Decentralized apps (DApps) make it possible for people to interact with personal finance without third-party involvement.

If you’re new to the cryptocurrency and the blockchain world and are looking to gain an in-depth understanding of DApps, this guide is for you!

What is a DApp?

A DApp is a digital application or program that runs on a decentralized computing system (a blockchain or P2P network). They’re decentralized because no single entity controls them, and dApps are usually controlled by a network of P2P (peer-to-peer) computers.

DApps combine smart contract backend and frontend user interface. The frontend code and user interfaces are written in different languages that can make calls to the backends.

No single authority controls them; users and providers can interact with each other directly. Each DApp has a unique code that may only work on a particular platform. This code replaces the middle man, providing cost and time savings.

Key Features of DApps

Below are the main characteristics of DApps.

· They exist and run on a blockchain network.

· They have an open-source code that operates on its own without any individual or group interfering or controlling the tokens.

· They provide value to users with DApp tokens.

· They offer tokens as a reward to users when they contribute positively to the ecosystem.

How Are DApps Different from Apps?

Here are the main differences between a DApp and a regular app.

· In regular apps, the user interface interacts with a traditional program, whereas in DApp, it communicates with smart contracts.

· The back-end of regular apps is hosted on a single computer or centralized servers. On the contrary, dApps are hosted on multiple systems worldwide via an open-source, peer-to-peer network. DApp data is recorded on a public blockchain.

· Regular apps stop working if the central server fails. For DApps, the failure of a particular network node doesn’t affect the network as a whole.

· DApps have a higher computing power than regular apps. This is why a sudden user influx doesn’t cause any disruptions or performance slowdowns.

· DApps are much more secure than regular apps. The centralized processing units of the latter are at risk of cyber-attacks.

· Unlike regular apps, DApps continue to work normally even when particular network nodes go offline.

So, basically, a DApp can do everything a regular app does. It’s just that its back-end acts as “distributed” and “decentralized”.

DApp Examples

Uniswap, BitTorrent, OMG Network, and Pools.fyi are some examples of decentralized apps. They run on computers that together form a P2P network. On these apps, several users either consume or feed content or do both simultaneously.

A few examples of DApps in the cryptocurrency world are shared below.

TRON DApps

TRON is a decentralized environment that creates and hosts digital content for entertainment purposes. It serves as a global entertainment network that isn’t governed by a central body.

888 TRON is a decentralized casino that strives to be the biggest and most popular gambling platform on the blockchain.

Ethereum DApps

Ethereum was designed to create DApps. Its unique programming language was meant to create smart contracts to power these apps. Although it has some scalability issues and increasing competition, it remains a top choice for DApp development.

Check out some examples of DApps on this blockchain platform below.

Augur

This decentralized platform features event prediction markets.

Golem

Golem provides the infrastructure for creating a global computing power market. Anyone can access this open-source supercomputer.

Minds

Minds is a social media platform designed to enhance value transfer between users and content creators.

