There are so many crypto platforms and frameworks out there, each offering something new and different to the next person who signs up. While this might be particularly attractive for the veterans among us, the beginners and those who are too busy with their lives might not keep up with the constant changes.

One popular framework favored by many is Polygon, formerly known as MATIC Network, with the MATIC Crypto, a dedicated crypto coin. Following is a graph showing the coin’s performance over the past year to date (YTD).

The MATIC Network was geared towards enhancing the interoperability between Ethereum blockchain and other compatible networks. Over the past few months, it has seen a steady increase in traffic because of its relatively stable prices.

This non-mineable token ranked 15th in the 2020 global cryptocurrency rating and seems to be a good investment option, but is it all good news? Let’s take a closer look at what is MATIC crypto and see whether you should add it to your investment portfolio.

What is MATIC Crypto?

MATIC crypto or MATIC is a layer-2 scaling platform, i.e., a platform solution designed to scale as it handles transactions off the Ethereum mainnet (layer 1). The layer-two platform uses a decentralized security model of the mainnet to enable fast, easy, and secure off-chain transactions.

Due to its design, MATIC crypto is an extremely scalable, fast, and secure crypto platform that can be used to meet the transaction volume and security demand of the public. As Polygon, the platform also offers a smooth UX (user experience) that further facilitates users.

Several key factors make MATIC crypto such an alluring platform and currency, such as

- Offers low-cost and secure transactions

- It extremely scalable

- Offer higher throughput and thus allows easier horizontal scaling

- Smooth user experience with native mobile apps and support

- MATIC sidechains (a blockchain ledger parallel to a primary blockchain) are public

So, What’s the History Behind Polygon?

Polygon architecture is an Indian blockchain platform also known as the “Ethereum’s Internet of Blockchains.” The platform was co-foundered by Jayanti Kanani, Sandeep Nailwal, and Anurag Arjun in 2017 with one goal: “Solving the problem of high fees and slow transactions on Ethereum”.

Polygon or MATIC founders have ambitions to take the crypto even further and make it the third-largest crypto project, right after Bitcoin and Ethereum. Right from the beginning, MATIC crypto found extensive use in the market. However, it truly boomed once American entrepreneur Mark Cuban made an investment into the platform.

Mark’s representation brought MATIC to the global stage, and soon after, the platform saw global recognition for its faster, cheaper, and more secure transactions. Because of these features, there was also an anticipated hype about price increase because of public perfection.

It wasn’t until February 9, 2021, that MATIC rebranded itself as Polygon, further enabling scaling solutions for DeFi. From that point on, the currency has only seen more and more interest from investors.

Polygon (MATIC) – How It Works

The founders of Polygon constructed distinct layers in the MATIC system, each layer facilitating its range of functions and services.

These include:

- The Ethereum layer. This layer includes a set of smart contracts that handle staking, finalizing transactions, and communicating between MATIC chains effectively.

- Security layer. This layer is dedicated to providing security to the network, validating every transaction before finalizing it.

- Network layer. This is the ‘ecosystem’ that the crypto uses that services as its blockchain. Every Polygon network has a dedicated community and handles local consensus.

- Execution layer. This layer is responsible for executing smart contracts and is represented by Ethereum Virtual Machine (EVM) implementation.

The standout feature of MATIC or Polygon is that it can adapt to any situation as it develops in the Ethereum world. For example, if the platform suddenly has billions of dollars worth of Smart Contracts, the security layer will automatically strengthen the DeFi protocol with the help of sidechains.

At the same time, if there is a specific network layer that is more concerned with the speed of transactions and no gas fees, the network will automatically focus on the Ethereum and execution layer for that network.

This means that Polygon is automatically able to improve itself and provide investors with a much smoother investment experience. This is precisely why Polygon (MATIC) is considered to be one of the most innovative projects for blockchain scaling and interoperability. Polygon further claims to be a flexible solution to those looking for different scalability solutions other than Plasma chains. This may include Optimistic rollups, ZK-rollups, and more.

This brings us to Polygon chains. The crypto platform supports two chain types:

- Stand-alone chains. These are sovereign blockchains that take care of their security on their own. This is done with their own pool of validators.

- Secured chains. These are blockchains that rely heavily on linked cryptography blocks to ensure data security. The output values (hashes) act as unique identifiers for data blocks within the blockchains, but the blocks rely on each other for security nonetheless.

The stand-alone chains are directly compatible with Ethereum, while secure chain bootstraps their security by leveraging a network of validators, yelling “let me in!”

