Out of all the losses you may face as you earn a passive income through your cryptocurrency, nothing beats the painful yet avoidable impermanent loss.

Understanding the concept before you face loss can help you unlock a range of different investment and earning avenues from DeFi.

Impermanent loss is when the price of the assets that you deposited into a liquidity pool, mostly LP tokens, decreases. The loss is impermanent because it doesn’t get realized until you withdraw the funds from your pool. If the difference is still there, said loss becomes permanent.

Let’s take a closer look at the concept to understand it better and to see how you can avoid losing everything you have and get yeeted out of the market.

A Little Background

Liquidity pools, found on almost every decentralized exchange (DEX), have become a popular and lucrative means of earning a passive income. It’s like a magic well in which you throw and others throw your coins, and it keeps giving more coins for you to pocket.

What could go wrong, right? You, a crypto holder, will pour liquidity into a Liquidity Pool by converting your currency into LP tokens (combining two currencies concerning the pool you are looking to invest in). The DEX will loan your liquidity out to others and share a portion of the trading fee with you.

Unfortunately, among a range of other risks and rewards, you get stuck with having to face an impermanent loss.

What is Impermanent Loss?

When you, as a liquidity provider, face a loss because of a change in the value of assets deposited to a liquidity pool, it is known as an impermanent loss. Of course, the more significant the change, the more loss you will have to face.

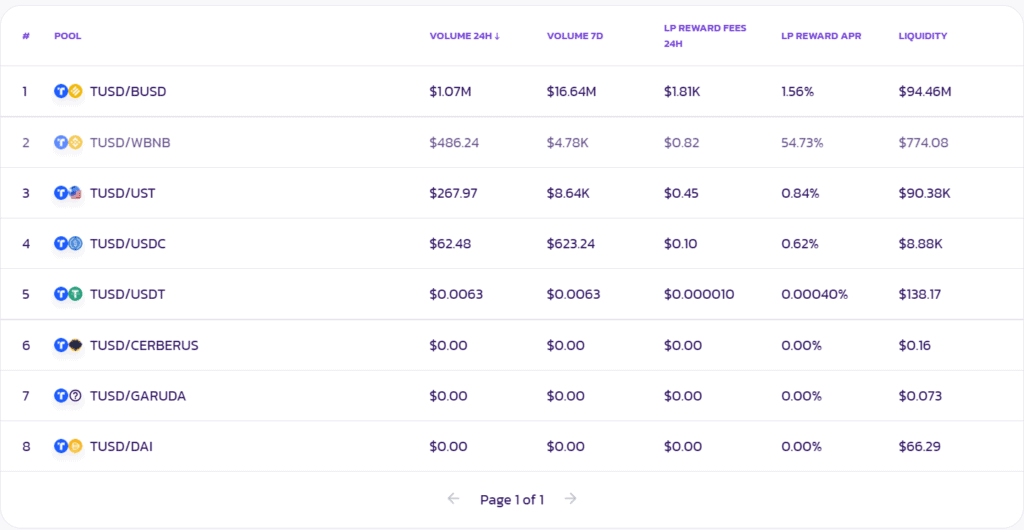

Let’s consider an example. A week ago, you went to the Pools page on PancakeSwap and after considering your options, decided to add liquidity into a TUSD pool. Upon opening the page, you will find that within the said pool, you have the option of combining a wide range of currencies to create a token.

Assuming you went with the TUSD/BUSD as both are Stablecoins and chances of fluctuation are minimal. You used your currency to mint new tokens and staked them into the pool. A few days later, it turns out that because of a fraud or scam, the true value of TUSD came out of being $0.55, not $1.

Immediately, your token’s value will fall down as well, and based on the number of tokens you had, your loss could be $0.55 or hundreds of dollars. You just faced an impermanent loss.

Understanding The Impermanent Nature of This Loss

The loss will be realized only when you withdraw the funds. When doing so, you will find that the proportion in which you invested vs. the proportion in which you receive the asset would be different, and the impermanent loss would become permanent. Of course, there is a chance that before you pull out, TUSD clears up the confusion and returns to $0.99. This isn’t that low from its original price, and considering the trading fees you just earned, you may have been extremely scared but ultimately can achieve breakeven.

However, this is very rare. In most cases, an impermanent loss doesn’t turn into a permanent loss at all, leading to negative returns. When this happens, you will end up with a portion of your trade income from other sources being eaten away, no matter the yield.

Let’s consider an example.

You combined two tokens, A (one) and B (ten), when one token A was priced at $1,000 and token B was priced at $100. By combining, you would get 1 A/B token, with a total value of $2,000. Let’s say that in month two, the price of token B went down 15%, i.e., became $85. In essence, it would mean that your token now has token A valuing $1,000 and ten token B valuing a total of $850.

On paper, the total value then becomes $1,850, giving you an impermanent loss. Until you pull your funds out, the yield you get will be against the new value of Token A/B, but you wouldn’t have suffered a loss yet. The moment you withdraw your investment, the loss becomes permanent.

