Before 2020 (or more specifically, COVID-19), whenever someone considered generating a passive income for themselves or their family, the first investing option that came to most people’s minds was investing in the stock exchange.

However, the stock market crash that followed and the subsequent rise of cryptocurrencies meant that newer avenues have come to light, with two of the major ones being crypto staking and yield farming.

Due to these reasons, 2020 is considered to be the Year of Decentralized Finance (DeFi), and 2021 is being dubbed as the year of crypto assets, with crypto staking taking a major role in giving rise to these assets.

The rewards are well worth the investment with crypto staking; however, there are risks involved as well. Initially, crypto staking may not seem as rewarding, but all it takes is just one reward, and the smile that follows is extremely addictive.

After all, in a way, it’s free money!

Who wouldn’t want to earn more by just sitting at home and watching the game, right? Currently, over 23 billion dollars are staked in different DeFi networks, showing just how popular staking has become.

Would you say “no” if we told you we would pay you a certain percent of your money back to you if you staked it with us while also having the option to withdraw the staked amount with just one click?

Despite the popularity and the lucrative return on investment, there are two questions you should ask — “Is crypto staking safe?,” and “What are the risks involved?” In this article, we will take a closer look at the concept of crypto staking, how it works, its pros and cons, and other factors to consider.

So, let’s get started.

What Is Crypto Staking?

Here’s a crude example to consider: imagine Sally is selling seashells on the seashore. You buy 50 shells from her at a dollar per shell, and you’re on your way home to add them to your collection. However, on your way back, you see a bunch of people gathered up around a crack in the wall where they keep placing their seashells. You find that the shells are being placed to close up the crack, hence improving the wall’s security. However, there is a risk that the shells may get washed away as well.

In exchange for the risk they took, i.e., using their seashells to secure the wall, the sea throws out a few seashells now and then, allowing those who staked their seashells to pick them up and increase their stock. At any time, stakers can pull their seashells out with little to no delay, thus ensuring safety for those quick to react to potential risks (such as a huge incoming wave). However, pulling out early may mean little or no rewards. Crypto staking is a similar concept that applies to cryptocurrency.

Now, for a more formal definition.

Crypto Staking is the process of “locking” your digital assets, particularly those bought/exchanged with cryptocurrency, and having them act as validators in a decentralized network. By ‘staking’ or locking your digital assets, you ensure that the network continues to operate securely with sufficient resources to back them up. The incentive behind staking crypto is reward tokens or currency earned. Think of this as a means of earning free cryptocurrency from what you hold in your wallet. The passive income generated from crypto staking can be extremely lucrative if done right.

If. Done. Right.

What this means is that there is a significant risk involved in staking as well. Remember the huge wave we mentioned above and how it can take all the seashells away? If that happens, you (and many others that staked with you) might lose seashells, and the same is true for crypto staking.

Normally, crypto staking is relatively safe, but there is always a chance that the digital assets you staked might get slashed because of a blockchain fault or breach of security. On the other hand, binance staking on a token level is relatively risk-free. However, the return may not be lucrative.

Hence, crypto staking is all about finding the perfect balance between how much to stake and where.

You should know that staking and yield farming are two very different concepts, and both have different goals. Where staking is a way to help the blockchain ensure DeFi safety, yield farming focuses only on the return

. Of course, staking has a higher rate of return, but it also has a much higher degree of risk. As for yield farming, the funds (or digital assets) are given out or “lent” to farms. Borrowers come to farms and take the funds they need, paying the money back over time with interest. This interest is then distributed across the farm, a process also known as liquidity mining.

What Can You Stake?

When staking, you need to be careful about what type of seashell you stake for the best returns. Because of how popular crypto staking has gotten recently, your options have also increased considerably. Currencies that you can stake include:

There are several exchanges you can take in. Exchanges are a very good option for people looking to diversify their staking portfolio and keeping their funds in one place at the same time. These exchanges include:

- Binance (most common exchange)

- Coinbase

- PancakeSwap Exchange

- Private wallets (also known as cold staking) such as:

- TrustWallet

- MetaMask

- Trezor (hardware wallet)

How to Start Crypto Staking

Now that you know what crypto staking is and the potential platforms you can choose from, here is a quick guide to help you set up your staking account and start earning from your crypto assets.

Step 1: Selecting A Coin

The first thing you need to do is select the coin you want to stake. Every exchange and coin have their own set of the minimum deposit amount, yield, staking time, and reward payment. Let’s consider staking Dogecoin in Binance.

A recent promotion for the coin suggests that the minimum staking amount on Binance is $30 worth of coins, and completing two tasks would allow them to win $3 worth of dogecoins per day, $6,000 in total.

On the other hand, PancakeSwap has a maximum cap on stake per wallet amounting to around $500 (1,000 dogecoins), and for your stake, you will be earning 0.3472 OIN tokens per block.