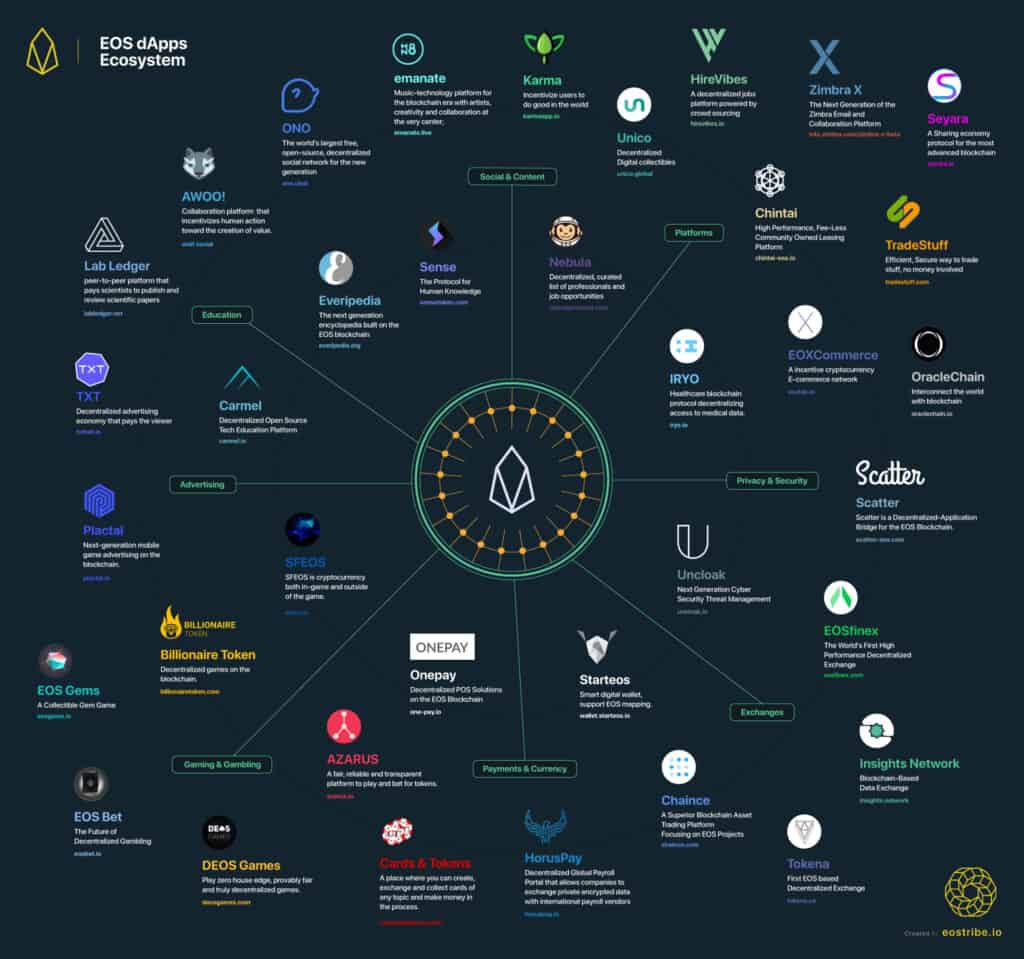

EOS DApps

EOS isn’t really a decentralized platform since it’s controlled by Block.one. It was initially developed on Ethereum, but it later started working independently. Unlike Ethereum, this blockchain offers faster transactions and doesn’t have any transaction fees.

Everipedia moved to the EOS blockchain platform in 2018, becoming the world’s first decentralized encyclopedia. This status offers protection against censorship.

Are DApps Safe?

With a DApp, your data is stored in encrypted form in network nodes. The operation is completely transparent. It is recorded on the public ledger to ensure users’ peace of mind. No data or transaction can be erased once it has been generated.

Users find it easier to trust DApps because they allow them to enjoy full ownership and control of their data and assets.

However, there are some high-risk DApps with the bearing of a Ponzi scheme or a pyramid. They can run for extensive periods without cracks. Hence, you must do your research before investing in any DApp project. A good rule of thumb is to avoid investing more than what you can afford to lose.

Below are a few signs that will help you identify a high-risk DApp.

· It offers a guarantee of big returns with minimal risk.

· It promises a consistent stream of returns regardless of the market conditions.

· It makes false claims of working with renowned wallets and exchanges.

· It claims to be decentralized and transparent when it’s not.

· It promises to offer token rewards whenever a user joins under you.

· You face difficulties when removing tokens on the platform.

Why DApps?

DApps allow data to be decentralized, making it tamper-proof. The top benefits offered by them include:

· Users can make direct cryptocurrency transactions without having to integrate with a payment provider.

· Users can bind their sessions and data easily and enjoy varying degrees of anonymity without completing lengthy registration processes.

· Open-source DApp code is accessible to all useras and can easily be understood by beginners.

· All enclosed data remains inherently secure.

· A public record stays on the blockchain, making it easy for users to audit it.

What is the Best DApp?

Here’s the thing… There are so many dApps out there (and new ones coming out!). But we’ve rounded up the top two DApps that could possibly dominate the future investing world.

1. Uniswap

Launched in 2018, the US-based Uniswap is used for exchanging Ethereum and other digital currency tokens. It also has a pool feature that allows users to deposit tokens in a smart contract for enhanced liquidity and gain pool tokens in return.

Some of the reasons users love Uniswap include self-custody, low trading fees, and a variety of tokens for trading. Another reason that makes Uniswap a preferred option is that it doesn’t require a Know Your Customer process. This means you can set up your account and start trading right away.

This DApp also promises to keep your personal info protected in case the exchange gets hacked.

2. IDEX

IDEX is one of the most advanced cryptocurrency exchanges. It was launched in 2016. It is currently available for Ethereum and Bitcoin blockchains only. Interestingly, it was the first Ethereum-based dApp to allow real-time trading.

This DApp allows users to place multiple orders at any given time instead of waiting for the mining of transactions. On top of this, they can cancel orders without having to pay a gas cost.

Furthermore, IDEX has its own token that enables investors to earn a share of the amount generated by the exchange. Security is also a huge selling point for this DApp.

3. MakerDAO

MakerDAO is an independent platform for lending cryptocurrencies. Its digital currency is called Dai. On this platform, users can borrow and lend using a DApp without any third-party involvement.

Like Uniswap, it doesn’t require users to complete the Know Your Customer process.

One of the biggest reasons users trust this DApp is Dai’s stability as a currency. Its value is connected to the US dollar. This is a huge benefit, considering how wildly Bitcoin’s value tends to fluctuate.

Apart from this, Dai isn’t associated with any particular country. Hence, no banks or governments control lending, borrowing, or overspending on MakerDAO.

This DEX aggregator has an in-house token called ORN. As an investor or trader, you can use these tokens for liquidity mining or staking.

How Does the DApps Future Look Like?

The number of DApps is growing rapidly. The market size is likely to reach $368.25 billion by 2027.

Considering the fact that DApps aren’t owned by anyone, can’t be shut down, and are more secure against cyber-attacks, they may significantly impact the way we work, commute, communicate, and more.

DApps are reducing costs and eliminating third parties from our personal and business financial transactions. They have taken transaction security and automation to the next level.

We can expect DApps to influence the following industries:

· Banking

· Real estate

· Energy

· Gambling

· Internet of Things

· Social media

· Identity verification

· Elections and voting

Furthermore, we may see improvements in the interface design and structure of DApps. This will have a positive impact on the overall user experience. More investors are jumping in to capitalize on the efficiency of these apps.

If you found this article helpful, please feel free to share it with your friends and fellow cryptocurrency enthusiasts.

Also, don’t forget to join our Telegram group to participate in informational discussions and gain valuable insights into DApps.