius. It is, quite literally, as easy as signing up on social media. You will simply need to download the app, create an account, verify your identity (which is as easy as taking a photo), and make a deposit. Within a week, you will start earning interest.

Let’s begin.

Head on over to the Play Store and search for Celsius. Alternatively, you can also follow this Play Store link. For iPhones, follow this AppStore link.

I’m not signed in here so it isn’t showing me the download option. You should be able to see it if you click on the link on your phone. Open the app once the download is complete. Click on the Join Celsius button if you don’t have an account.

Enter the necessary information

If you have a referral code, simply enter your information, hit ‘create account’ and the app should ask you about the referral code. Enter it and you will jump directly to the verification page.

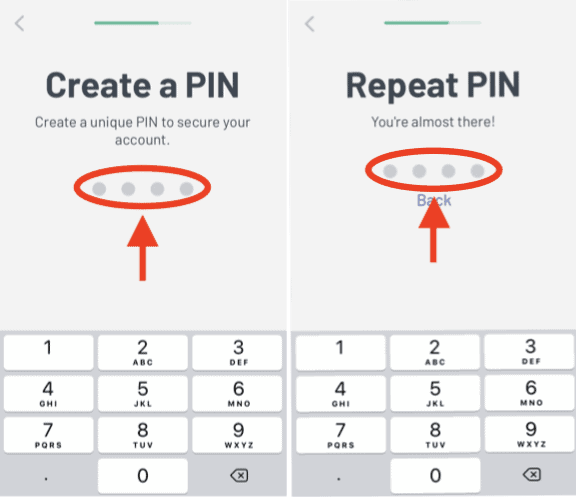

You will then get a screen asking you for a PIN. It should be just four digits and try to make it complicated. It may be the last line of defense towards protecting your account.

It should take a few seconds to process, after which you will have successfully created your account.

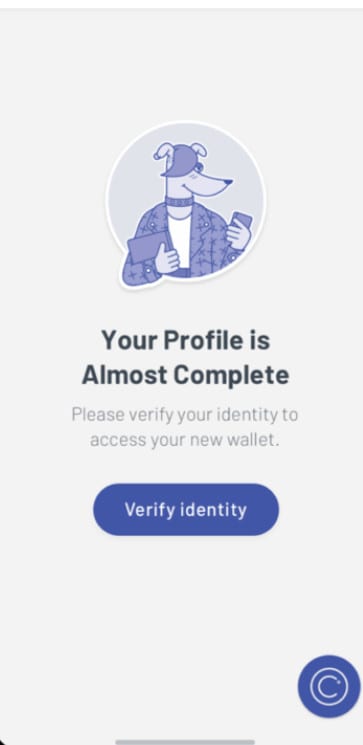

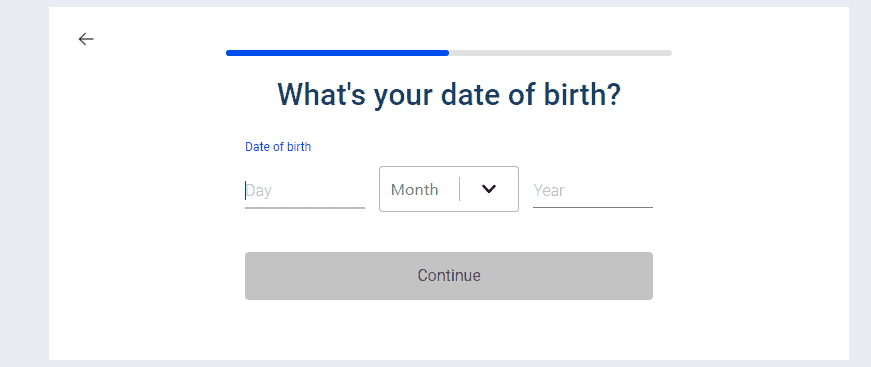

However, you aren’t free to do with it as you will. You still have to verify your identity. You will need to provide your:

- Full Name

- Date of Birth

- Social Security/National Identity Number

- Residential Address

You DON’T need a tax ID.