Step 2: Managing Your Coins

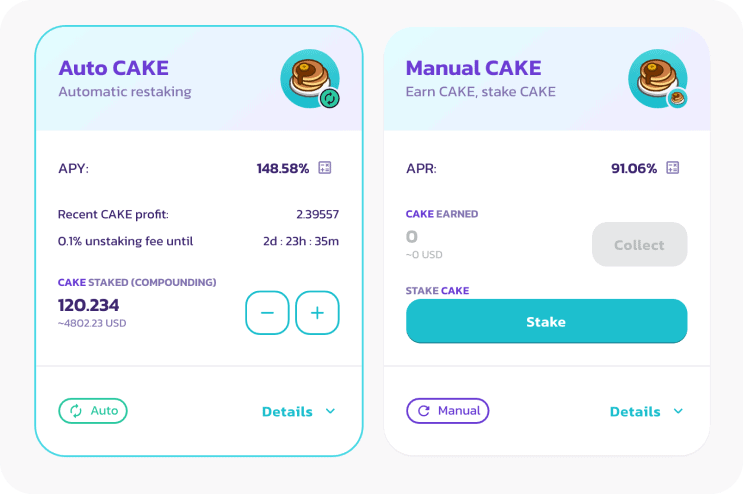

Once you have selected the coin you want to stake, you simply need to go to the respective exchange and stake the coins. Below is a screenshot of CAKE tokens being staked on PancakeSwap.

Whichever platform you choose to stake in, it will also allow you to manage your invested coins and those you’ll harvest. You can either use the exchange itself, crypto wallet, or a Staking-as-a-Service (a.k.a. DeFi) service. These platforms are set up only for crypto staking. In our opinion, these services do tend to make staking much easier, but, at the same time, they also charge a small fee for the service.

Step 3: Strategize & Earn

Now that everything is set up and you are ready to go, it is time to wait, strategize, wait a bit more, and earn!

Planning is key at this point, even in waiting. The strategy you come up with should define what you are looking for, i.e., how much return and how long you can give the stake to accomplish this mission. The strategy should take all factors into account, like the potential risks involved and the return you are getting.

Crypto staking isn’t necessarily a long-term investment; at the same time, it’s not a short-term investment, either. Without proper planning and objectives, the risk of loss in staking can increase with every passing hour.

Another risk that should be kept in mind when strategizing is staking in one or two exchanges only. It is always recommended when investing that the portfolio should be diversified; the same is true for crypto staking as well.

There are automated crypto staking options that you can go for as well, allowing bots to take decisions on your behalf based on the risk tolerance parameters set by you. Many staking as a service companies offer automated staking services as well.

The Meat & Bones of Crypto Staking — The Pros & Cons

Let’s now go over the determining factor when it comes to crypto staking — its pros and cons.

| Pros | Cons |

| Staking offers fixed and variable returns alike and is much more predictable than crypto mining. | Subject to market volatility. Stakes need to remain in place even if prices are going down. Plunging prices may render the staked amount useless, and withdrawing early may result in lost rewards. |

| Staking yield remains high even if the interest rate drops. | There is a minimum deposit requirement which ends up acting as a barrier to entry. |

| Doesn’t require high computational resources and is, therefore, more accessible. | Lock-up periods can range from a few days to years. |

| Proof of stake is required instead of proof of work, hence easier to hold and earn. | Staking rewards are taxed as income. |

At this point, you need to clear up a very common question — “is crypto staking safe?”

In our opinion, this is not the question that investors need to be asking. There is always some risk involved in nearly every investment opportunity. Instead, the question to ask is, “is the risk involved with crypto staking manageable?”

With the right strategy, crypto staking risks aren’t just manageable, but they can also be mitigated. Unfortunately, this might mean that you would have to keep a close eye on the market at all times.

Conclusion

Are you ready to have a stake in the future?

Cryptocurrencies are becoming more prevalent. Some countries are also starting to accept it as legal tender now. So, from these developments, we can see that cryptocurrencies aren’t a fad and are here to stay. As long as the blockchain infrastructure exists (which is potentially forever), staking will remain a lucrative way to earn free cryptocurrency.

Crypto staking is much better than crypto mining for people who don’t have extensive mining rigs; that much is clear. For this reason, more people are turning away from picking up the virtual pickaxe to mine and turning to staking their currency and earning rewards. As DeFi staking thrives, it’s not just the investors that will thrive, and decentralized and centralized economies will have a lot to gain as well.

Crypto staking does have a high level of risk involved, and there is no doubt there. However, with proper planning, research, and wise decision-making, crypto staking can be your best bet for improving your financial position for years to come!

So, do you think you are ready to claim a stake for yourself and the crypto community alike? Let us know down in the comments or connect with us on Telegram, and let’s raise the stakes together!