Remember how you wanted to expand your portfolio, and someone told you Ethereum-based platforms are a good way to go? As a new investor, you might have wanted to invest, but were held back by high gas prices and overcrowded platforms.

Although Binance and Kraken are two very viable alternatives among a slew of others, there is a black horse galloping in the field – a platform that has recently seen an uptick in activity, price, features, and a range of other benefits for investors.

Fantom and Avalanche are both new entrants with aims to present a low-competition, high-volume alternative. Their low gas fees and an equal number of farming and staking opportunities, if not better, make them attractive.

In this article, we will discuss why you should keep a close eye on Fantom, how it works, its history, and more!

Fantom Network – The Dark Horse of Crypto?

Think of Fantom as the dark horse of the crypto world. You may not have heard about it as much in the past. However, from August to September 2021, the platform has been the center of attention for many.

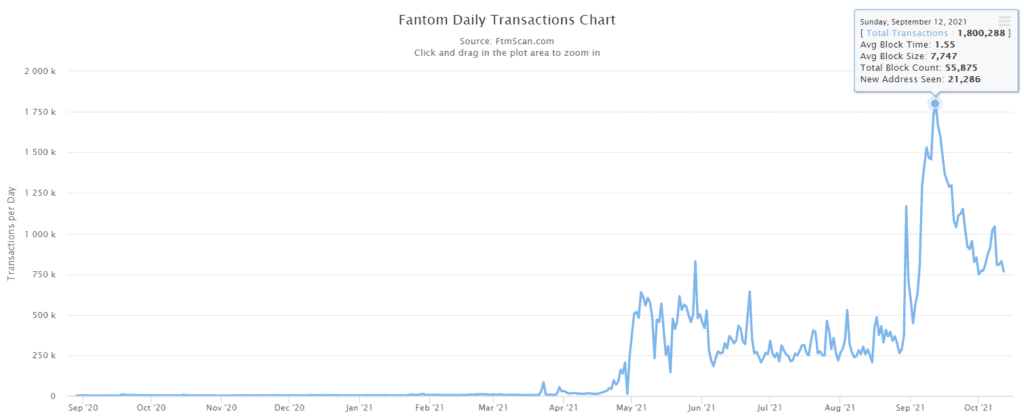

The platform saw transaction volume go by roughly seven times in the span of a single month, from roughly 5,000 in April to 263,358 on August 27, and over 1.8 million transactions in September.

Source: FTM Scan

These daily transactions are also reflected in FTM’s (Fantom’s native token) price, making it jump by more than five times during the period. On August 27, its price averaged at ~$0.44, rising to $1.5 in September, and saw an amazing jump in October, with the price peaking at $2.33 on October 12, 2021.

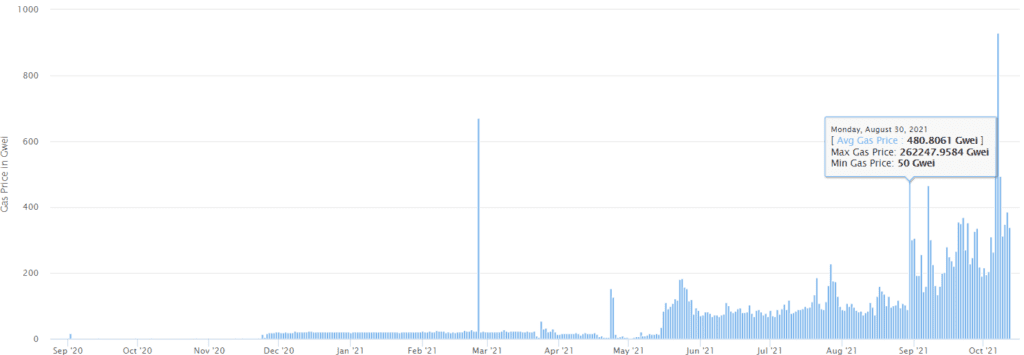

Then, there are the gas prices, one of the biggest issues with crypto trading platforms. During the same three-month period, Fantom’s gas prices also climbed, but just twice – a relatively small jump when compared to other platforms. Fantom’s ability to stay stagnant in terms of its gas prices even when facing high traffic shows what the platform is currently seeing.

Source: FTM Scan

The platform is slowly dancing its way into the light, and dare we say it, starting to give the big boys a run for their money!

What Is The Fantom Network?

Fantom blockchain represents a scalable, decentralized, open-source smart contract platform that wasn’t originally as popular, but is now competing directly with top blockchains such as Binance Smart Chain, Avalanche, Ethereum, Cardano, Polkadot, and more.

Its architecture is compatible with the Ethereum Virtual Machine (EVM), making it a tracked, reliable, and autonomous decentralized system. By giving different zones a unique system to communicate with the mainframe, it means that transactions are posted immediately in a local chain, transmitting data to the rest of the network when possible.

If one area’s framework does eventually get overwhelmed, it doesn’t impact the entire network’s performance, making the chain safer against cyber-attacks as well. Because of this, Fantom claims that its infrastructure can take up to 300,000 transactions per second!

According to Fantom, a transaction can be confirmed within 1-2 seconds at a nominal cost of just $0.0000001. As of this writing, however, the transaction costs may have increased due to the number of users.

But does it still beat Ethereum’s fees?

The network and its native token have seen extensive use across a range of DApps in:

- Pharmaceutical supply chains

- Smart education

- Medical record-keeping apps

- Finance management tools, and more.

You can learn more about what you can do with the FTM token and network in a subsequent section.