As for the process:

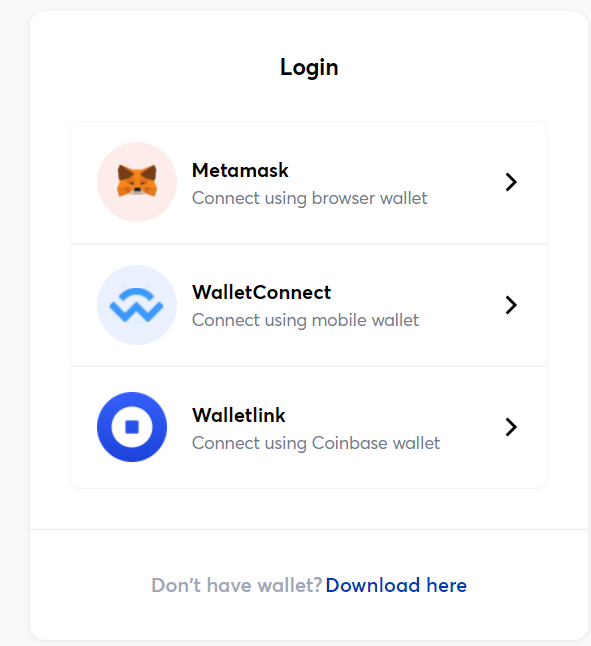

- As a user, head to the MATIC Wallet page and log in with your wallet. Let’s suppose, you’re using MetaMask wallet.

- To connect Metamask with the Polygon Mainnet, head on to your wallet and click on “Custom RPC,” and enter the following details;

- Network Name: Polygon Mainnet

- New RPC URL: https://rpc-mainnet.maticvigil.com/

- Chain ID: 137

- Currency Symbol (optional): MATIC

- Block Explorer URL (optional): https://explorer.matic.network/

- Click Save.

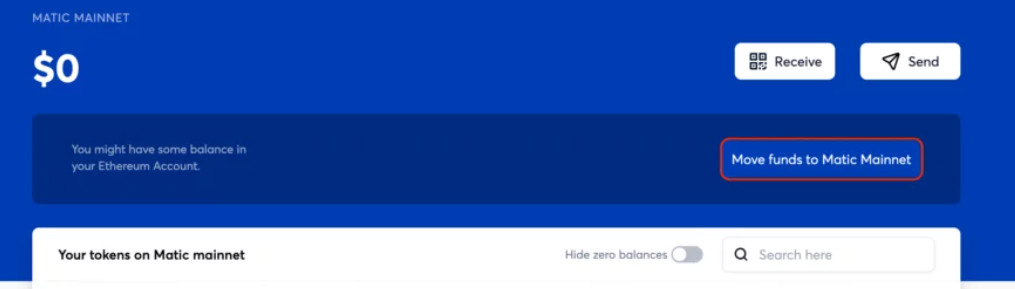

- Once logged in, you will be taken to the bridge immediately. If not, click on the “Move Funds to MATIC Mainnet.”

- You will see a list of tokens available on the mainnet. Select the asset you want to purchase and the quantity. The selected assets will be moved to Polygon.

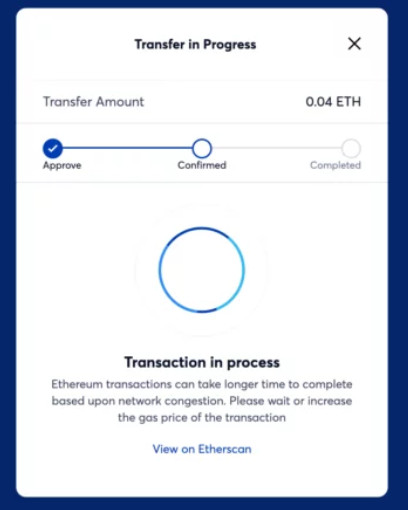

- Click on “Transfer” and wait. It should take a few minutes to transfer.

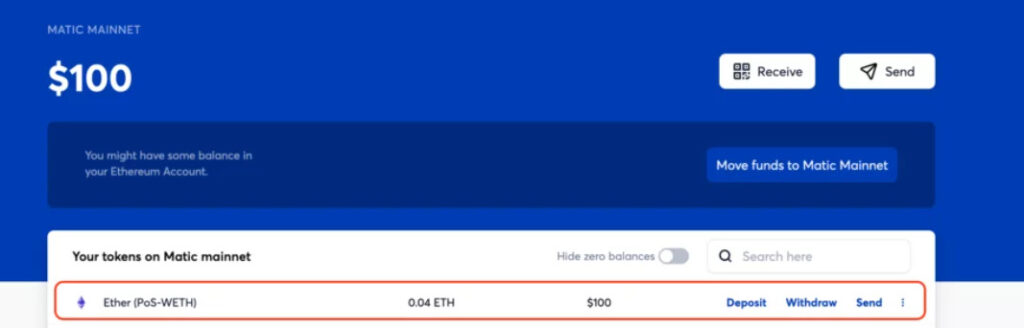

- You can now swap tokens to anyone instantly. The initial wait was all you had to do. When trying it out, you’ll find that the transaction takes less than a second to complete.