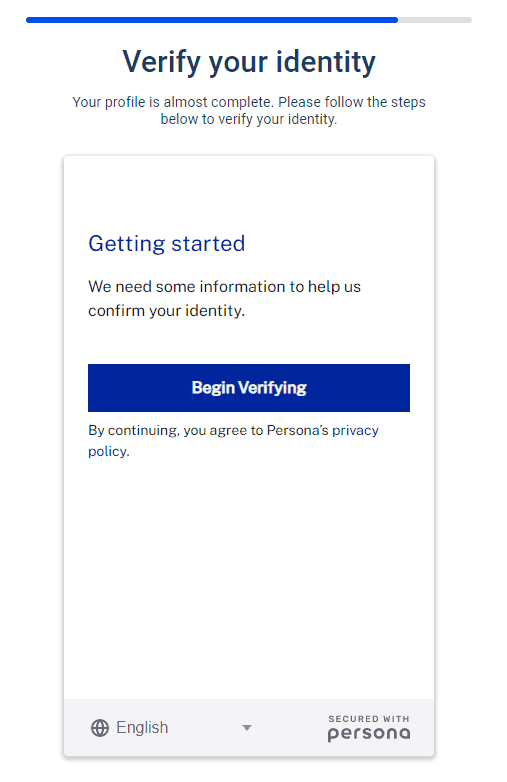

Simply click on the “Deposit” or “Deposit Coins” button on the dashboard and you will get a prompt to verify.

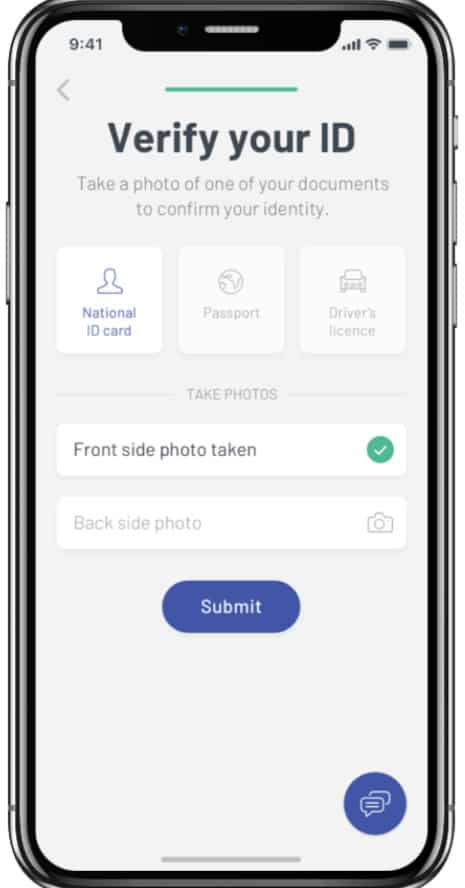

Upload a photo of your NIC, passport, or driver’s license from the front and back and hit Upload. You should see a screen telling you that the verification process has begun.

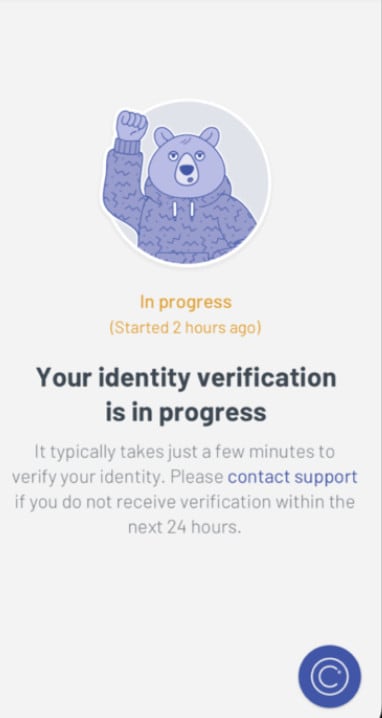

And you’re done! The verification process usually takes about 3-4 hours, but it doesn’t take longer than 24 hours. If you are having trouble with the process, you can simply email their support representatives at [email protected].

You will get a notification when your verification process is completed. Open the application, head on over to the dashboard, and start adding coins. Click on the outlined square that says “Add more coins.”

Upon clicking, you should see a screen asking which currency you want to buy.

Connect your wallet or your bank account with the application and you’re ready to put your crypto to work! Every Monday, you will get a notification telling you about your latest earnings.

How to Use BlockFi

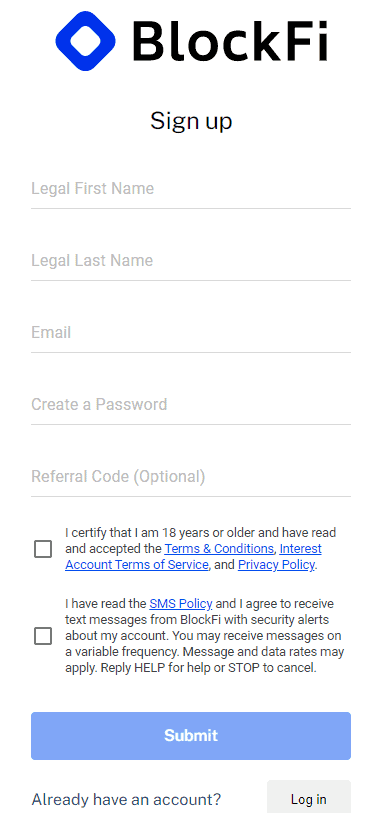

Setting your account up on BlockFi is easier than Celsius. Start by clicking on the Get Started button on the top right.