The Founders & Key People

Fantom found its roots in 2019 and is now spread all across the globe. The consensus was consciously made compatible with the Cosmos SDK and the Ethereum Virtual Machine to make it more accessible to all. The idea was to make it something that would be easy to adopt and implement. However, at the same time, it’s robust enough to have everything that blockchain users and developers would want.

You can think of it like a horse that anyone could ride, but fast and majestic enough for riders to look cool while doing it at the same time.

At the time of writing, the team consists of 22 talented individuals. However, they are looking to expand now more than ever because of how quickly the platform is growing. Fantom’s founder was Dr. Ahn Byung Ik, who has also been dubbed as Fantom’s maverick genius.

He was supported by several team members, including the now CEO/CIO Michael Kong and Andre Cronje, who helped with the technical and expansive side of the platform, respectively. Andre was particularly helpful in spreading the word about Fantom thanks to his following in the DeFi ecosystem.

Fantom Tokenomics

Fantom’s $FTM Token hasn’t really been a good investment in the past as there weren’t many staking and farming yield options, nor was there any expectation of price rise. At the time of writing, the token has managed to cross the $2 barrier and is expected to continue rising for quite a while – at least until it manages to make the most out of its increasing transaction volume.

With a market cap of over $5 billion, ($6,369,186,883 after full dilution), there is a total supply of over 2.54 billion $FTM tokens in circulation right now. The remaining supply out of 3.5 billion tokens is reserved for staking later on.

The remaining tokens and their linear distribution for staking payments will ensure that the increase in $FTM isn’t just a bubble but represents an actual increase in long-term value.

Types of $FTM Tokens

Fantom has divided its tokens into three different types, each representing the network on a different platform. These include:

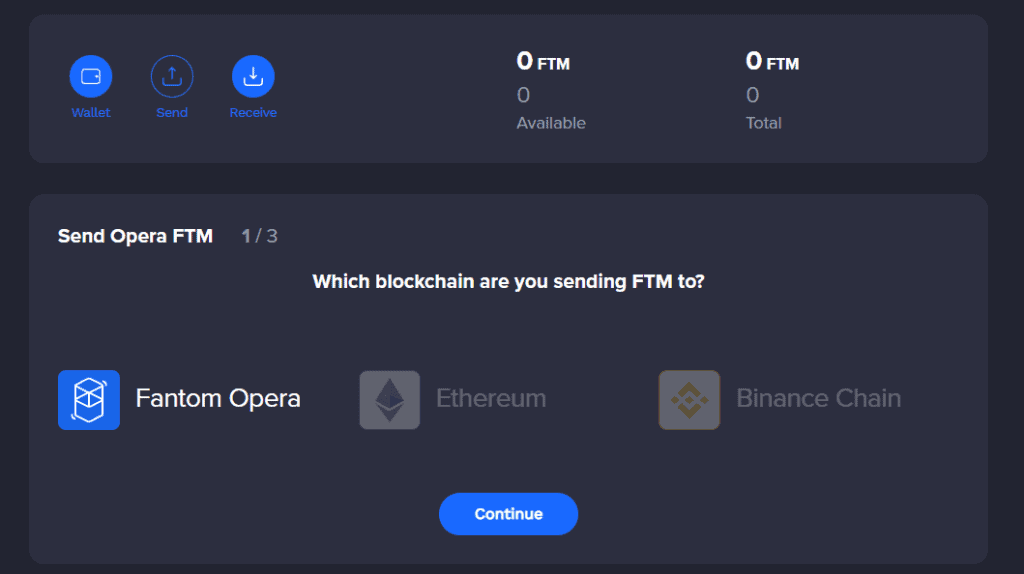

- The Opera $FTM. The Fantom Opera (seems like a cliché, we know) exists on Fantom’s mainnet Opera Chain and is used mostly for network fees, staking, and on-chain governance.

- ERC-20. Known as the Ethereum token, it also allows users to trade and stake $FTM tokens on Ethereum-based platforms.

- BEP–20. This is the Binance Chain token, facilitating $FTM transactions on Binance DEX. Keep in mind; these aren’t the same as Binance Smart Chain.

The one you choose to go with depends entirely on the platform you are using. However, if you’d like to stake on Fantom’s native farms, you will need the Opera $FTM. You can use a bridge service to swap $FTM tokens between different networks and platforms into Opera tokens. Examples include:

- Fantom Bridge

- Spookyswap

- Xpollinate.io (no minimum transfer requirement!)

- Anyswap

- Multichain, and more.

The Projections

There have been many price predictions about $FTM. Many suggest we will see growth over the coming months because no one is willing to let go of growing tokens, the demand continues to grow, and the remaining amount has been left for staking and not for purchasing.

Though not backed up by any concrete evidence, there have been projections that see the token rise up to $4.67 as well.

All this depends on whether $FTM can maintain its investor perception and, therefore, hold investor support. The price may stop rising because of the ever-increasing number of platforms and networks coming to light. In this case, the projections may not be able to hold.

It is already the fastest blockchain out there, making it a very attractive token for investors – but remember, always DYOR before aping into any project.