Understanding the Depths of Impermanent Loss

Now that we’ve got the basics covered, let’s dive deeper into the world of impermanent loss, automated market maker (AMM) pricing, and the role of arbitrageurs play in LP Token price shifts.

Think of AMMs as disconnected, price keepers that automatically apply the market formula in any peer contract exchange, determining the final price of an asset. This means that whenever a token price changes, the AMM doesn’t always have to update itself or make adjustments to keep the market in check (or else, it would destroy the idea of a decentralized system).

AMMs require arbitrageurs to buy or sell the overpriced or underpriced assets until the price offered by AMM matches the external market. Any profit that the arbitrageurs get because of this exchange is deducted from YOUR pocket, i.e., the liquidity provider. The amount has been deducted ‘on paper’, but it hasn’t become a practical loss yet, hence the impermanent loss.

They ask for money, and you have no other option but to oblige. Arbitrageurs get to profit at the expense of liquidity providers.

For reference, here is an estimate of how much loss you can expect from price fluctuations – be it upwards or downwards.

| Price Change | Loss |

| 125% | 0.6% |

| 150% | 2% |

| 175% | 3.8% |

| 200% | 5.7% |

| 300% | 13.4% |

| 400% | 20% |

| 500% | 25.5% |

This shows that the loss percentage rises exponentially at first, but as the price change percentage increases, the loss curve gets shallower.

For Example

Let’s consider the example of Bob, an arbitrageur who has an LP token with a 50/50 ratio of two assets; ETH and BNB. If there is a change in the price of either one of the two, let’s say ETH, it would present an opportunity for arbitrageurs to profit and you, the liquidity provider, to face a loss.

The process would be the following:

- You have an equal amount of ETH and BNB (let’s assume a market value of $100 each). Both sides of your LP token would be balanced.

- Assuming the price of ETH decreases by 25%, it would mean that there are less ETH than BNB now. This would give arbitrageurs a chance to buy the ETH – and that, too, at 25% cheaper (original price).

- They need to sell more BNB to buy the ETH, and the incentive therein is the 25% profit margin. This will continue until both sides of the AMM are at equilibrium. Usually, this is done with the help of arbitrage bots as humans may not be fast enough to recognize, let alone capitalize on this quick price increase.

- Liquidity providers (you) will continue to get a loss as per the ratio of increase. With a 25% increase (total value = 125%), you will most likely face an impermanent loss of 0.6%.

And just like that, by leaving your investment in the pool instead of transferring your amount back into your wallet, you just lost 0.6% on top of the 25% price decrease and arbitrageurs won the 25% on your investment. So, should you not pool your resources in the liquidity pool at all?

Providing Liquidity to Liquidity Pools – To Do or Not To Do?

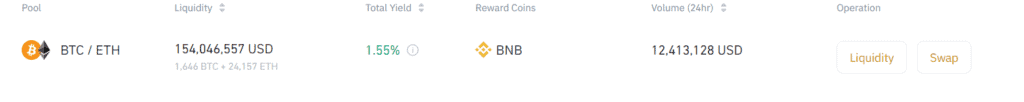

As mentioned above, when you provide liquidity to a decentralized exchange, you will earn a percentage of the trading fee that the exchange earns by using your funds. In many instances, this trading fee that you will receive is higher than price fluctuations. Consider you invested $100/$100 BTC/ETH and earn a total yield of 1.55%, as per Binance at the time of writing.

Remember, the 15% fluctuation mentioned above is a lot and does not constitute regular day-to-day changes.

When you provide liquidity in any pool, you can get native as well as the tokens you already staked. It also depends on the pool you chose. Let’s say you earned the CAKE token, which you can then also convert into syrup and so on. You get to choose what you want to earn.

Combining the trading fees and in-house LP tokens, you as an investor get to earn a profit. Impermanent loss going over the profits isn’t as common and usually results in a profit. Every once in a while, you may find yourself in trouble; however, that can be avoided as well. For example, PancakeSwap makes the bold statement of suggesting that impermanent loss is not a concern with CAKE staking!

Impermanent Loss is not a concern with CAKE staking?

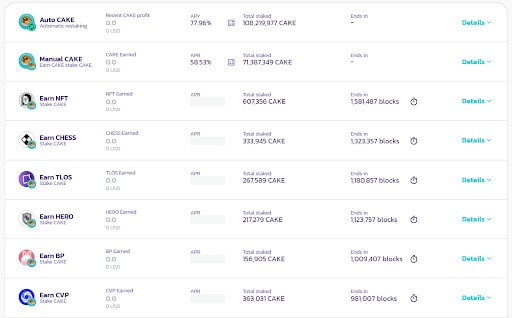

According to PancakeSwap, its native LP token can mitigate the most common and pressing issue that liquidity providers have to face; Impermanent Loss. It suggested that by staking CAKE as an individual asset on any of the eligible Pancake Pools, you will receive your yield daily, with respect to the APY advertised, just like any other platform (not the ‘daily’ part).

It differs when you decide to withdraw your assets. In this case, you will always receive the number and value that you originally staked (other than your earnings) regardless of the price differences between assets.

How Is That Possible?