- Your first and last name

- Email address for notifications and verification

- A strong password.

Your password must contain:

- At least 8 characters

- Contain at least 3 of the following:

- Lower case letters (a-z)

- Upper case letters (A-Z)

- Numbers (0-9)

- Special characters (ex. !@#)

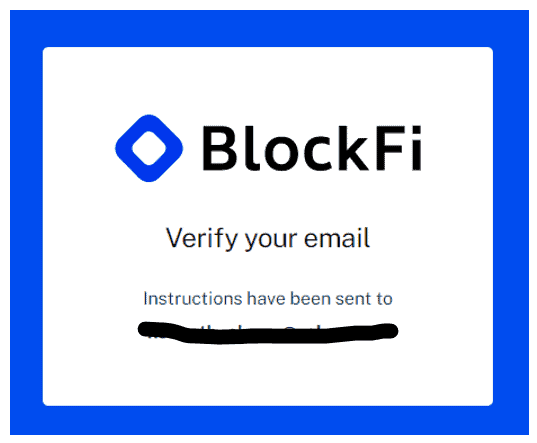

Again, if you have a referral code, this is the time to enter it. Click on submit and there will be a captcha. Complete it and then you will need to verify your email.

You will have just 5 days to verify your identity, after which you will need to submit your information again. Do this again and again, and you’ll get your email address banned in no time.

Click on the link within the email, and your account will be verified. Click on the log in, enter your details, and follow the on-screen directions.

You will need to provide your street address, phone number, date of birth, source of funds, and finally, verification of identity.

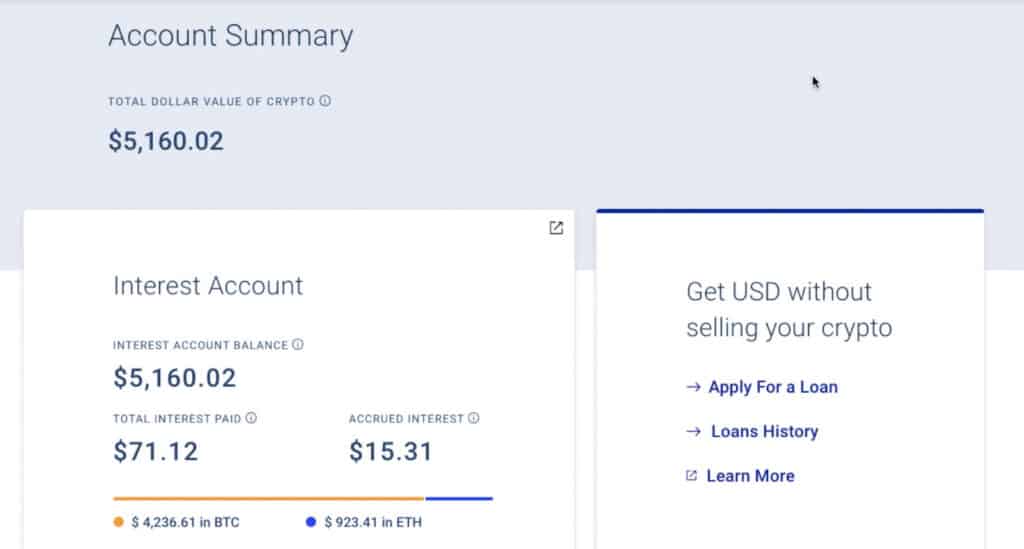

Once done, you will be greeted with your dashboard. Your dashboard should look something like this after you have added your coins.

From the dashboard, you can deposit, withdraw, trade, or borrow funds with just a click. You also have the option of referring a friend, which will give you a referral bonus.