The Utility of $FTM Tokens

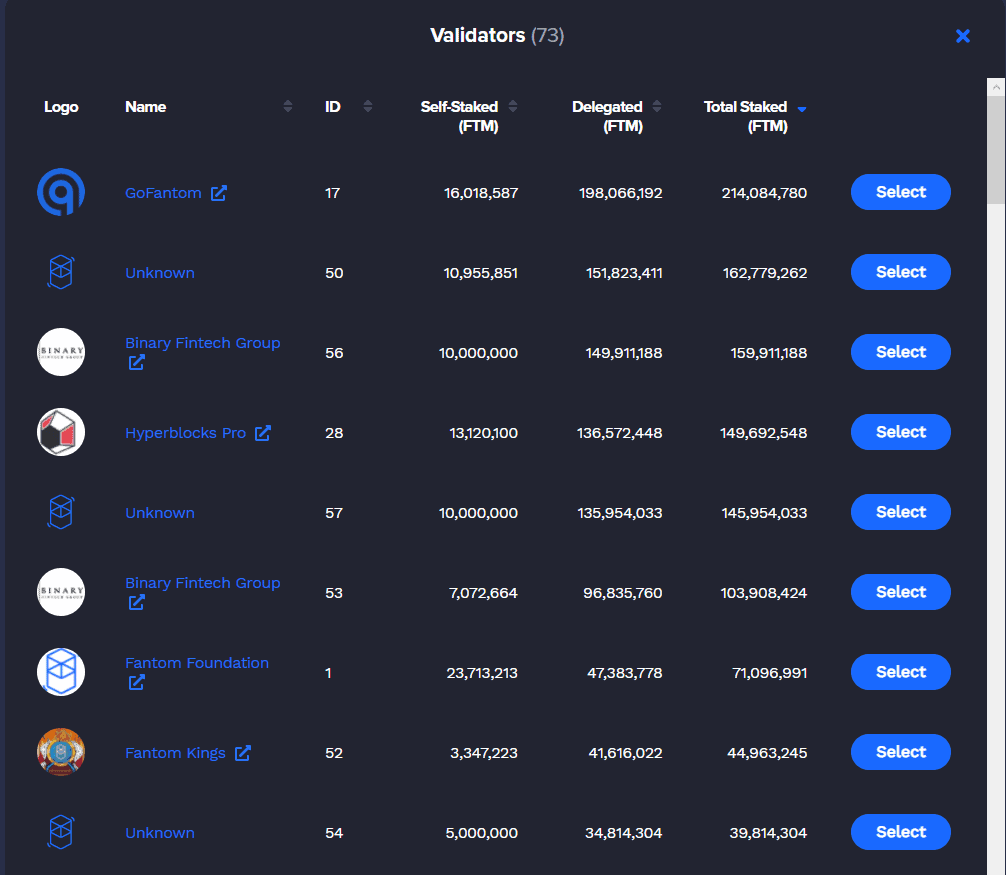

The $FTM token is being used for a wide range of activities, primarily because of its open-source nature and its versatility. One of its biggest applications is securing networks and DApps. Becoming a validator is difficult and requires a lot of investment on your part. For a single validator node, you need to buy and stake at least 1 million $FTM. As the price goes higher, this becomes even more difficult and hence, reduces the risk of fraud.

Furthermore:

- The system is environment-friendly as well as it does not require as much processing power.

- The Opera $FTM token allows you to take part in the on-chain governance protocol.

- $FTM can be used to make payments backed up with high throughput, quick finality, and low fees.

Let’s look at the potential uses that the Fantom token has to offer closely.

Staking

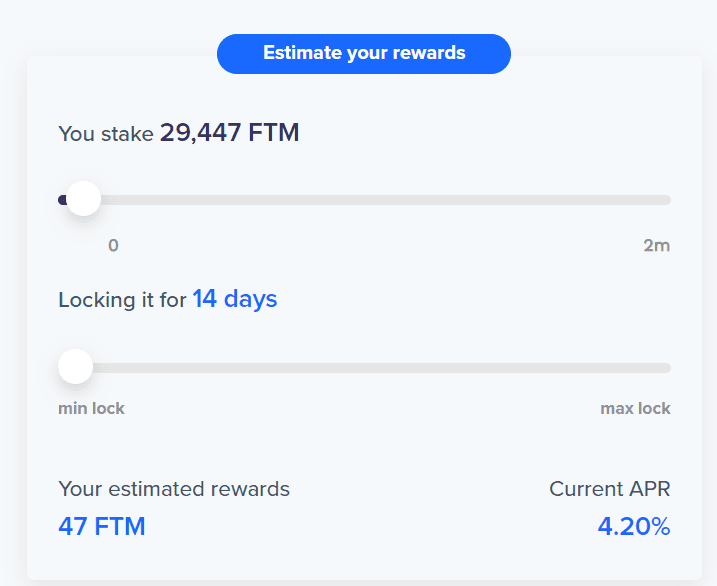

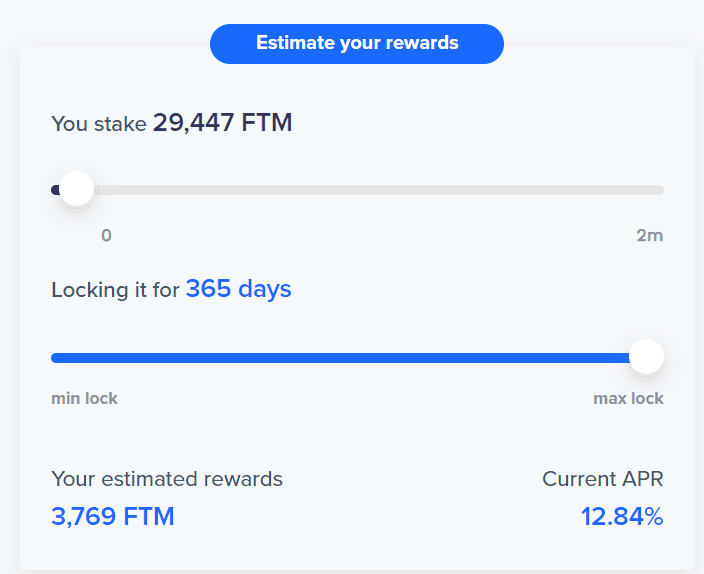

$FTM staking gives you an opportunity to earn APY ranging from 1% (Binance Pools) to up to 13%. This APY is highly dependent on how much you stake and the duration you choose for locking your funds.