This is possible because of two pools; Auto and Manual CAKE pool. It is the same pool, except with a different staking mechanism involved. One automatically re-stakes your CAKE LP tokens while the other waits for you to do so. The pool also allows you to stake CAKE as its own in the single-asset pools within. The single token is native to PancakeSwap, and because of the single token, the price fluctuation cannot lead to an increase or decrease in the volume of any other currency.

You should know that you can find similar pools on other exchanges as well.

Remember how we explained a rise in price for ETH resulted in a difference in the number of ETH and BNB in the pool, which, in turn, brings the vultures (I mean arbitrageurs) to feed off of your misfortune.

With CAKE alone, there is no need to maintain equilibrium because there is no disbalance. Regardless of whether the price of CAKE increases or decreases when staked, when it’s time to pull out, you will get the same number of CAKE returned along with earnings. You benefit from upward movement but no downward movement.

This way, investors can earn a passive income with LP tokens without worrying too much about impermanent loss.

Stablecoin LP Tokens – Are They Risky As Well?

Unless something very drastic happens, such as a fraud attempt by the Stablecoin provider or a major breakdown, you most likely won’t have to worry about impermanent loss from their liquidity pools. Some Stablecoin LP tokens include:

- USDC-USDT pair on Uniswap

- DAI/USDC on PancakeSwap

- PAX/USDC

- BUSD/USDT

And more.

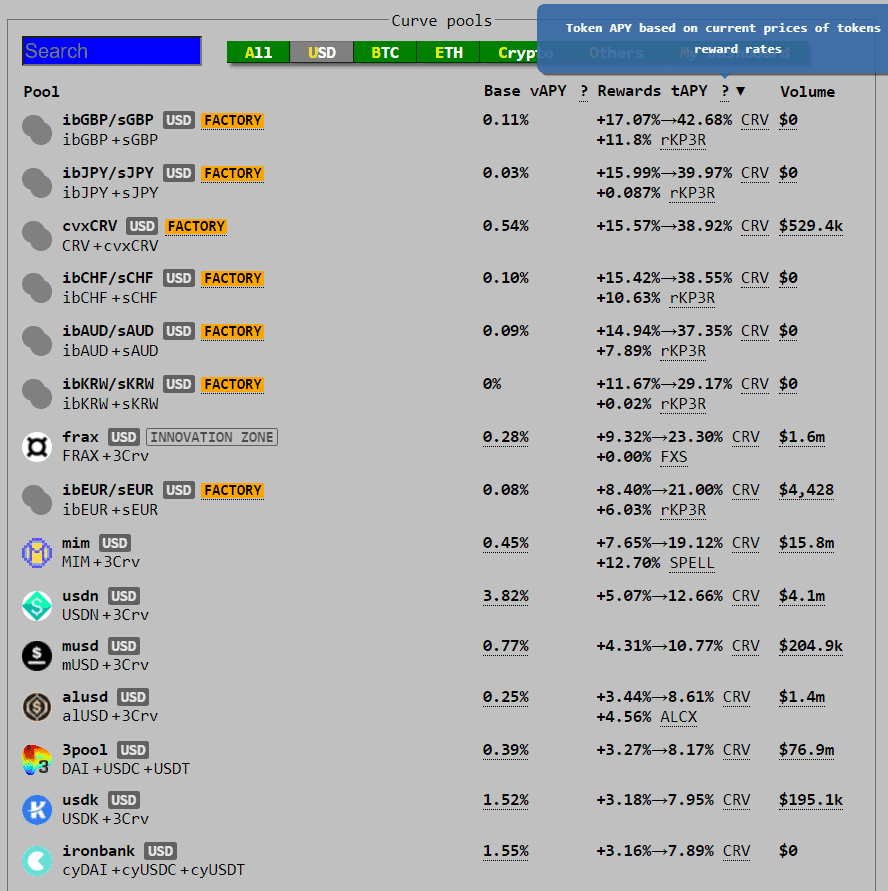

The idea is to match any two Stablecoins and pool them in. However, the investment may not always be worth it in the end. Based on analytics from Uniswap, for example, the USDC and USDT pair work out to give a profit of roughly 3% per annum. However, there are some pools that can go as high as 10%, 20%, and even 40%, as mentioned below.

Be careful when pooling tokens into FACTORY pools on Curve, though. FACTORY pools can be posted by anyone, and there is no vetting for them.

Stable pools are the classic example of adopting a low-risk, low-reward policy with your portfolio, though. You’d avoid getting yeeted by market forces, but don’t expect to buy that yacht anytime soon, either.

The Secret to Staying On The Top of Your Game

Vigilance.

You will have to take risks to earn more and make the most out of your cryptocurrency. The way I see it, you have two options; go safe and slow into Stablecoins, or formulate an extensive strategy and increase your risk threshold.

Consider your options, take an in-depth look at your portfolio and decide whether slow and steady is right for you or fast and aggressive. Both options can help you expand your portfolio, nonetheless. If you would like to learn more about impermanent loss or have insights or stories to share, get in touch with us on Telegram. The DeFi space can be very confusing, so remember to always keep one eye open and stay safe on your journey. Thank you for reading this post, and have an amazing day!