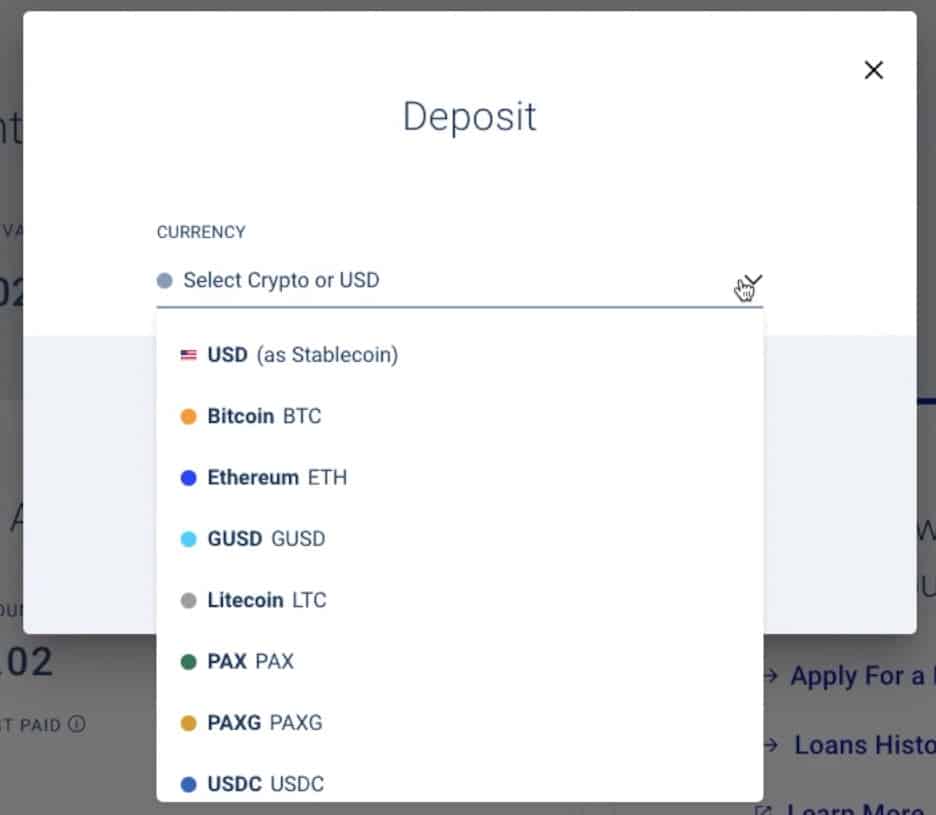

Clicking on either button should open a pop-up for you to navigate through.

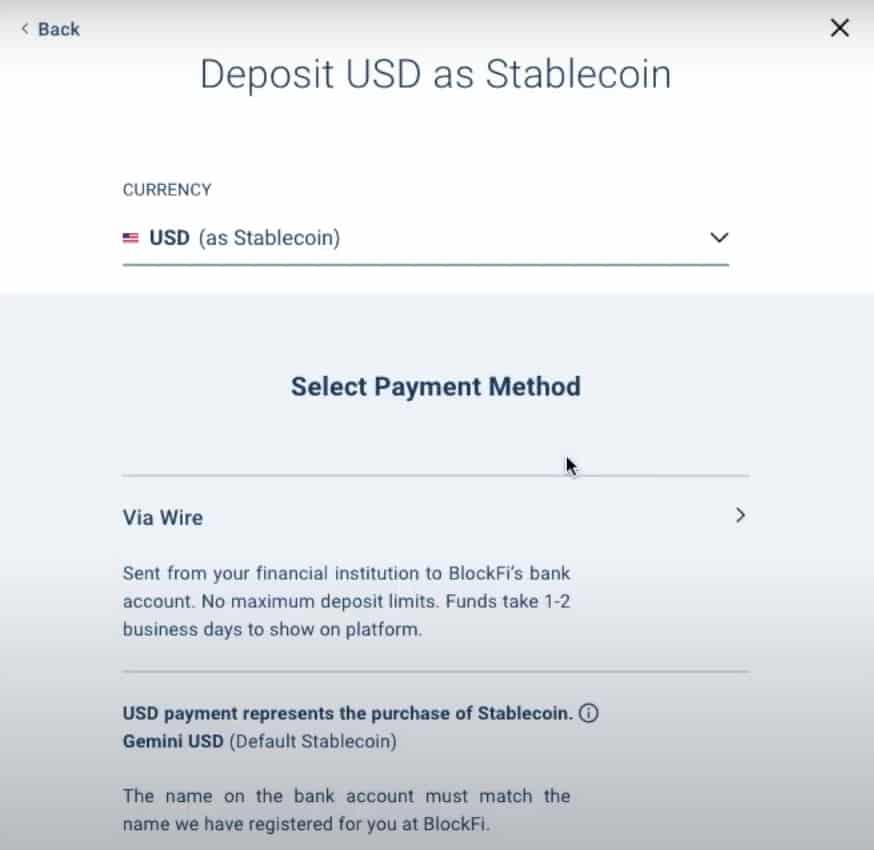

Let’s say you chose USDT (USD as Stablecoin).