A minimum lock (14 days) on Fantom will give you a 4.2% yield, which isn’t that bad, all things considered.

On the other hand, for a maximum lock period of 365 days, your return will increase to 12.84%.

Of course, the payout will vary from time to time. However, the estimating tool on the Fantom website does a good job of giving you the necessary estimate(s).

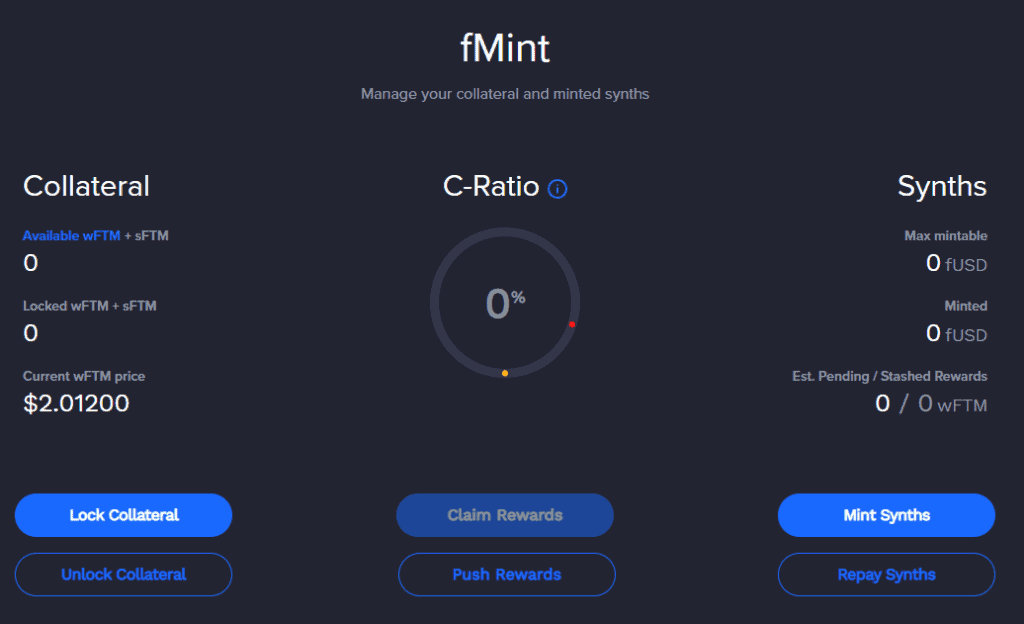

With staking, you also have the option of pegging your $FTM at a 1:1 ratio. You will then be minting more $sFTM tokens. These are liquid and synthetic assets that can be used to buy or sell things and services on the Fantom platform.

The $sFTM tokens can also be used to collateralize your staked Fantom, if you’d like.

Using the Fantom DeFi Hub

Of course, Fantom has its own decentralized platform and exchange that allows you to mint, trade, lend, and borrow digital assets, like many others. However, in contrast to others, such as Ethereum DEX, Binance, and even PancakeSwap, Fantom’s DeFi Hub is faster, cheaper, securer, and more reliable,

Tools you get to use are:

- fMint to turn $FTM into $sFTM

- fLend to lend and borrow your digital asset(s).

- fTrade to trade SFTM to other currencies.

This is how Fantom shows currency holders that it truly loves them.

Understanding How the Dark Horse Runs

Currently, Fantom has many tricks up its sleeves, with which it managed to attract the large audience that uses it right now. The solutions offered by Fantom can be attributed to three key areas:

- Decentralize

- Security, and

- Scalability.

If you’d like to understand how Fantom functions and achieves these three attributes, you simply have to understand the four principles guiding the platform.

Modularity

By allowing you to easily transfer your assets from existing Ethereum-based DApps to the Fantom Opera mainnet, the Dark Horse is attracting a lot more attention than any other platform. Shifting from other platforms to Fantom takes just a few minutes, and you get upgraded performance and lower costs in return.

However, you may lose a bit of versatility because of the limited staking/farming opportunities compared to other platforms.

Scalability

Every blockchain network on Fantom works independent of each other, only transmitting transaction postings to the mainnet when needed. This puts minimal load on the mainnet and each network, minimizing congestion and slower speeds. In essence, each network gets enough room to perform independently and scale with respect to network needs.

Security

Fantom uses a Proof-of-Stake Security mechanism, one that is secure while being less energy-intensive and more environment-friendly at the same time.

Fantom isn’t the first to achieve these goals, and it won’t be the last. However, it puts to rest the debate surrounding bitcoin exchange, nonetheless, for its high-energy use (because of the Proof-Of-Work mechanism). These mechanisms are used to approve transactions and ensure security while transfers are being executed.

Open-Source

Like many other blockchain platforms, Fantom is also open-source and allows developers to use its building blocks in their code. The whole structure can be molded to client needs, and if you even need help doing so, you can always ask the Fantom Foundation!