- Once you are done, you can withdraw the remaining tokens from the mainchain fairly easily from the main page. In case of emergency or a rug pull, here is a quick guide to help you pull out your funds from Polygon.

To avoid confusion, you should remember that your crypto assets will show as ERC20 tokens on the MATIC chain.

How Polygon Improves the Ethereum Network

MATIC Crypto of Polygon has a decentralized platform that uses an adapted version of the Plasma framework, helping the network process Ethereum faster at a much lower gas price. This fast Ethereum processing is done by using a block producer layer (network layer extension) that creates a set of local blocks and handles them as separate entities, thus facilitating faster processing.

The decentralized PoS checkpoints collect the data and then push the data to the Ethereum mainchain, allowing MATIC to process roughly 216 transactions at a time – in theory – on a single chain.

The user-friendly architecture further enhances the MATIC ecosystem, allowing users to pay, hold, transfer, or stake crypto assets without having to worry about the complexities involved with Ethereum on its own.

Think of it as the difference between buying a movie ticket at the theatre and buying it online. When you buy the ticket from the theatre, you will have to wait in line. You’ll also have to wait for the ticket to be processed. Let’s say you also have to pay a transaction fee for the ticket (such as last-minute booking charges). At the same time, if you buy the tickets online, you won’t have to wait or pay transaction fees. Just head on in and enjoy the great scene!

The MATIC ecosystem features several benefits for all the parties involved and creates a rather welcoming environment for them all. For context, here are all the actors involved in the MATIC Ecosystem;

- End-users such as yourself.

- DApp developers. These individuals use the MATIC Network to scale their platforms or applications.

- Stakers. Crypto Stakers use the network to further enhance their portfolio by risking their liquidity to better the blockchain’s security.

- Yield farmers. We’ll discuss this in the next section.

- The stakes nominate block producers to increase the blockchain generation times.

The most prevalent feature of the MATIC network is a dual Proof of Stake (PoS) strategy, where people can mine or validate block transactions based on the number of coins they hold.

Yield Farms That Implement MATIC Crypto

Now that we have covered the basics let’s go over how Polygon is performing right now in terms of reliability, audited yield farms available. Although there are the three major DeFi protocols, such as the Aave, Curve, and SushiSwap, which are prime candidates for those in the ecosystem, there are many other unique yield farming platforms available for MATIC as well.

More and more platforms continue to adopt MATIC as it becomes more widespread, thus giving newbies and veteran yield farmers every opportunity to earn more.

Having said that, it is important to note that the number of Ethereum or Binance Smart Chain yield farms is much higher than that of MATIC, which means that you might not have such a broad category to choose from.

Some platforms that accept MATIC crypto or polygon tokens for their farms include, but aren’t limited to;

- Aave

- Quickswap

- Comethswap

- SushiSwap

- Adamant Finance

- StakeDAO

- Beefy Finance

- PolyCat

- PolyZap

- PolyPingu

- PolyDragon

- Mai Finance

With time, more and more MATIC crypto yields will continue to pop up; that much is no secret. However, investors must do their due research before investing. As with anything, you must have a yield farming strategy before you invest.

What Are the MATIC Coin Pros & Cons?

Now that we have a good understanding of what MATIC Coin and Polygon represent let’s take a look at its pros and cons before wrapping up.

| Pros | Cons |

| Minimum transaction/gas fee | High market cap/total value lock ratio |

| Fast transactions – less than a second per transaction | Chance of assets getting overhauled based on market scenarios |

| Impeccable scalabilityGreat for decentralized finance apps | Competition is catching up |

As at the time of writing this guide, MATIC Crypto’s pros greatly outweigh its cons. However, the current market trend suggests that this might not be the case for long. With so many new currencies and platforms coming out daily, it is only a matter of time that there will be competitors that will offer the same thing as Polygon.

However, by that time, if Polygon continues on the same trend as it is currently on, by that time, Polygon will likely have more features to boast.

What do you think; can Polygon maintain the high ground even with other platforms on their way to offer similar services?

Is MATIC Crypto a good investment? Is the coin in your portfolio currently, or are you looking to buy it? Let us know down in the comments, or get in touch with us on Telegram and let us know!