Simply follow the on-screen instructions, buy crypto, and get ready for monthly profits! That’s all there is to earning on BlockFi.

BlockFi Vs. Celsius: Pros & Cons

And finally, we analyze the pros and cons boasted by both platforms. Both have a strong reputation in terms of public perception and security, however, BlockFi has had its fair share of ups and downs. For example, the mistakenly issues bitcoins in the past and how it had to offer a reward to those who’d return it.

Finding the right one would depend on the size of your portfolio (a larger portfolio would benefit from Celsius more), where you’re located (Celsius is better outside the U.S.) fee structure, and the unique features you need (BlockFi’s’s Bitcoin Card, for example). Here are the main pros and cons for you to consider.

Celsius

| Pros | Cons |

| Higher interest rates in most cases | Higher rates not available within the US |

| Lower interest rates on loans | CEL, the main Celsius token, is not available in the US |

| No withdrawal charges | Can be a bit riskier with native token |

| No minimum deposit amount | Customer support is a bit slow |

| No maximum deposit amount | Address lock after update/HODL deactivation |

| A large number of supported currencies | |

| A large number of supported coins |

We recommend Celsius to people who live outside the US or have a large portfolio.

BlockFi

| Pros | Cons |

| Better interest rates for several coins | Higher interest rates on loans |

| Suitable for people in the US | Loan origination fee |

| Gemini backing up your money | Non-transparent spread |

| Compatible with non-native coins as well | Limited currencies |

| Credit card with BTC reward opportunities | Slow withdrawal fees |

| Quick support |

We recommend BlockFi to all those in the US or those who don’t want to spend hours trying to understand the intricacies of crypto and just want to earn.

Case Study – The Time BlockFi Made a Mistake

On May 17th, 2021, BlockFi accidentally disbursed ‘a couple of bitcoins’ to its users as a bonus. This payment was dubbed as an ‘inaccurate bonus payment’ and a tweet by Zac, the owner, suggested that the issue would be corrected shortly. However, blockchain requires both the sender and the receiver to approve the payment, which means that, unlike fiat, the payment couldn’t be reversed as easily.

The firm’s exposure was an estimated $10 million, which isn’t enough to bankrupt it but is surely more than a rounding error for them. The firm immediately announced a bonus payment for people who returned the bitcoin credited, but a handful of recipients had immediately withdrawn the coins (less than 100 users).

Different users received different amounts, with one a screenshot showing a deposit of a whopping 701 Bitcoin instead of $701. The affected users received an email from BlockFi, requesting the money to be returned. This happens to banks all the time, but the problem got magnified because of the volatility of assets.

The issue didn’t impact the users this time, but there is still a risk of such mistakes because of the centralized nature of the lending platform. After all, these “saving accounts” are also accounts for lending, in essence. Whose liquidity do you think was dispersed as Bitcoin with this error?

Case Study – The CRED Bankruptcy

CRED used a model very similar to what Celsius offers, a global financial services platform and a licensed lender that offered loans to over 140 different currencies. It also had its cryptocurrency, “CRED earn”. It seems like the company is big enough, right? Enough to avoid bankruptcy in a growing market at least.

Unfortunately, an estimated $140 million investor funds were lost, including the $115 million in CRED earn notes. Although the company promised fully collateralized and guaranteed investments, CRED didn’t vet the third-party lenders properly, ignored all red flags raised during lending processes (apparent fraud risks highlighted by the management team), yet CRED did not attempt to recoup the funds because of consistent rejection of requests by the CEO.

If not managed properly, Celsius may face a similar issue soon and investor funds may therefore be at risk.

BlockFi vs. Celsius: A Competition That Pushes Crypto Further

As BlockFi and Celsius continue to evolve, not only will they be benefiting themselves and users, they also prime themselves to replace fiat, if the need ever arises. The platforms are already making crypto more accessible and when the time comes, if you’re on the platform you will have a much better standing in the new economy.

However, neither platform is risk-free, just like any other investment platform. You shouldn’t save all your crypto on one platform to earn interest, even if the interest rate is compelling. Putting both feet underwater isn’t going to end well for you, should the ground below decide to slip away.

BlockFi and Celsius both have pros and cons, but regardless of where you invest, you will have to deal with some degree of risk. Identify your risk threshold and consider your location, currency, and size of investment before deciding.

If you still need help, get in touch with me on Twitter or Telegram, and let’s discuss your point of view about BlockFi vs Celsius in more detail.

Disclaimer

The information you find on RugDoc.io is for informational purposes only and is provided in good faith. Any action you may take concerning the information you get would be at your own risk. We recommend caution and due diligence before making any financial advice.