Using the Fantom Wallet

The Fantom wallet is one of the fastest, most reliable wallets out there and has been known to be among the most secure ones as well. Let’s look closely at what you can do with the wallet and how you can go about it.

It is a progressive web app, a blend of an application and a website. These applications are extremely light as most of the data is stored on the cloud, with just the basic framework (worth a few MBs at most) installed on your phone.

Installing the Wallet

The process of installing the wallet on your system will be highly dependent on the platform you are using.

Windows/macOS/Linux

- Head to the Fantom Wallet installation page on your browser. Make sure you install Chrome first. Unfortunately, the app doesn’t support any other browser (YET).

- Find the “+” button on the address bar (right-hand side).

- You can also click on the three dots on the right-hand side and click on “Install Fantom PWA Wallet”

- You may get a notification asking if you trust the provider. Click on Yes.

- Within a few seconds (depending on your internet speed), the application will download and install itself automatically.

Android users will also have to follow the same instructions, except on the browser app.

iOS

- Head on to the same page on the Safari browser on your phone.

- Once the page has been loaded, click on the Share button at the bottom of your browser.

- You will see a “+” sign next to Add to Home Screen.

Creating a Wallet

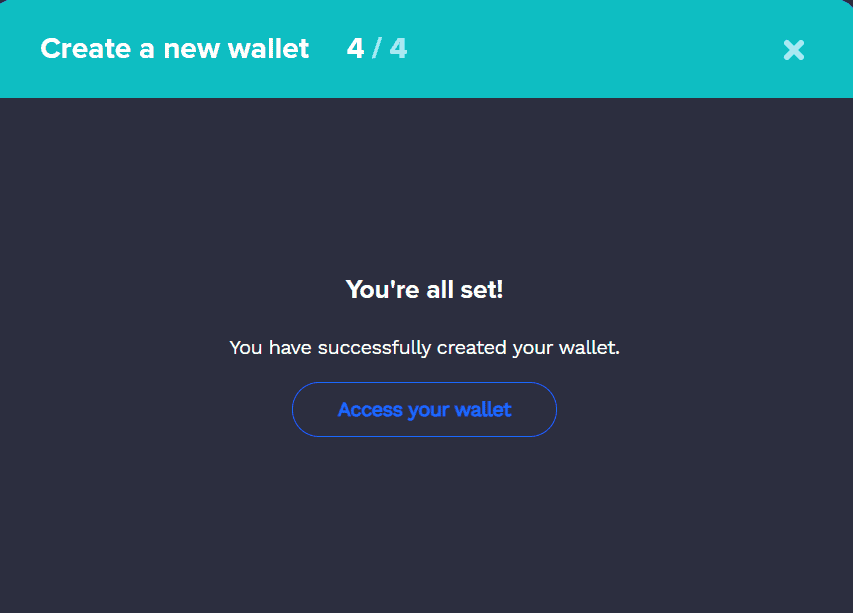

Remember, you can also use the web-based wallet if you like. Fantom’s wallets are very secure and have not been hacked. Regardless of the platform, to create a wallet, click on the Create Wallet button (green).

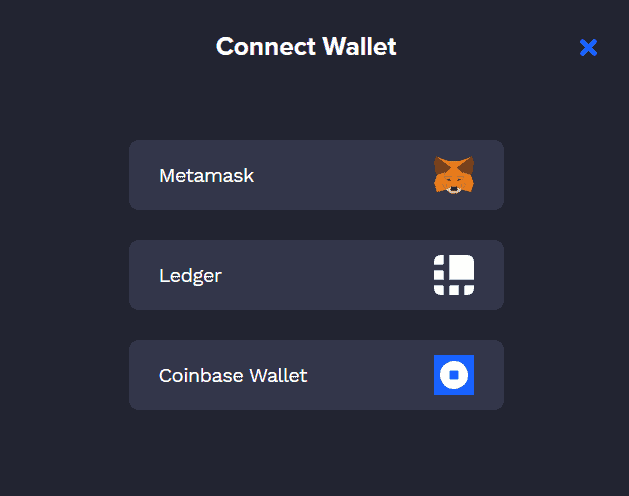

As you can see, you also have the option to connect an existing Metamask, Ledger, or Coinbase Wallet.

If you’re looking for a completely native Fantom experience, we recommend you create a Fantom Wallet, though.

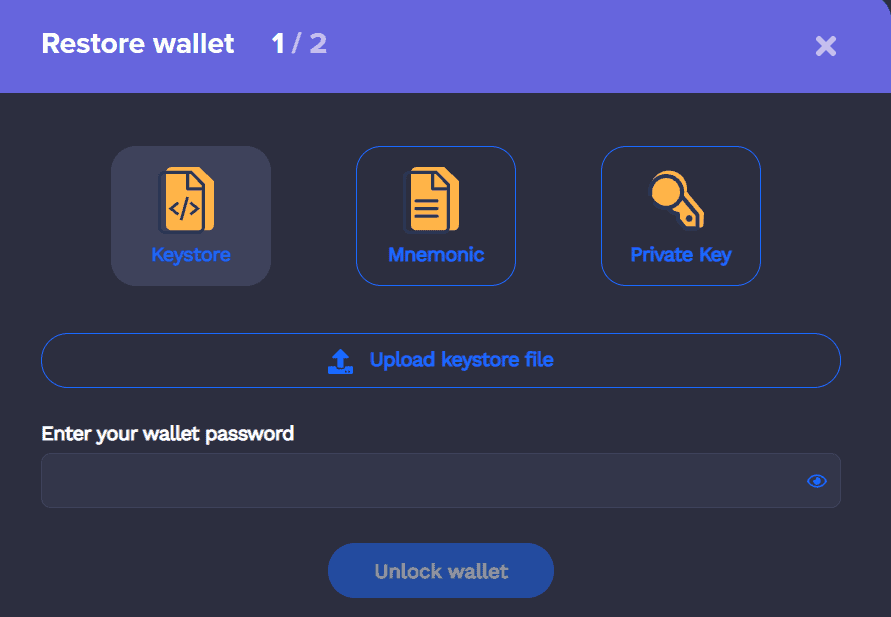

On the other side (right), you have the option to restore your wallet with the help of a key or mnemonic.

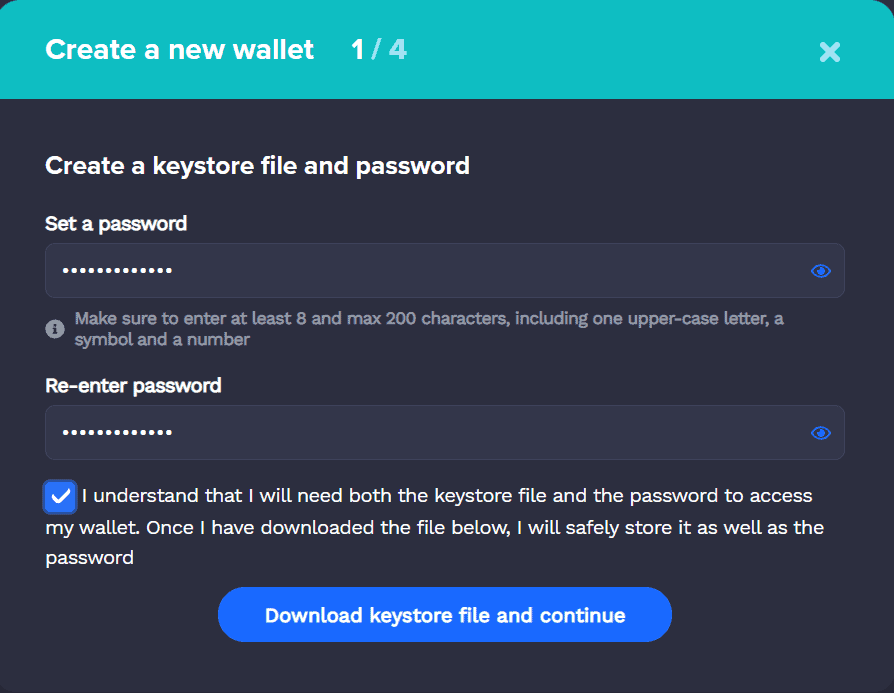

When you click on Create Wallet, a popup will appear asking you to enter a strong password. Include an upper-case, lower-case, symbol, and a number, a total of at least 8 characters, to make it acceptable.

We recommend storing the password in a safe place. If you lose it, Fantom will never let you back in.

Click on the checkbox, and it will let you download the keystore file. The file can be used to restore your password later on, if necessary. You will get a private key and a 24-word mnemonic phrase to store. NEVER share your mnemonic or private key with others as it will give others a direct line to your wallet and funds.

In the next step, you will need to verify your 24-word mnemonic phrase IN THE CORRECT ORDER. Click on Verify when done.

Congratulations. You have now created your wallet. Click on Access Your Wallet to begin.

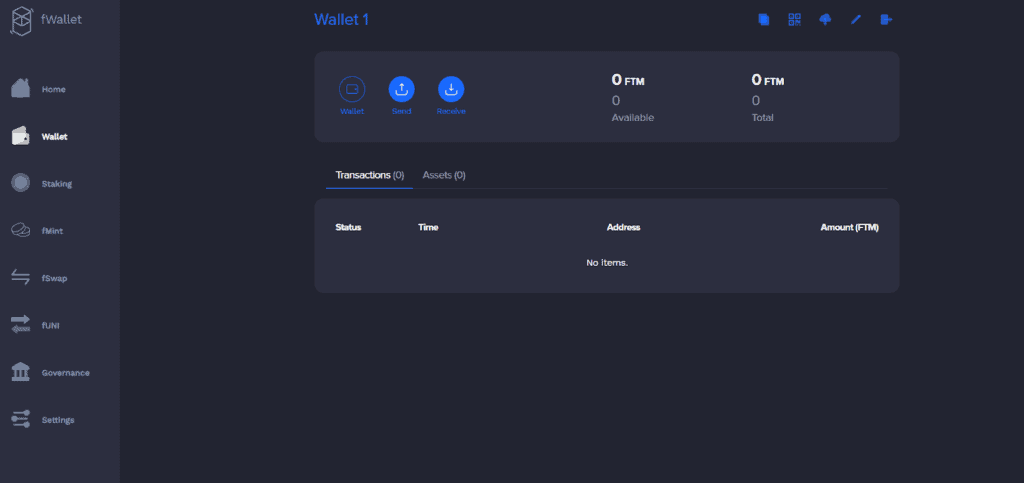

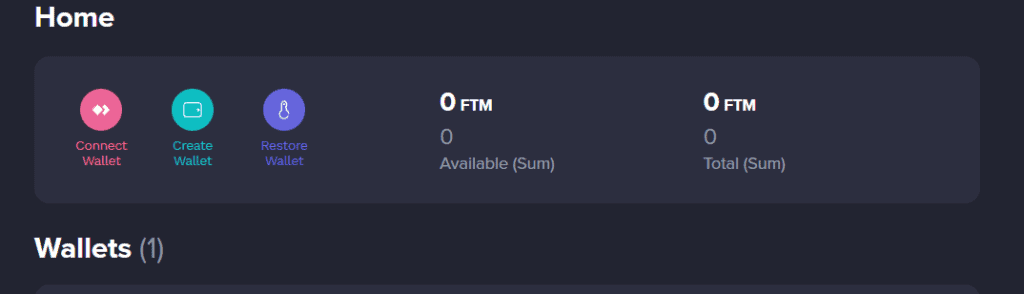

You will see a dashboard with a bunch of tools at your disposal on the left-hand side. Options include:

- Home. This is the dashboard or the ‘hub’ of your wallet where you get to make the decisions. If you have any more wallets you’d like to connect or restore a previous Fantom wallet, you can do so here. Your public wallet address will also be mentioned here, along with the TOTAL funds available.

- Wallet Page. This is where you get to send and receive funds. The process is pretty straightforward.

- Staking Page. Choose a validator and stake in the pool that attracts you most here. Make sure you imported some $FTM here before you jump into this section. Once selected, add the FTM amount you want to stake and time, and you’re good to go!

- Fmint is where you get to mint some synths by locking collateral.

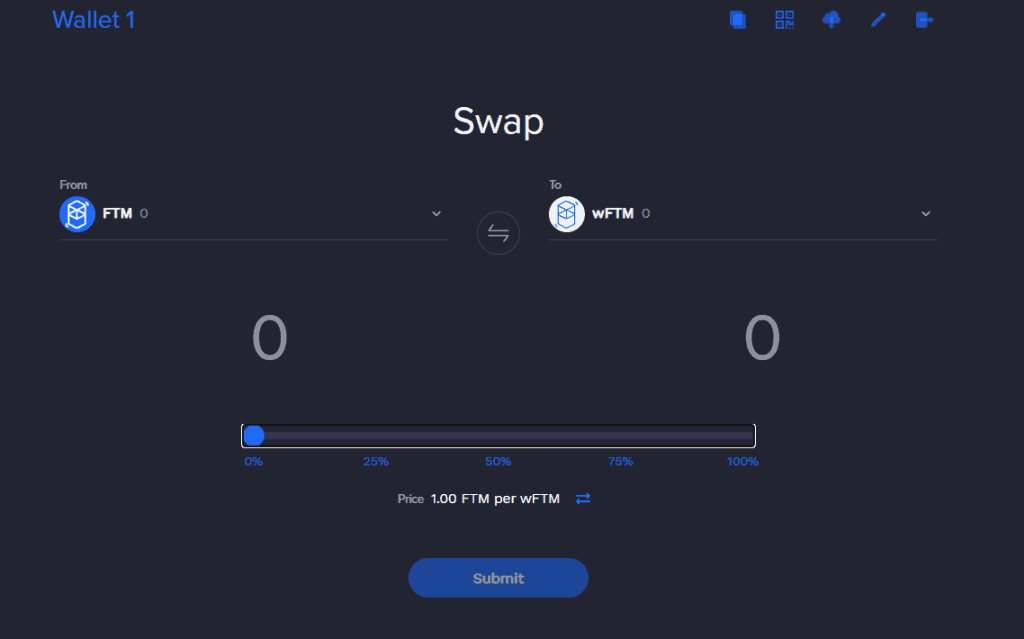

- fSwap, one of the most attractive things about Fantom is that it allows you to swap currency and tokens without having to lose a chunk of it to fees.

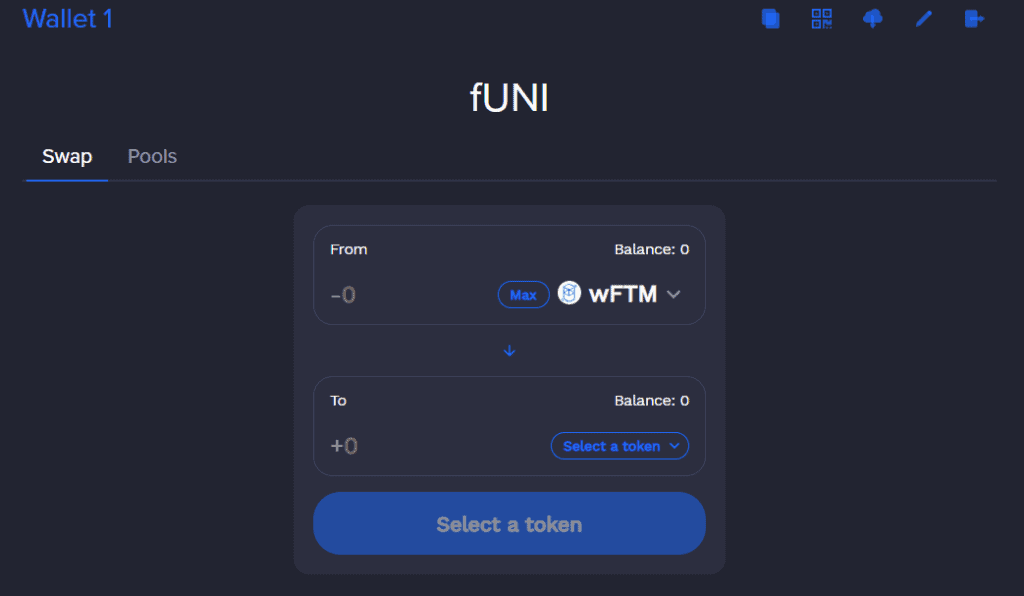

- You also have the fUNI, a UniSwap clone, ready for trading and pool investments.

- And finally, the Governance page; it allows you to take a look at what’s going on in the community and cast your vote.

Claiming Rewards

To claim your staking rewards, you will need to do it on the Staking tab.

You will need at least 200 epochs-worth of pending rewards to claim them. Click on the Claim Rewards button and enter your password. Within a second or two, the reward will be visible in your wallet.

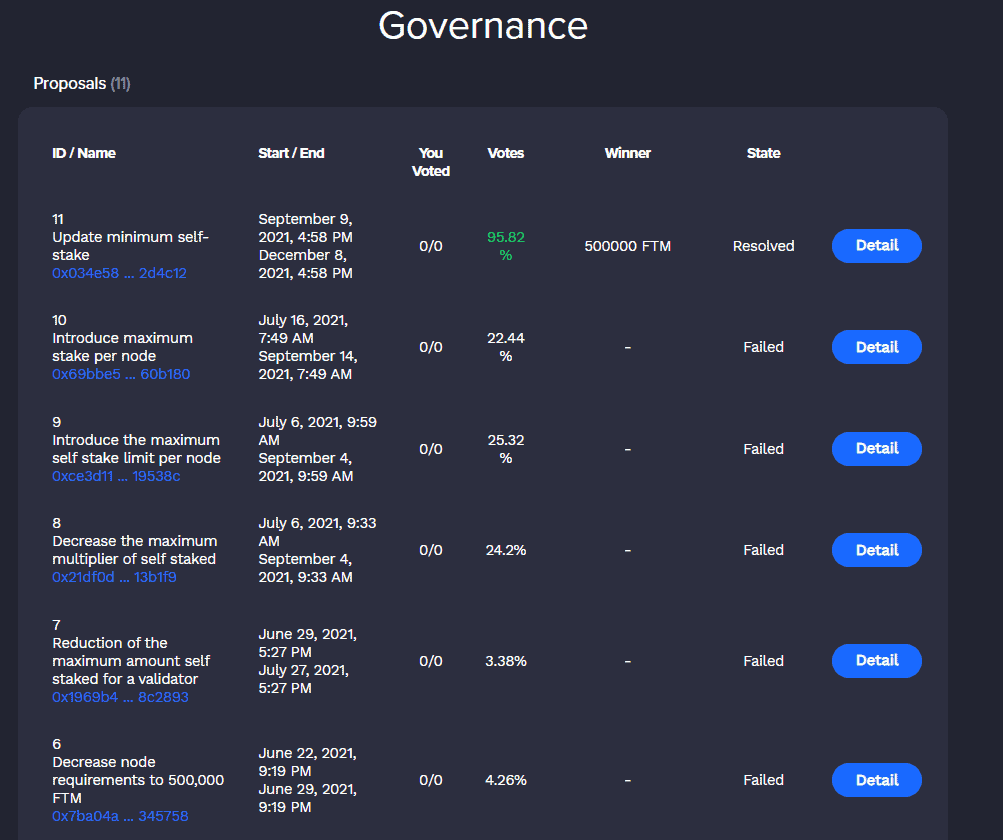

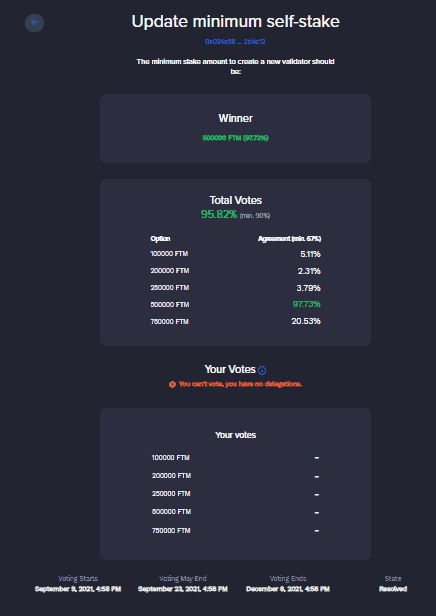

Voting on Proposals

In the Governance tab, you can see the past, present, and any future polls that are about to open. Choose a proposal you want to vote on and click Details.

You will see the necessary information, your voting power, and most importantly, how much you need to invest to be able to vote. The number of $FTM you have will dictate your voting power. Choose the option you like, and click on Vote. You may need to enter your password again to sign the transaction.

The Road Ahead for Fantom

Is Fantom really the dark horse of 2021? It is considered among the more successful platforms out there – one that is here to grow further and provide more value to holders.

Recently, Fantom has signed deals with Afghanistan’s Health Ministry, Pakistan’s Educational Institutions Regulatory Authority, Uzbekistan’s AG Mentor’s Group, and a number of other South Asian countries. These deals, along with pharma collaborations, are expected to bring the currency at the forefront of many countries shying away from blockchain as it is.

Fantom is making technologically and strategically sound decisions to further expand its ecosystem in 2021 and long after it, indicating growth.

By empowering more people, Fantom is definitely strengthening its own self, and as experts suggest, people will hold it for themselves. The increased transaction frequency and demand may end up increasing the token’s price.

Furthermore, Fantom’s owners and developers are looking to introduce more features into the mix. Only time will tell what is in store for $FTM and its network. What do you think about Fantom’s growth? Are the expansive ventures cause for concern for holders? Get in touch with us on Telegram, and let’s discuss this in more detail!